“Having searched thousands of times in the crowd, suddenly turning back, She is there in the dimmest candlelight.” And “she” might very well be Tizen. (Although I have no clue what Tizen might mean in Chinese…).

Baidu (BIDU) is expanding the scope of its businesses and seems to be planning a massive growth in the coming years. It’s now working very closely with Japan based Rukaten, a video sharing platform and it paid $1,850,000,000 (Seems like a lot more than 1.85 B$) to buy the well known app store “91 Wireless”. That of course helped them to grow their market share and we’re pretty sure they plan for a lot more growth the coming years. Their own location services Map also showed growth in users and revenues.

Joining the ranks of Tizen, with partners like Intel, is another indication of the plans that will propel this Chinese success generator into a pleasant future.

Why Baidu will benefit from Tizen?

Tizen is an open source operating system with a lot of similarities to Android. In spite of being around for quite some time there are few commercially available (or soon available) devices. Why? Because it goes way beyond Android as a connecting platform, a true InternetOfThings platform. On our site you’ve seen many referrals and examples, like fridges but also a GearWatch

It’s up to large corporations like Baidu, Intel, Samsung and ZTE to finally develop a useable and available operating system as well as devices desired by many buyers. Tizen goes way beyond smartphones but these as well as laptops are the ones that create buzz and desire. Devices and a stable platform are one requirement for success, the other comes from apps. However slightly their importance might be in the grand scheme of things, it’s what separated the old boys from the new men. Like Blackberry and Nokia realized too late.

Baidu shelved out $1.85 billion making it one of the biggest acquisitions in China. And with some good grounds as it is said to be a profitable investment. Analysts at Maxim group anticipate that Baidu’s revenues and net income will be better than expected for Q4 and suggest the well trained buyer to buy. (All at your own risk!)

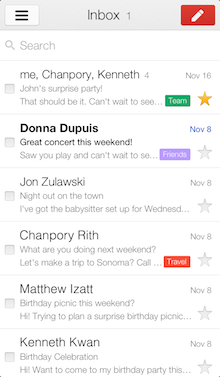

Baidu can use the codes of Tizen to make 91 wireless the biggest app store for Tizen. Wireless already has a strong customer base and by offering Tizen apps it can make it even stronger. This would lead to an even better financial result in 2014 as a whole.

Baidu Map:

Baidu has been working hard on their location based services. Through its subsidiary, Nuomi, and two other companies, Mituan and Lashou, Baidu Map offers services like hotel booking, restaurant reservation, movie ticketing and traffic checking. As of the third quarter, Baidu Map managed to increase its market share from 19.1% to 26.6% as compared to the same period last year. And that share seems intent to closing the gap with market leader AutoNavi’s share of 31.3%.

AliBaba, the e-commerce giant, is said to have bid $1.6 billion to buy full ownership of AutoNavi. They already owned 28% of AutoNavi. and that acquisition would pose a threat to Baidu in the near future. AliBaba and Baidu are competitors in other segments of business and markets and it looks they are ready to battle head-on. The edge Baidu has over AliBaba is that it has a series of markets and products as a fall-back scenario. And that’s a secure feeling to both management and owners.

Conclusion:

Fortune telling is an ancient art and not something we’re really good at, so no predictions from us. Not from the palm of your hand, a crystal ball or information on the internet. Nobody knows to what extend Tizen will help Baidu grow. In one of my earlier posts I have hinted on Tizen becoming the OS of choice for device that will compete high end smart-phones and tablets as it’s more connectable to “things”. And with Baidus’ position in massively growth markets in the ASEA region it might be that in 2015 Tizen will be the most shipped OS on smart-phones, tablets and wearables.

warning: This information might make you buy Baidu shares. Don’t! Get more information, make a well based decision and than take action. Any forward looking statement or opinion is like a path through quicksand. Buyer beware also!

This opinionated colum is based on Source