Looking to trade crypto without revealing your identity or uploading ID verification documents? You’ll need an exchange that offers accounts without KYC.

This guide ranks and reviews 10 no KYC crypto exchanges that offer a private and safe trading experience. Discover which platforms stand out for trading pairs, low fees, fast withdrawals, and robust security.

Ranking Non KYC Crypto Exchanges

Consider the 10 platforms below when choosing a no KYC crypto exchange:

- Best Wallet – The overall best no KYC exchange with a native self-custody wallet

- OKX – Decentralized web 3.0 portal with instant token swaps and earning yields

- MEXC – A great no KYC option for trading perpetual futures with high leverage

- Margex – Global trading platform with low margin requirements and a native app

- Bybit – 24-hour withdrawal limits of 20,000 USDT without completing KYC

- BingX – Top-rated crypto exchange with solid security and 100% proof of reserves

- PrimeXBT – No KYC accounts allow $2,000 in fiat deposits and $20,000 in daily crypto withdrawals

- KCEX – Buy and sell over 170 cryptocurrencies without paying trading commissions

- Changelly – User-friendly crypto exchange with instant wallet delivery

- CoinEx – Popular trading platform for building diversified portfolios with over 1,000 coins

Reviewing the Top Exchanges Without Verification

We’ll now review the leading crypto exchanges without ID requirements. Read on to choose the best exchange for you.

1. Best Wallet – The Overall Best No KYC Exchange With a Native Self-Custody Wallet

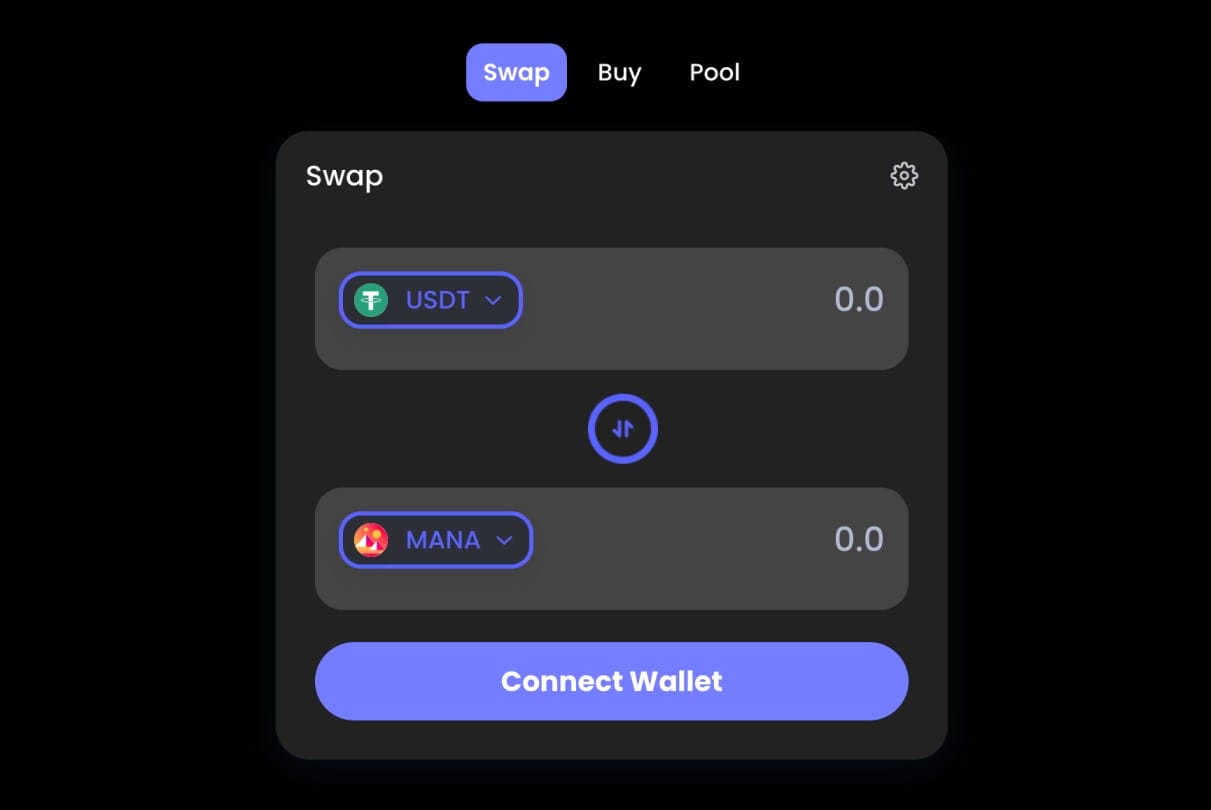

Best Wallet offers everything you need for a safe, reliable, and anonymous trading experience. It’s a hybrid ecosystem offering an anonymous, self-custody wallet with an in-built exchange. Best Wallet’s exchange doesn’t require an account – so there’s no need to provide any KYC details. Best Wallet supports all tokens on the Ethereum and BNB Chain networks.

This means you can buy and sell the best meme coins at the click of a button. Traders get the most competitive market prices, as Best Wallet uses multiple liquidity providers. There are no extra fees – so you’ll pay whatever the liquidity provider charges. This is often less than a percentage point. Importantly, any tokens you buy are instantly added to your Best Wallet balance.

You can access Best Wallet via an Android or iOS app. A browser extension is also being built – this should be launched in the coming weeks. Similarly, support for Bitcoin is also on the way. Best Wallet is also the best no KYC crypto exchange for security. The app is protected by biometrics and two-factor authentication. You’ll also receive a unique backup passphrase.

Additionally, Best Wallet also stands at the top of our list of best P2P crypto exchanges.

Pros

- Our top pick for no KYC trading

- No accounts or KYC documents – meaning complete privacy

- Supports the best cryptocurrencies from Ethereum and BNB Chain

- Traders get the best market prices via external liquidity providers

- The exchange also offers a self-custody wallet app

Cons

- Bitcoin won’t be supported until the next development update

- Currently only available on smartphone devices

2. OKX – Decentralized Web 3.0 Portal With Instant Token Swaps and Earning Yields

While its centralized exchange requires KYC processes – this isn’t the case with the OKX web 3.0 portal. This is a decentralized exchange that connects with over 400 liquidity providers. This covers more than 70 blockchain ecosystems, including Ethereum, BNB Chain, Polygon, Litecoin, Avalanche, and Solana, meaning you can find all the best altcoins here.

No account is needed – just connect a self-custody wallet to the OKX platform. Select which cryptocurrencies to swap and OKX will connect you with the most cost-effective liquidity pool. Swaps take seconds to complete – and the tokens will be transferred straight to your connected wallet.

Additionally, cross-chain swaps are also supported. This means you can swap tokens effortlessly from two different network standards. OKX’s web 3.0 portal also offers earning opportunities. This includes staking and liquidity farming. OKX can be accessed on standard web browsers. It also offers a decentralized app, plus a Chrome extension.

Pros

- Decentralized web 3.0 portal with no account requirements

- Bridges to more than 400 liquidity providers

- Supports over 70 blockchain ecosystems

- Near-instant token swaps with cross-chain functionality

- Available via browsers, apps, and a Chrome extension

Cons

- Some liquidity pools have low TVL (total value locked)

- Commissions are built into the final market price

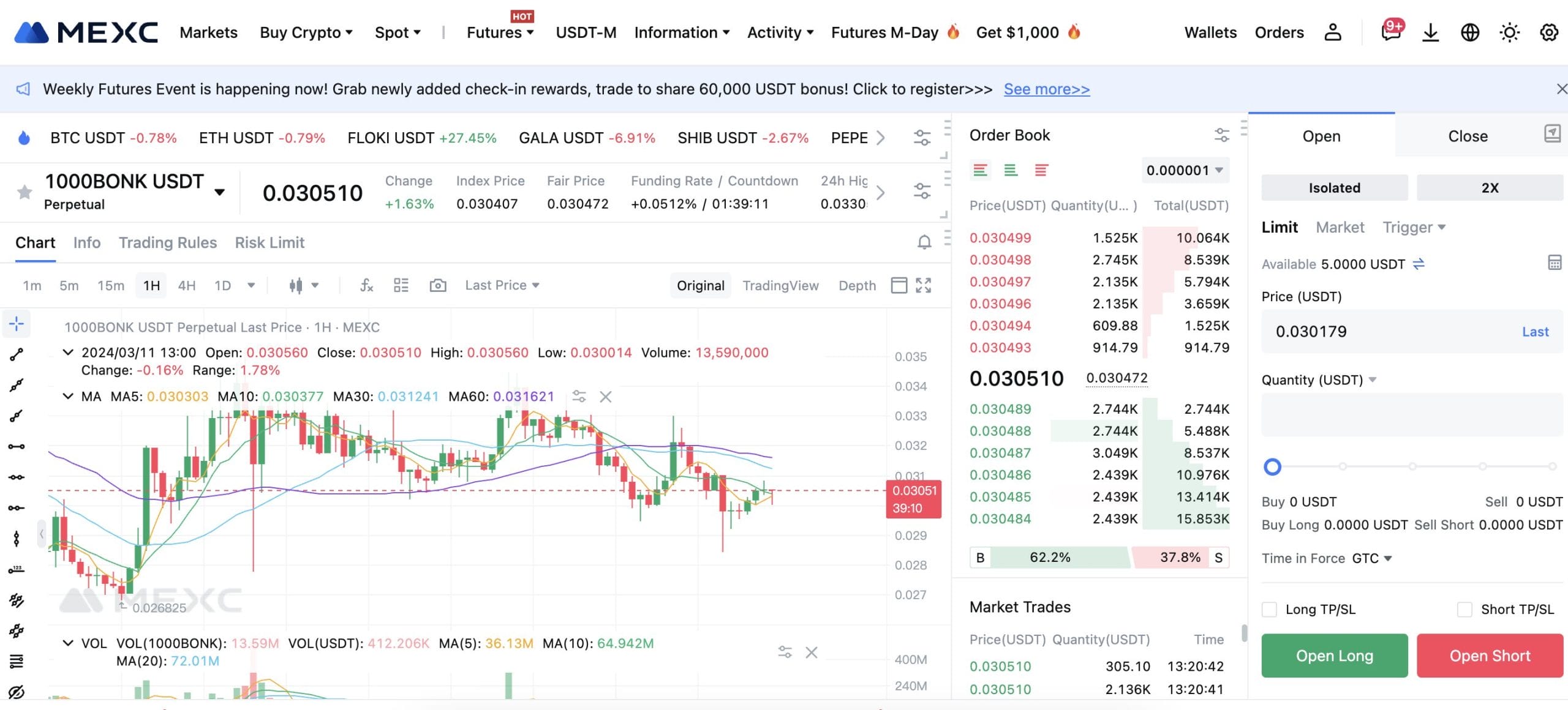

3. MEXC – Great No KYC Option for Trading Perpetual Futures With High Leverage

MEXC is one of the best crypto exchanges in the market. It offers premium liquidity levels with deep order books. Not to mention some of the lowest fees in the industry. Those buying and selling coins on the spot trading markets will pay just 0.1% per slide. This covers more than 2,000 cryptocurrencies, including meme coins, DePIN tokens, and everything in between.

That said, MEXC really stands out when it comes to leveraged trading. It supports hundreds of perpetual futures, covering large and small-cap markets. The minimum margin requirement is 0.5% – which converts to leverage of up to 200x. This means you can open a $20,000 position with just $200 in your MEXC account.

Perpetual futures at MEXC are also cost-effective – you’ll pay just 0.01% per slide. In terms of KYC, new MEXC accounts only require an email address or cell phone number alongside a password. While no KYC limits seem to vary depending on the account holder – most users can withdraw up to 5-10 BTC per day – which is plenty.

Pros

- The best no KYC crypto exchange for trading perpetual futures

- Trade hundreds of futures with leverage of up to 200x

- Futures commissions of just 0.01% per slide

- Also supports more than 2,000 spot trading pairs

- Most users can withdraw 5-10 BTC per day without completing KYC

Cons

- Doesn’t accept traders from the US

- Isn’t regulated by any tier-one licensing bodies

4. Margex – Global Trading Platform With Low Margin Requirements and a Native App

Margex is the next no KYC exchange to consider. Just provide an email address and password to get started. Accounts can be funded anonymously with multiple cryptocurrencies, including Bitcoin, Ethereum, and USDT. Margex is a crypto derivatives platform that specializes in perpetual futures. All supported markets come with low margin requirements.

For example, you can open BTC/USD positions with a margin of just 1%. This means you can increase your account balance by 100x. In addition, Margex offers lots of crypto trading tools, including technical indicators and customizable pricing charts. Margex can be accessed on desktop browsers or its native app for Android and iOS.

Both options offer a smooth trading experience. Margex is also popular for its low pricing structure. Traders pay commissions of just 0.06%, charged per slide. Margex also offers staking tools – you’ll earn up to 5% when holding USDT and USDC. However, Margex isn’t regulated by any notable bodies, so investor protections are limited.

Pros

- User-friendly trading experience on desktops and mobiles

- Trade cryptocurrencies with a minimum margin requirement of 1%

- Get started in seconds – only an email address is needed when registering

- Earn up to 5% when staking USDT or USDC

- Low trading commissions of just 0.06% per slide

Cons

- Doesn’t accept traders from Canada or the US

- Only supports perpetual futures – which won’t suit all trading preferences

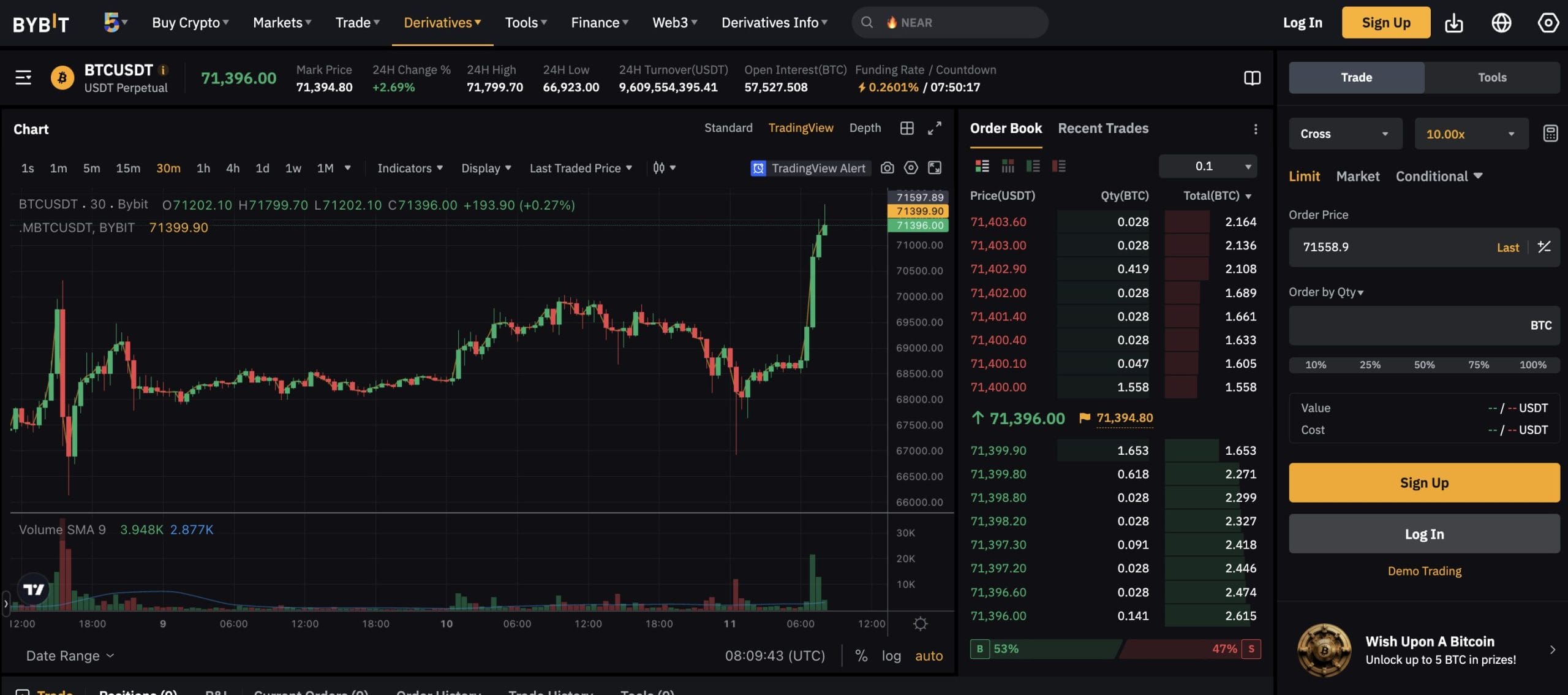

5. Bybit – 24-Hour Withdrawal Limits of 20,000 USDT Without Completing KYC

Bybit is one of the best crypto leverage trading platforms. It supports hundreds of derivative markets and the maximum leverage limit is 125x. This turns a $1,000 account balance into $125,000 worth of trading capital. Bybit supports perpetual futures contracts that are settled in USDT or USDC.

More experienced traders will like Bybit’s inverse contracts – these are settled in the coin being traded. Delivery futures for Bitcoin, Ethereum, and Solana are also available. Not to mention option contracts with extensive chains. Getting started with Bybit takes seconds – no personal information is needed.

Best of all, you can withdraw up to 20,000 USDT every 24 hours without completing KYC. This will be sufficient for more traders. However, Bybit isn’t a regulated exchange – so traders should think carefully about holding large balances. It doesn’t accept US or UK traders either. Nonetheless, most other nationalities are supported.

Pros

- Withdraw up to 20,000 USDT per day without completing KYC

- Offers leverage on hundreds of markets

- Derivative products include perpetual and delivery futures

- Also offers spot trading facilities

- Access high-level analysis tools – such as technical indicators from TradingView

Cons

- US and UK traders are banned

- No tier-one regulatory licenses are held

6. BingX – Top-Rated Crypto Exchange With Solid Security and 100% Proof of Reserves

The next option to consider is BingX. This top-rated crypto exchange supports spot trading and derivative products – so there’s something to suit all strategies. Opening an account only requires an email address and no KYC limits are high; you can withdraw up to $50,000 per day without ID verification.

This is on the proviso you’re depositing and withdrawing crypto. Fiat money payments will trigger KYC requirements. We also like BingX for its robust security systems. Accounts are protected by two-factor authentication and AI-backed risk management flagging. It also offers 100% proof of reserves, ensuring that client funds are safe.

In terms of markets, users can easily find cryptocurrencies to trade based on the category. For example, you can view tokens from the Ethereum, Solana, or Toncoin ecosystem. Or, view tokens from the meme, GameFi, and AI markets. Spot trading fees are very competitive at BingX – you’ll pay just 0.1% per slide. Perpetual and delivery futures cost 0.05% and 0.045%, respectively.

Pros

- 100% proof of reserves and solid security systems

- Offers spot markets and derivative products

- Low trading fees on all supported markets

- Withdraw up to $50,000 per day without KYC

- Also offers copy trading tools

Cons

- Much smaller trading volumes when compared to tier-one exchanges

- Doesn’t support crypto options

7. PrimeXBT – KYC-Free Accounts Allow $2,000 in Fiat Deposits and $20,000 in Daily Crypto Withdrawals

PrimeXBT is another great option for trading perpetual futures with leverage. It charges commissions of just 0.01% per slide. Dozens of futures markets are available, including Bitcoin, Cardano, Ethereum, Polkadot, and XRP. There’s also support for Axie Infinity, Internet Computer, Stellar, and other popular altcoins.

Futures contracts come with deep liquidity and high leverage limits. What’s more, advanced charting tools are available – including technical indicators like the MACD. Alternatively, eligible traders can also speculate on cryptocurrencies via contracts-for-difference (CFDs). Just like futures, CFDs support long and short selling.

In terms of ID verification, there’s no requirement to complete KYC at PrimeXBT. Anonymous accounts can deposit up to $2,000 with fiat payment methods – such as a debit/credit card. Crypto withdrawals are limited to $20,000 per day on KYC-free accounts. These limits are suitable for most trading profiles.

Pros

- KYC-free accounts can deposit up to $2,000 with fiat money

- Crypto withdrawals of up to $20,000 per day without ID verification

- Supports futures and crypto CFDs

- Low trading commissions of just 0.1% per slide

- Offers advanced charting and analysis tools

Cons

- Offers fewer trading pairs than most other platforms

- Doesn’t offer crypto spot trading markets

8. KCEX – Buy and Sell Over 170 Cryptocurrencies Without Paying Trading Commissions

KCEX is an up-and-coming exchange with over 1 million clients. It’s a market leader when it comes to fees – KCEX doesn’t charge any spot trading commissions. This is ideal for day traders and scalpers – as buy and sell orders only attract the market spread. More than 170 cryptocurrencies are supported.

This covers the most popular coins like Bitcoin, Ethereum, and Dogecoin. KCEX also offers low-cap tokens from multiple ecosystems, ensuring traders can build a diversified portfolio. In addition to spot trading, KCEX also offers perpetual futures. Large-cap markets come with leverage limits of up to 100x.

Charts are integrated with TradingView – which is ideal for performing technical analysis. KCEX also offers a user-friendly trading app for iOS and Android. This has been optimized perfectly – resulting in a top-notch trading experience. There is no requirement to complete KYC at KCEX – unless you need to increase daily withdrawal limits to 30 BTC.

Pros

- Spot trade cryptocurrencies without paying commissions

- Supports more than 170 coins and tokens

- Fully optimized app for smooth mobile trading

- Also offers perpetual futures with 100x leverage

Cons

- Is still relatively unknown in the wider crypto space

- Charges a huge withdrawal fee of 0.002 BTC

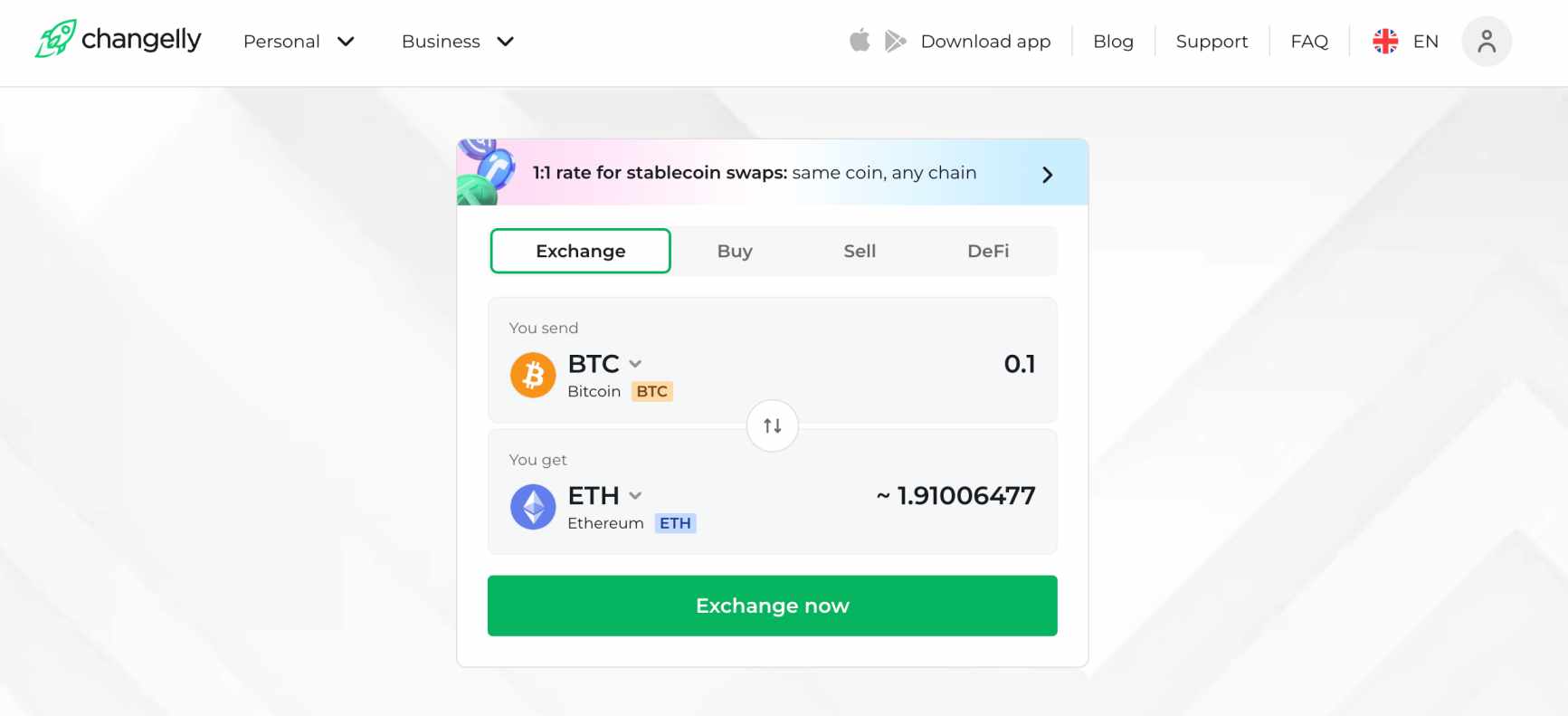

9. Changelly – User-Friendly Crypto Exchange With Instant Wallet Delivery

Founded in 2015, Changelly is an established crypto exchange that offers a user-friendly experience. It works differently from conventional exchanges, as swaps are delivered directly to your wallet. There’s no requirement to connect a wallet to Changelly – simply provide the address when completing the order form.

What we really like about Changelly is that cross-chain swaps include Bitcoin – which you won’t find with most other platforms. More than 500 altcoins are supported, covering everything from Ethereum and Solana to Bitcoin Cash and Pepe. Changelly also offers a 1:1 swap on any supported stablecoin.

For instance, you can swap USDT for USDC without worrying about micro-price movements. One of the drawbacks is that Changelly builds commissions into the exchange rate – which can make it difficult to know what you’re paying. Nevertheless, Changelly allows KYC-free swaps of up to 1 BTC every 24 hours – which is huge.

Pros

- Reputable exchange that launched in 2015

- Supports Bitcoin and over 500 altcoins

- Cryptocurrencies are transferred straight to your wallet

- KYC-free limits of up to 1 BTC per day

Cons

- Fees are built into the exchange rate

- Wallet deliveries can take up to 40 minutes

10. CoinEx – Popular Trading Platform for Building Diversified Portfolios With Over 1,000 Coins

Last on this list of no KYC crypto exchanges is CoinEx. This is one of the best options for building a diversified portfolio – CoinEx supports over 1,000 coins. This translates to over 1,500 trading markets. Meme coin investors are particularly catered for, with CoinEx supporting MAGA, cats in a dogs world, Roaring Kitty, FLOKI, Baby Doge Coin, and dozens more.

In terms of fees, spot trading commissions start at 0.2% per slide. This is more than the industry average. However, lower fees are available when holding CET tokens – which are native to CoinEx. Larger trading volumes also trigger low commissions. CoinEx also offers a wide range of perpetual futures markets.

This is a great option for short-selling, and trading with low margin requirements. The maximum leverage limit is 100x, although this is reduced on lower-cap markets. The daily withdrawal limit is $10,000 when opting against ID verification. Once again, this will be suitable for the majority of crypto traders.

Pros

- Withdraw up to $10,000 per day without completing ID verification

- Supports over 1,000 coins and more than 1,500 trading markets

- Choose from spot trading or perpetual futures

- Supports short-selling and leverage of up to 100x

Cons

- Some listed tokens appear to be scams

- Doesn’t offer support via telephone

What is a No KYC Crypto Exchange?

Crypto exchanges with no KYC are more flexible when it comes to ID verification procedures. The account opening process often only requires an email address or cell phone number. Users can then deposit funds with their preferred crypto coin and begin trading. Although no KYC exchanges support anonymous accounts, limitations will apply.

For instance, most platforms have 24-hour withdrawal limits. Even so, these limits are often high – meaning they’re suitable for most trading profiles. Users at MEXC, for instance, can withdraw up to 5-10 BTC every 24 hours without completing KYC. At Bybit, the daily withdrawal limit is 20,000 USDT. And when using PrimeXBT, 24-hour limits stand at $20,000.

Potential Advantages of Non KYC Exchanges

The main advantage of using a no KYC crypto exchange is anonymity. This isn’t possible when using a traditional exchange like Coinbase, Kraken, and even Binance. Due to increased regulatory pressures, these platforms must adopt comprehensive KYC processes. Not only does this mean users must provide personal information. But also ID verification documents.

This includes a government-issued ID at a minimum. For instance, a state ID card or a passport. Most KYC procedures also require proof of address, like a utility bill or credit card statement. So, by using a no KYC exchange, you can avoid these intrusive measures. Simply provide an email address to get started.

Another benefit is that no KYC exchanges are more inclusive. As long as you stay within the permitted limits, the exchange won’t ask for your country of residence. This ensures that anyone can buy and sell cryptocurrencies – no matter where they’re based. No KYC exchanges also offer access to a much wider range of trading products.

This often includes crypto derivatives like perpetual futures and options. These products aren’t always available to retail clients. So no KYC platforms are a great option if you seek leverage or short-selling facilities. All that said, exchanges have the legal right to request KYC documents in certain circumstances. Especially if they suspect a financial crime, like money laundering.

How to Buy Crypto Without KYC

It takes minutes to get started with a no KYC crypto exchange. Here’s a step-by-step walkthrough for beginners:

Step 1: Choose a No KYC Exchange

There are many no KYC exchanges to choose from – select the best one for your preferences. Consider factors like supported pairs and trading products, commissions, withdrawal limits, and security.

Scroll up for a recap on the 10 best no KYC crypto exchanges for 2024.

Step 2: Open an Anonymous Account

Visit your chosen exchange and open an account. This will only require an email address or a cell phone number, plus a password.

Step 3: Deposit Crypto

The next step is to deposit some crypto. The exchange will provide a unique deposit address. Open your wallet and transfer the respective crypto coins.

While most exchanges also accept fiat money, KYC requirements might be triggered. That said, some platforms allow small fiat deposits without ID verification. For example, PrimeXBT allows up to $2,000.

Step 4: Start Trading

Once the account is funded, you can begin trading. Search for a crypto market – such as Bitcoin or Dogecoin. Set up an order by typing in the investment size.

Choose between a market or limit order, and don’t forget to deploy stop-losses and take-profits.

Step 5: Withdraw Funds

You can withdraw your account balance at any time. Just remember that most no KYC crypto exchanges have 24-hour limits. That said, this is often at least $10,000, which should suffice for most.

Factors to Consider When Picking a No ID Crypto Exchange

Consider the following factors when choosing a cryptocurrency exchange without KYC:

- Full Anonymity: Make sure the exchange offers anonymous accounts – meaning KYC procedures won’t take place. The only information required should be an email address or a cell phone number.

- Limits: Most no identification crypto exchanges have 24-hour withdrawal limits. Make sure this aligns with your trading profile. Otherwise, you won’t be able to withdraw funds without uploading ID.

- Supported Coins: Check which coins the exchange offers before opening an account. Some platforms offer more than a thousand coins, while others support a few dozen.

- Trading Markets: Some traders prefer the spot trading markets – as they directly own the coins they buy. Alternatively, you might also want to trade derivatives like perpetual futures or options. These products often support high leverage limits and the ability to go short.

- Security: Another important factor is security. Stick with established no KYC exchanges with robust safeguards – such as proof of reserves and two-factor authentication. Client funds should be kept in cold storage for additional safety.

- Fees: The fee schedule should also be checked before proceeding. Explore commissions for your preferred market, such as spot trading or options. Also, assess fees related to payments and financing.

Are No KYC Cryptocurrency Exchanges Legal?

Regulators are increasingly monitoring exchanges to ensure they comply with anti-money laundering regulations. This includes robust KYC procedures, such as ID verification and proof of source of funds. Failing to do so can lead to serious financial penalties. For example, Binance was recently fined over $4 billion for money laundering breaches.

Binance’s then-CEO, Changpeng Zhao, was also sentenced to four months in prison. All that said, KYC requirements will vary depending on where the exchange is located. For instance, most no KYC exchanges are based in countries with weak regulations. This provides exchanges with more flexibility in how they approach their anti-money laundering responsibilities.

This typically means installing withdrawal limit thresholds, such as $10,000 every 24 hours. Additionally, exchanges agree to enforce KYC procedures if they have strong reasons to suspect money laundering or other financial crimes. Ultimately, this means that exchanges can ask for KYC documents at their discretion.

Is it Safe to Use Crypto Exchanges Without KYC?

Like any financial platform, there are safe no KYC exchanges – as well as those that have murky reputations. This is why due diligence and research are so important. For a start, traders should assess when the exchange was launched, where it’s headquartered, and whether it holds any regulatory licenses.

Additionally, evaluate how many registered users the exchange has and how it’s rated in the public domain. Standard security tools should also be explored. For instance, how accounts are protected – whether that’s via two-factor authentication or IP whitelisting. Traders should also stick with exchanges that keep the majority of client tokens in cold wallets.

For an even safer experience, consider using a decentralized exchange like Best Wallet. No account is needed, so there’s no risk of being asked for KYC documents. Moreover, as a decentralized platform, Best Wallet never holds client cryptocurrencies. Instead, after completing a trade, the coins are instantly added to your wallet.

Conclusion

In summary, while most tier-one platforms have ID verification processes – there are still plenty of no KYC exchanges worth considering. Most offer KYC-free accounts with huge 24-hour limits. So unless you’re a large-scale trader – you shouldn’t face any ID requests.

However, just remember that most exchanges without KYC are located offshore – meaning you won’t have access to domestic investor protections. Make sure you conduct due diligence and research before choosing a platform.

FAQs

Can I buy crypto without using ID?

Which crypto exchanges don’t have KYC?

Which wallets don’t require KYC?

Can I use Binance without KYC?

Does Coinbase require KYC?

Is Kraken non kyc?

How can I buy crypto in the US without KYC?

References

- Guidance on Digital Identity (FATF)

- New EU Rules to Combat Money-Laundering Adopted (European Parliament)

- Binance and CEO Plead Guilty to Federal Charges in $4B Resolution (Department of Justice)