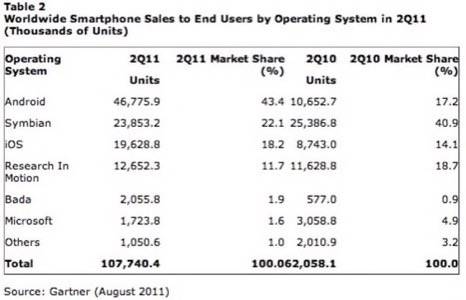

Research firm Gartner has released its study of second quarter global mobile sales and, to the surprise of no one, Android and Apple are dominating the smartphone market. Globally, smartphone sales were near 107.7 million, of which Android was the top performer (43.4% on sales of 46.7 million units) and iOS was third (18.2% on sales of 19.6 million). Between the two, they accounted for 62% of smartphone sales worldwide.

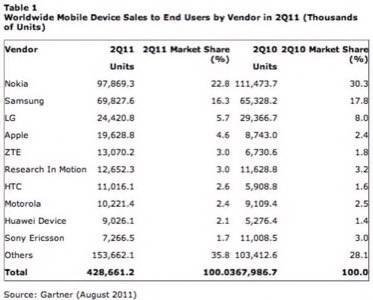

Nokia’s Symbian is still clinging to the leader board, with 22.1% of the smartphone market on 23.8 million units sold. That is way down from Nokia’s high when it controlled nearly 48% of the world smartphone market. Overall, Nokia is still the world’s largest cell phone manufacturer, having sold 97.8 million devices in the quarter, good for 22.8% of the market. Yet, Gartner does not see Nokia’s lead lasting into the third quarter and beyond.

Nokia maintained its lead despite its slump because it is working to reduce stock levels and is cutting the prices of older devices. That means the average Nokia phone is sold for less as it liquidates stock, mostly in Europe and China.

“The sales efforts of the channel, combined with Nokia’s greater concentration in retail and distributors’ sales, saw Nokia destock more than nine million units overall and five million smartphones, helping it hold on to its position as the leading smartphone manufacturer by volume,” said Roberta Cozza, a principal research analyst at Gartner in a press release. “However, we will not see a repeat of this performance in the third quarter of 2011, as Nokia’s channel is pretty lean.”

One surprising note from Gartner’s numbers show that, by operating system, Microsoft Windows Phone (or Windows Mobile CE, if any of them still exist in stock somewhere) sold 1.7 million units worldwide. That is disconcerting if you are a member of the Windows Phone team in Redmond. Samsung’s also-ran operating system, Bada, which almost nobody in the United States knows about, outperformed Windows Phone with 2.05 million units sold, which is a 75% gain from the 577,000 it sold in Q2 2010. Microsoft’s phone share has declined from 4.9% of Q2 2010 sales to 1.6% in Q2 2011.

Basically, the Nokia Windows Phone really needs to come out soon, especially in time for the holiday season.

By volume, BlackBerry actually increased sales from Q2 2010 to Q2 2011 from 11.6 million to 12.6 million sold. Yet, with sales of smartphones increasing, Research In Motion’s market share went down from 18.7% to 11.7%. RIM is still the sixth largest phone manufacturer in the world and holds a 3% market share of all devices sold (including feature phones). It was jumped by ZTE for the fifth spot by about a half-million devices. Apple is fourth with 4.6% while Samsung trails only Nokia at 16.3%.