App developers are looking for ways to gain users and keep them in the fold through actionable data. There are a variety of ways to do this and several startups have popped up in the last couple of years to focus on particular elements of analytics, advertising, marketing and engagement layers. At this point most of these startups are focusing only on one or two of these problems.

Analytics and engagement startup Apsalar wants to change that. The company has been working all summer on products for analyzing data, engaging users across app platforms, optimizing the time spent in apps and helping developers monetize their users. It is a holistic approach that none of the other competitors have fully grasped yet.

What Apsalar Is Trying To Do

To understand Apsalar, you have to understand the ecosystem in which it is playing. The categories fit into the survey that Appcelerator and IDC released yesterday: reach, engagement, loyalty and monetization. Apsalar, and most of the other analytics/marketing tools available to mobile developers right now, focuses on the latter three categories while reach is more focused on developer frameworks and integrated developer environments (IDEs) like Appcelerator and Sencha.

The principle of re-engagement is what Apsalar is pinning its product offering on. It calls the environment it works in “mobile engagement management” (MEM) and is similar to what analytics company Flurry, likely Apsalar’s closest competitor, does with its analytics and AppCircle Re-Engagement tool. Localytics uses its data to help premium publishers push notifications to readers. Socialize and BeInToo have engagement layers based on social and gamification layers. To a certain extent, Apsalar is playing in all of these realms.

This is the way Apsalar CEO Michael Oiknine described Apsalar’s MEM offerings; ” … [It] bridges the gap between analytics and behavioral targeting by offering best-in-class analytics paired with an action engine that provides developers and publishers with concrete steps to take in their quest for greater engagement, retention, and revenue.”

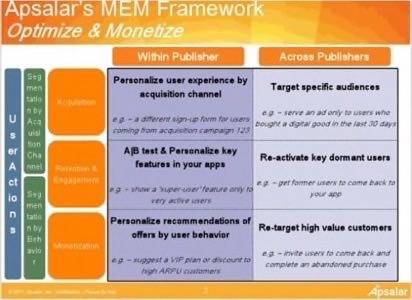

The way Apsalar does that is by taking a “lifecycle management” approach. This approach is similar to what PlayHaven does with its real-time marketing tool for games and its engagement dashboard. Apsalar provides a ways and means to reach a user anywhere in the mobile ecosystem, either in the target application, another app from that publisher or a completely separate app that is tied to Apsalar through its partnership with advertising networks.

Apsalar calls this “re-engagement” and is based on segmenting the user base on common use behavior. Think of it as in-app dynamic targeting with the intent on maximizing the reach of the app by re-targeting a user that has a certain pattern of behavior, thus making them candidates for Apsalar’s notifications and messages across apps. The data from a user in one app informs the decisions that Apsalar can help make in another app.

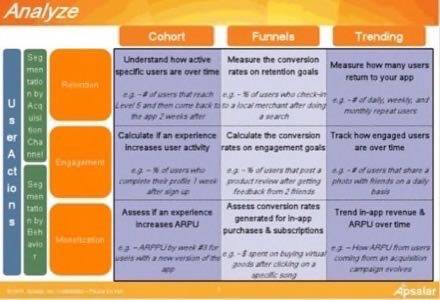

The product of this approach is Apsalar’s integrated product suite that has three main components: analyze, optimize and monetize. Let’s take a closer look.

Three Pillars: Analyze, Optimize, Monetize

Analyze: Apsalar takes a sophisticated approach to data analytics. It is reminiscent of Sun Tzu’s Art Of War; “The general who wins the battle makes many calculations in his temple before the battle is fought. The general who loses makes but few calculations beforehand.”

Here is how Oiknine describes Apsalar’s approach to analytics; “The first imperative is to understand the lay of the land. Indeed, publishers must understand and segment their users. They need to answer the “how, why and what” questions from the data they collect. Ask themselves: How is my app doing? Why is it performing well or poorly in certain areas and with some type of users? And, what can be done to improve the user experience?”

Oiknine correctly identifies that “analytics are a means to an end,” not the end unto themselves. That leads us to the next points.

Optimize: Apsalar uses its customizable conversion funnels and flexible cohort analysis to then target the user behavior in such as way that the platform can then find them in a different app and bring them back to the fold with personalized messaging. This is the crux of “re-engagement.” This type of behavior analytics is akin to predictive analytics that a company like Sonamine does with its segmented behavioral analysis. Apsalar then takes the PlayHaven approach to acting upon this granular data.

Monetize: None of this means anything if nobody is getting paid in the end. “This is where the logic of engagement fades to allow a logic of conversion to come to the front,” Oiknine said. Basically, add up all the different points of integration mentioned above with the ability to find a user almost anywhere in the app ecosystem and you have a higher probability of converting that user behavior in to tangible dollars.

There is more coming from Apsalar in the first quarter of 2012. As of yet, this is one of the most comprehensive analytics and engagement platforms on the market. Publishers: are you likely to use or give it a spin? Let us know what you think about Apsalar’s approach in the comments.