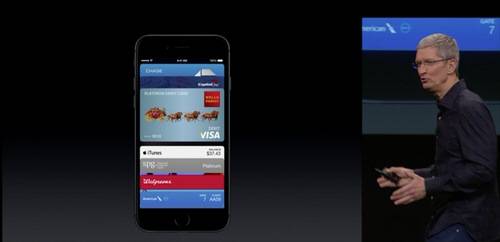

Apple CEO Tim Cook just announced that Apple Pay, the company’s mobile-payment system, will work with payment cards issued by the federal government, and some federal agencies will start taking Apple Pay payments in the fall.

Bloomberg is calling it a “big win” for Apple Pay. Well, hold on there. Yes, the government does $26.4 billion in transactions a year on GSA SmartPay cards. But what are these cards? They’re not some strange, alien form of payment. They’re just plastic Visa and MasterCard cards issued by Citibank, JPMorgan Chase, and US Bank—all of which are existing Apple Pay partners.

All they had to do was turn on a switch for these cards, and the federal employees, veterans, and others using them can now scan their cards into Apple Pay (if they have an iPhone 6 or 6 Plus).

What this doesn’t change is where they can spend money with those cards. If the National Park Service, say, starts accepting NFC-based payments, that’s another category where iPhone users can tap to pay. But that will require upgrades at thousands of locations—and the federal government is notoriously slow about upgrading its physical and technical infrastructure.

Oh, and by the way—Google Wallet, Softcard, and other NFC-based payment services should work at those same locations once they’re upgraded. In fact, the federal government issued a request for information on new payment systems in January, suggesting it’s considering embracing many new forms of payment technology.

If you’re a federal employee on a business trip who’s spending her per diem at Whole Foods, I suppose this is a marginally interesting development. And it’s good publicity for Apple. But otherwise, this news doesn’t mean much for most of us.

Screenshot by ReadWrite