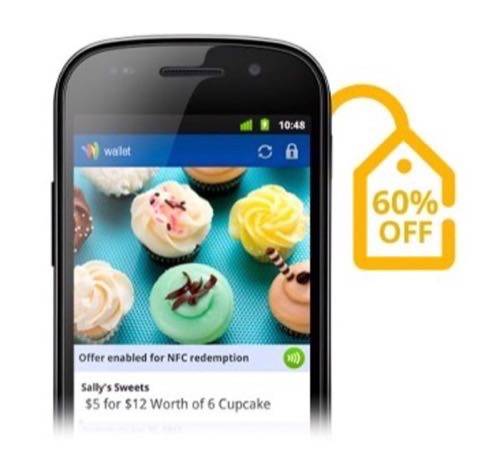

Google and MasterCard have announced the official launch of Google Wallet, their joint effort in mobile payments using near-field communications (NFC).

Google Wallet is rolling out in a limited fashion, but there aren’t enough NFC-capable phones out there to really call this a “launch.” And that’s just the hardware part; customer behavior will have to adjust, too. Industry insiders say the era of NFC payments is still a year or two away.

Google Loves Its Betas

GigaOM has spotted a Google Wallet-branded NFC reader in the wild, but despite having readers at San Francisco coffee houses and releasing funny George Costanza videos, Google Wallet is not ready for primetime.

Google Wallet will surely be convenient, but the current generation of Android phones is not equipped to handle it. The Nexus S 4G is the only officially compatible phone on the market. Google’s announcements so far have been about partnerships, preparing the industry for Wallet, but the consumer side is just not there.

Google has offered some incentives to use Wallet with the initial partners, but it uses a “virtual” system to include people without capable phones. In short, it doesn’t count as NFC. For the real deal, there’s only one phone (Nexus S 4G), one operator (Sprint), one bank (Citi) and one payment network (MasterCard). This is a trial phase. The NFC World Congress starts today, and Google isn’t even making an official appearance. It’s Google, remember? Everything’s always in beta. Today’s Wallet announcements are just an expansion of the test.

The Competition

Google has to come out of the gate strong on mobile payments because it faces stiff competition. PayPal, the pioneer of online payments, seems downright calm about Google Wallet. “Put simply, before you try mobile (or any other payments) solution, you need to be great at payments,” PayPal spokesperson Anuj Nayar told us in May.

Visa’s digital wallet is coming, and it has also made a large investment in Square, which provides a mobile payment solution that doesn’t require an NFC-capable smartphone. Square’s Register and Card Case also offer an alternative to NFC for merchants.

Square has also been playing nice with Apple, Google’s real competition for the actual point of sale: the smartphone. There have been conflicting reports, but the latest rumblings indicate that the imminent iPhone 5 will have an NFC chip. In the keynote address at WWDC this June, Apple revealed that it has over 200 million iTunes accounts with credit cards, making it “very likely” that Apple has “the most accounts with cards anywhere on the Internet.” An NFC-enabled iPhone would make it possible for any equipped merchant to charge those accounts.

The mobile payments field is green, the lines are drawn, and the lights are on, but the teams are still warming up.

Google’s Commerce Convergence

Google is working on a bunch of commerce plays right now, and they haven’t been integrated yet. In addition to Wallet, Google is still developing Offers, its local daily deals product. While Google announced Wallet and Offers on the same day, they’re both far from finished. Offers is only available in a handful of cities.

In fact, the pattern of simultaneous announcements about Wallet and Offers continues; just as Wallet’s “launch” was revealed for today, the German coupon site DailyDeal has announced its acquisition by Google. Google also recently acquired The Dealmap, a map-based aggregator for daily deals. It seems determined to make a stand against Groupon, who rejected Google’s $6 billion acquisition offer last year.

Google has to make lots of noise in commerce, but the game won’t be changed for some time. Before we see more smartphone penetration, more compatible hardware and – most importantly – broad changes in consumer and merchant behavior, this is all just a warm-up.

How would you like mobile payments to work? Let’s discuss in the comments.