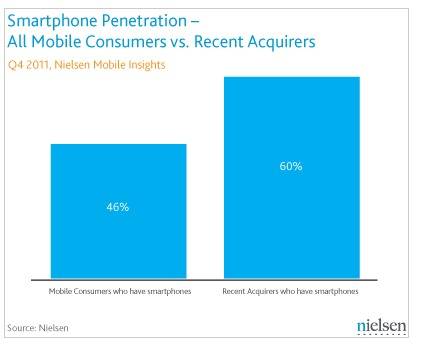

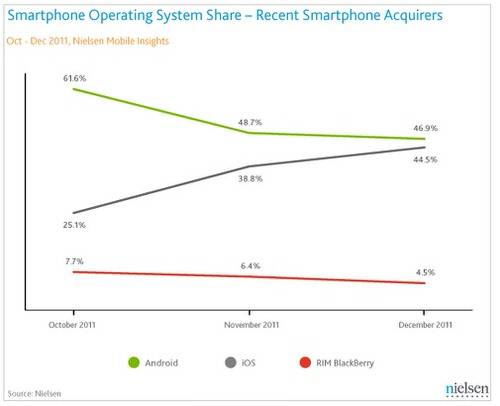

Apple’s strategy to take over the lead in the smartphone market from Android is working. In new numbers from research firm Nielsen, 37% of recent (within the last three months) smartphone buyers chose the iPhone, well above the 25.1% that did so in October 2011. Android still holds the market lead but the margin is beginning to shrink.

Android rose to the top of the smartphone heap by sheer volume. It has a plethora of original equipment manufacturers pumping out new devices every week that are distributed across the four major U.S. mobile carriers along varying price points. Why has Apple caught up? Well, because it now does that too.

For the most of the life of the iPhone, its major limiting factor? It was only available at AT&T. In March of 2011, the iPhone 4 came to Verizon and the world seemingly rejoiced. While Verizon iPhone sales have been solid, they have not been quite as killer as Apple or the pundits had originally thought. People have expensive contracts and early termination fees to contend with and the notion of jumping from one carrier to another does not make sense for a lot of consumers.

Those AT&T contracts are starting to expire. That does not mean users are dropping the nation’s second largest cellular operator in droves, but would-be iPhone buyers finally have freedom of choice. There are also a variety of price points available. The iPhone 3GS is now free from AT&T on a contract. The iPhone 4 is $99 on Verizon and AT&T with a contract while the iPhone 4S is available across AT&T, Verizon and Sprint for $199. That makes the iPhone available to more than 260 million Americans whereas it used to only be available to the 95-100 million or so on AT&T.

Market depth + price = more smartphone sales. It should come as no surprise and we have been curious to see these numbers since Apple made the announcement of the 4S last October. It is also no surprise that the 4S is leading the charge. Of new iPhone buyers, 57% chose the 4S.

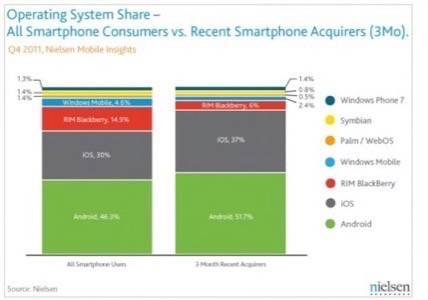

Of all smartphone owners (not just recent acquirers) that Nielsen surveyed, 46.3% are Android owners. Apple has risen several points in the overall market share to 30%. Research In Motion’s BlackBerry has dropped precipitously in these types of surveys, going from near 22% at this time last year to 6% of new buyers in Q4. Windows Phone and Windows Mobile (which indeed still exists) made up for 3.8% of new users and 5.9% overall in Nielsen’s numbers with Windows Mobile making up for 4.6% of that.

The smartphone market is cyclical. Apple made its big push with iOS 5 and the iPhone 4S in the fall. The company is likely to do that again this year with a late season rollout of the iPhone 5. Meanwhile, it is time for Android to reassert itself as version 4.0 Ice Cream Sandwich makes its way to new devices across carriers. The seesaw battle will continue and when we see Nielsen’s numbers for Q1 or Q2, the tone of this story might be quite different.

It is not like Android is losing much steam. Of recent acquirers, more than half chose Android at 51.7% in Q4. The growth of Android and Apple comes to the detriment of, well, everybody else, but especially RIM. Of all smartphones purchased in Q4, 88.7% were either iOS or Android. That leaves several billion dollar companies such as Microsoft, RIM and to a certain extent Hewlett-Packard to battle over a very small slice of the pie.