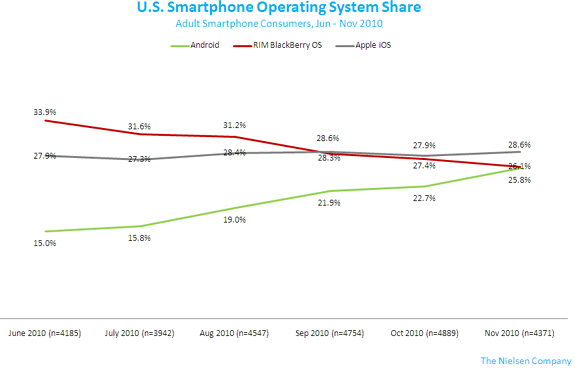

Apple is still the U.S. market share leader when in comes to smartphone operating systems, according to new data revealed today by Nielsen, but just barely. In fact, its lead is so tenuous, that the margin of error on Nielsen’s report places second-place platform RIM BlackBerry in a statistical tie for both Apple’s top spot and the third place spot now occupied by Google’s Android.

Says Nielsen, “this race might still be too close to call.”

According to Nielsen’s report, Apple has a 28.6% share, RIM a 26.1% share and Android, despite its recent surges, remains in third place with a 25.8% share.

However, as noted above, the margin of error is too close to really give the winning title to any of the three.

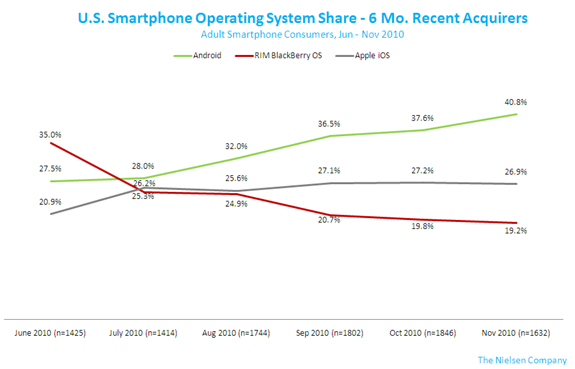

The stats are remarkably different when looked at in terms of recent acquirers (as defined by Nielsen, “recent” means within the past 6 months). Here, you can more clearly visualize Android’s dramatic rise over the course of 2010, from June to November, the months which Nielsen analyzed. Clearly, more new smartphone users are choosing Android (40.8%), instead of BlackBerry (19.2%) or Apple (26.9%).

Nielsen doesn’t go so far as to speculate on why Android is gaining, but it could very well be the lower price points for Android devices that seal the deal for many consumers. Some Android phones are priced so low – for example the $179 Huawei Ascend on MetroPCS or the $99 (with rebate) Samsung Intercept on Sprint – that they’re almost comparable to feature phone prices. Considering that, up until recently, roughly two-thirds of the market consisted of feature phone users, pricing has been a critical component in mobile phone choice. But now, thanks to the availability of more low-cost phones combined with the new, lower-priced data plans offered by many carriers, smartphones are becoming more affordable for price-sensitive consumers.

So Who’s Winning? You Are.

Although much of the focus of today’s news is on who’s winning the smartphone race, the real answer is simple: it’s the consumer, of course.

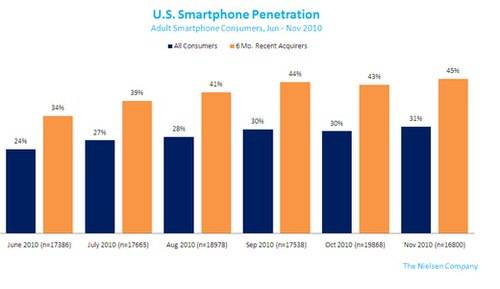

Smartphone adoption is increasing in the U.S. In November 2010, 45% of recent acquirers chose a smartphone, said Nielsen, compared with 34% back in June. It’s obvious that the demand for smartphones is growing as the race between the different platforms heats up, with each trend fueling the other. For consumers, this means the manufacturers and operating system makers will battle for their attention – a battle that will bring new and better hardware, more features and functions and even more price drops. Sounds like a good time to buy a smartphone, if you haven’t already.