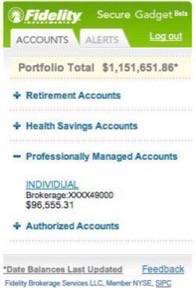

Fidelity, one of the world’s largest financial service institutions, has just launched the first iGoogle secure banking gadget for use by their tens of millions of customers. With the new Fidelity Secure Gadget, customers no longer have to visit Fidelity.com or NetBenefits.com in order to check their account balances – they can now do so right from their own iGoogle homepage.

In addition to displaying account balances, this new gadget, now available for download from Fidelity Labs, can also be configured to display alerts on certain account-related activities, including trade notifications and price trigger alerts. Customers can choose to either add the Secure Gadget as a standalone gadget or they can click a button to add a customized Fidelity Tab to their iGoogle. The tab includes the gadget itself, plus two RSS feeds from Fidelity: Fidelity Investor’s Weekly and Fidelity Investment Insight Podcast.

Fidelity iGoogle tab (click to view larger):

To use the gadget, customers log in using their SSN or Customer ID and PIN, as they would do online. That information is not saved on Google’s servers on any other 3rd party servers, says Fidelity.

The Fidelity Labs web site states that they developed the gadget, but it looks to us like it came from WorkLight, an enterprise 2.0 startup whose banking 2.0 survey data we reviewed earlier this year. At that time, the survey results showed that nearly half of the respondents said they would use web 2.0 tools if offered by their current bank. We also took note of the secure banking gadgets they had under development – gadgets that greatly resemble this one from Fidelity – which we considered to be very promising technology.

The release of Fidelity’s gadget may hint at the beginnings of a new trend in banking – making banking 2.0 mainstream. Along with numerous web 2.0 services for managing finances, many of today’s banking customers can manage their money from their mobile phones while other customers are receiving personalized recommendations on their iPhones, as well. However, none of the services offered so far have the potential for mainstreaming banking 2.0 the way a Google homepage gadget could. It’s already a technology most everyone is familiar with and it’s being offered by the financial institution itself, which should help customers feel comfortable about its security. We hope more financial institutions will start offering gadgets of their own in the near future.