If you haven’t filed your taxes yet, you might want to triple-check your math before you do. That’s because the IRS employs a more watchful eye than ever, thanks to Big Data analysis and digital information-gathering tactics.

With the ongoing budget crisis, pressure for the IRS to recover lost revenue has never been higher. Conveniently enough, the agency has made massive investments in its computing power and tools for crunching big data, allowing for more automation and rapid analysis. That means a greater capacity for robo-audits and less room for honest mistakes.

It’s not just the tools that have improved. The data itself is richer and more varied than ever, drawing increasingly from whatever details about our digital lives the IRS can get its hands on, including information that isn’t publicly accessible. We don’t know the full extent of the IRS’s data-mining capabilities, but recent reporting has revealed new details.

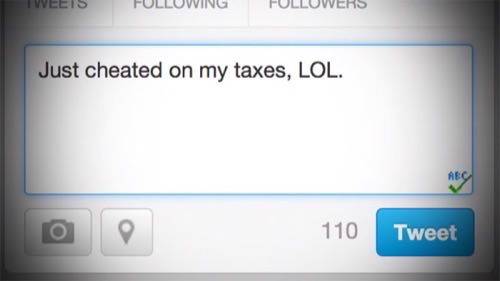

1. Analyzing Your Social Media Updates

The social Web has been a boon for IRS investigators, who can use updates from Facebook, Twitter and other services to bolster its cases against alleged tax cheats. Information about work history, one’s physical whereabouts and even purchases can be gleaned from social networks. Some of it, like tweets and certain details from Facebook, are public. But should the IRS want to take a closer look, it supposedly has the means to do so, with or without a warrant.

According to recent reports, the IRS cross-references data from social networks with Social Security numbers and then works in a host of other private data to look for suspicious patterns.

2. Monitoring Digital Payments and Credit Card Activity

The rise of commerce and digital payments have also given the IRS new sets of data to mine and analyze. The agency has long looked at taxpayers’ activity on ecommerce sites like Ebay, but are now going deeper and getting a look at credit card transactions and other online payments.

The agency looks for potential auditing targets “by matching tax filings to social media or electronic payments,” according to MSN Money. The exact mechanism of this monitoring isn’t known, but MSN Money indicates that it includes examining credit card transactions “for the first time ever.”

It’s not clear how detailed or widespread this monitoring is, and the IRS isn’t likely to spill the beans (lest they tip off tax cheats), but suffice it to say that if the agency feels it has cause to take a peek at your online payment data, it won’t have a problem doing so.

3. Peeking At Your Email Usage

Exactly when and how the IRS looks at email usage isn’t entirely clear. The MSN Money report says the agency’s big data analysis tools are used in part for “tracking individual Internet addresses and emailing patterns.” That’s pretty vague. In theory, the IRS could glean some details about email usage simply by looking at browsing activity, whether that insight comes from an ISP or email service provider.

Does that mean that the IRS has blanket access to everybody’s Gmail account for the purpose of feeding its data-crunching behemoth? That seems pretty unlikely. Instead, what it likely does is request access to individual accounts for people who are already suspected of wrongdoing. The American Civil Liberties Union recently uncovered documents that suggest the IRS doesn’t feel a warrant is necessary to get such access. Good to know!