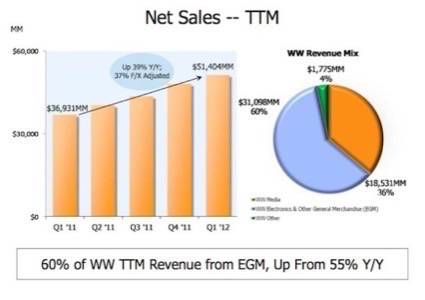

Amazon has announced its Q1 earnings. It was a strong quarter, beating Wall Street expectations. As usual, there’s not much specific information about its most-watched products. Amazon is thrilled with its book business, Kindle sales are “strong,” and that’s all we get. But the overall numbers reveal some trends to watch closely at Amazon this year.

Razor-Thin Margins

While sales and revenue are up in all the important segments, Amazon’s margins are still very narrow, and profits are down. The worldwide operating margin held steady at 1.5% this quarter, down from 3.3% a year ago. Apple’s margin for the same quarter was an incredible 44.7%. This is an apples-and-oranges comparison (and forgive the pun), but it demonstrates just how different the structures of these two tech companies are.

Apple’s business makes extraordinary profits selling hardware. Amazon doesn’t even try to do that. Kindle hardware is sold at a loss as a way to extend the rest of Amazon’s retail business into people’s hand-held devices. Physical retail, too, has very thin margins. It involves lots of organizing and shipping of materials all over the world.

Amazon has to sell everything, everywhere to keep its profits healthy. But all-digital sales don’t have the costs of physical goods, so the Kindle family will help Amazon expand its margins.

There are signs that this strategy is working, getting the pieces into place for when it kicks in. Today, comScore released a study showing that the Kindle Fire comprises more than half of Android tablets sold. That’s a good foothold for Amazon’s all-digital media business, and digital sales.

Big Investments

Amazon’s return on invested capital is down to 12%. That’s because it’s spending its capital to get into a favorable position.

The Kindle Fire, Amazon’s star product, should actually be thought of as an investment. It doesn’t make money on sales of the devices. Those are priced as low as possible – those thin margins again – in order to get them into more hands. That effort is working. People with Kindle Fires buy more media, and that’s how Amazon makes its money.

But in a more traditional sense, Amazon spent some major dough this quarter, acquiring Kiva Systems for $775 million. Kiva manufactured the robots Amazon uses to keep its warehouses organized. Once this merger is completed, Amazon will make those itself. This is a big expense, but if it makes Amazon’s inventory more efficient, it will open up some headroom in those margins.

Plus, there’s lots of money to be made selling warehouse droids to other companies.

But Amazon made a third kind of investment this quarter. It hired lots of people.

Staffing Up

The one big surprise from Amazon’s first quarter is that the droids aren’t replacing its human workers. On the contrary, this was Amazon’s biggest hiring quarter ever. It hired 9,400 people, bringing its total headcount up to 65,000. According to CFO Tom Szkutak, the “vast majority” of that growth was in operations and customer service, and many of the new hires were formerly temporary workers.

But the biggest hiring quarter ever? In a quarter in which Amazon bought a company to automate its warehouses? That’s a strong signal. Amazon doesn’t break down its employment by region, but this is a worldwide number. If Amazon truly does want to sell everything, everywhere at razor-thin margins, it’s still going to take a huge force of people to make it happen.