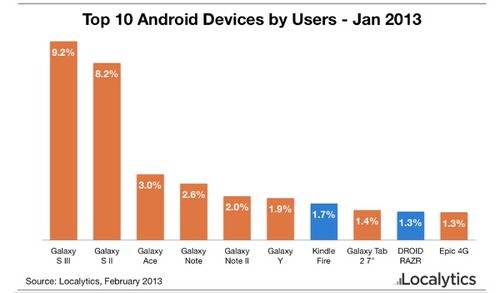

We all know that Samsung is the dominant player in among Android smartphone makers. Just how dominant is the Korean smartphone maker? According to data from mobile analytics firm Localytics, eight of the top 10 Android devices in the wild belong to Samsung.

The top two devices in circulation are Samsung’s last two flagship devices, the Galaxy S III and its predecessor the S II. Between the two, the S series has 17.4% of Android phones in actual users’ hands. The Galaxy Ace is third with 3% while the Note and Note II – the original “phablets” – are next at 2.6% and 2%, respectively.

The first tablet… real tablet… on the list is the Kindle Fire, with 1.7% of Android devices. The Fire is closely followed by the Galaxy Tab with 1.4% of market share. It is interesting to note that Google Nexus 7 does not show up in Localytics data for top 10 Android devices, considering that it constitutes 8% of Android tablets in the United States, right behind 9% for the Galaxy Tab.

Samsung’s Noose

The breadth of Samsung’s offerings is choking the rest of the Android manufacturer ecosystem. Samsung controls 47% of the total Android ecosystem, according to Localytics. Essentially, Samsung is taking all the market share and profits while would-be competitors like HTC, LG and Motorola battle for scraps. Earning reports bear this out. HTC announced earnings on Monday and was down to $2.03 billion for Q4 2012, a paltry sum compared to Samsung and Apple. Google is raking in about $1 billion a quarter from Motorola. The Droid Razr was the only non-Samsung smartphone to break the top 10.

The squeeze from Samsung will eventually force Android competitors (and non-Android players like BlackBerry and Nokia) to a breaking point. Manufacturers can only go so long with slim sales and profit margins before they have to abandon pursuit of smartphone market share. This will hit mobile-only companies, like HTC and Motorola, especially hard – while a company like LG can hold out longer against Samsung with its more diverse product base that includes other electronics like televisions.

Amazon is a misnomer in this equation. The e-commerce king sells its Fire series essentially at cost, hoping to make profits from its growing ecosystem of content and apps. Amazon can afford to be patient as it attempts to grow market share with its tablets while awaiting the time when it could possibly release its own series of Amazon-branded Android smartphones.

Apple’s Motivations

Looking at the top 10 list of Android devices, the motivations for Apple’s global campaign against Samsung in patent courts becomes clear. Samsung’s long tail of devices is extremely valuable to the company, represented here with strong numbers for the Galaxy S II, original Note, Galaxy Ace, Y and Epic 4G.

When Apple won its $1.05 billion patent award against Samsung in a California court in the summer of 2012, it requested injunctions against eight Samsung devices, including the S II. Apple, which never has more than three iPhones on the market at varying prices, knows that Samsung’s long tail has the potential to strangle its own sales as well. Anything that Cupertino can do to keep devices like the Galaxy S II off the market is theoretically good for its bottom line.