According to the latest data from Compete, consumers are slowly warming up to the idea of mobile banking, but this growth is slowed by the fact that most users, even though they already use online tools to interact with their bank, never use their mobile devices to access the Internet. 72% of those who bank online never access the Internet from their mobile devices and only 8% do so more than 20 times per month. Because of this, it it no surprise that only 5% of online bankers use a mobile device to check their bank accounts.

Most Users Think Mobile Banking Would be Useful

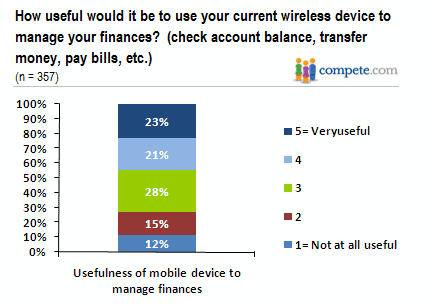

At the same time, however, Compete’s survey also found that almost 45% of respondents who use online banking think that using a wireless device would be ‘useful’ or ‘very useful,’ while only 12% think it would be ‘not at all useful.’

This data from Compete also fits in well with a survey from WorkLight we reported about in June, which stated that 48% of consumers between the ages of 18-34 would use secure gadgets for personal banking if their bank offered it.

Judging from these data points, mobile banking can clearly look forward to robust growth, especially once consumers get more comfortable with using the Internet on their mobile devices.

Mobile Banking Has to be Easy

The poster-child for online banking in the U.S. so far is the mobile site of the Bank of America, which has close a one million active users, 2/3rds of which are under the age of 35.

One aspect of mobile banking that the Compete study doesn’t take into account is that a lot of banks simply don’t offer very compelling mobile sites yet. Unless the experience on a mobile device is as frictionless and simple as possible, consumers will wait to check their account status at home.