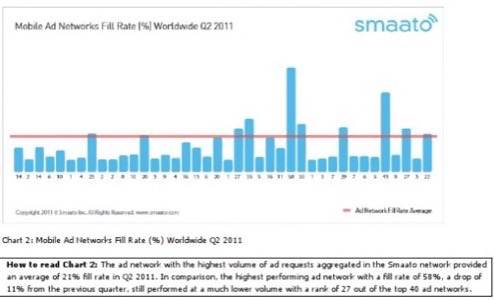

Mobile ad optimizing network Smaato has released metrics from its second quarter that show the state of mobile advertising is not what many had thought. Mobile advertising inventory may be higher than ever, but that does not mean fill rates are keeping up. Overall, Smaato saw a 2% decline in worldwide mobile advertising fill rates in the second quarter across the top 40 mobile ad networks. Only 18% of mobile ad inventory had been filled.

The fact of the matter is that there are just too many apps and not enough ads. Smaato’s metrics show that the larger mobile platforms, iOS and Android, do not perform comparatively well on a global index. That could leave developers scrambling for ways to make money from their apps as the ecosystem grows.

Mobile analytics platform Flurry’s research on ad rates suggested that booming inventory would be boon to developers’ bottom lines. Yet, an analyst described it like this: “just because there is a lot of ad space, that does not mean it is any good. It is like having a ton of warehouse space that either stands empty or full of garbage.”

Smaato’s metrics give credence to that statement.

“Although current economic conditions are a factor, the continued quarter on quarter decline in fill rates is an indicator that the market is not only becoming increasingly fragmented, but also under threat of commoditization as inventory increases at a faster rate than budgets,” said co-founder Harald Neidhardt in Smaato’s report. “While we will absolutely see more ad dollars coming to mobile and the average campaign size increase, this will be across a much wider range of inventory, which will in turn drive costs down.”

Smaato says that nine of the 40 mobile ad networks performed above average in their index in the second quarter. Fill rates ranged from 23% to 58% among those 40 networks. The networks that performed well tended towards specialization, such as geo-location or video. In the United States, fill rates declined 8% from the first quarter.

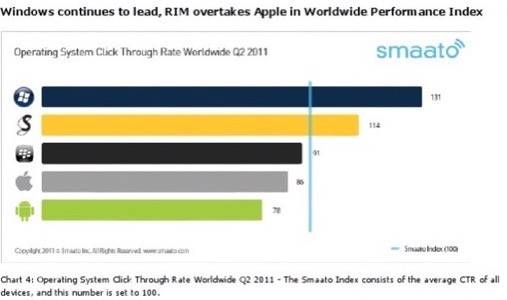

When it comes to click through rates, the smaller mobile platforms performed better. Windows Phone topped the global click through rate on Smaato’s index followed by (the dying) Symbian, Research In Motion, Apple then Android. This is a function of volume. Less users clicking more skews the sample size in comparison to Apple and Android, which both have many millions more devices in the market. Smaato did note that Android click through rates have improved considerably this year.

Smaato, of course, thinks it has the product to help app publishers to fix these ad fill rate and inventory problems. Hence, their findings should be viewed through the prism of their product. Yet, the numbers do make sense and Smaato’s metrics are robust enough to give a fair sample size of the overall mobile ad economy. Neidhardt suggested (along with using Smaato, of course) that app publishers should spread their resources among several ad networks to achieve higher fill rates.

The notion of putting up a shingle and saying “we will function through ad dollars” is not going to get developers paid like they hope. What solutions are available that mobile app makers can use to ensure that they will be able to make a living off their products? Let us know in the comments.