In the 10 years since Bitcoin was created, a lot has happened to cryptocurrency. Do we understand crypto any better? Are we underestimating it?

Bitcoin, Blockchain, Ethereum, and even Satoshi Nakamoto went from obscurity to something we might see on mainstream news.

Completely new industries around cryptocurrency and blockchain technology sprung up. Investors and early adopters took the price of one bitcoin from nothing to $20,000 and back down to $4,000. Millions of people made the journey from “What’s a Bitcoin?” to owning cryptocurrency personally.

Yet, despite 79% of Americans having heard of cryptocurrency today, is it possible we are still underestimating the decade-old technology?

The weight of great expectations.

Bill Gates famously said: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.”

In recent years there have been times when we overestimated the change of cryptocurrency and blockchain. Some of the promised changes include blockchain-enabled smart contracts becoming the new fabric of the internet, or “Web 3.0.” Bitcoin becoming the dominant, global form of value in a process of “hyperbitcoinization”. And blockchain technology replacing all types of existing infrastructure, from supply chain to personal records.

While progress has been made on these promises, none have been fully realized. This has caused much of the attention to focus on insecure smart contracts, exchanges losing client cryptocurrency and hacker activity within the industry. Add market price volatility and controversial initial coin offerings (ICOs) to the mix, and you get plenty of loud critics:

Some criticism is certainly warranted. We are dealing with people’s money after all.

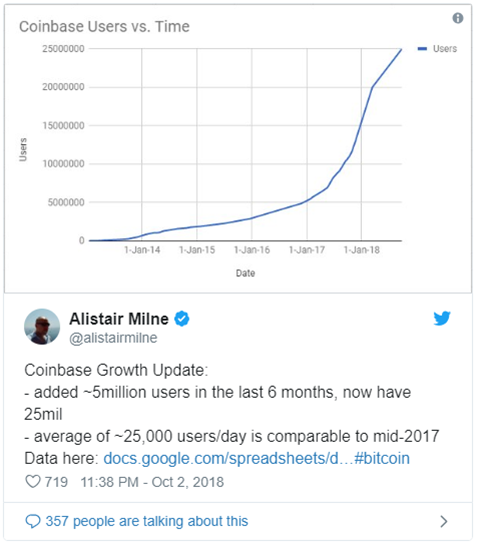

But if you remember that we tend to both overestimate in the near-term and underestimate in the long-term, it gives you a different perspective. Things look quite a bit different from a decade’s viewpoint in either direction. We see cryptocurrency companies growing from fledgling startups to supporting tens of millions of users.

We see world-class technology companies integrating Bitcoin and cryptocurrency into their core offerings. And perhaps most important for the future: we see Wall Street aggressively competing to be the leader in this new alternative financial system.

Crypto has tens of millions of users.

What if I told you that some cryptocurrency companies are as large as the most significant traditional finance companies? Would you believe me?

The analysis shows that Coinbase, a favorite U.S. based cryptocurrency exchange, has amassed a user base of over 25 million. Compare that to Fidelity, the traditional investment management juggernaut, which has 27 million individual investor accounts. Those are big-time numbers for any company in any industry.

It’s not just the U.S. market. Binance, the global cryptocurrency exchange, reports a user count north of 9 million. When we add it all up, you’ve got tens of millions of cryptocurrency users across the world. This means that for any new cryptocurrency product or service, you’ve got a large, global market to pull from. That’s precisely why mainstream technology companies are jumping in.

Fintechs leading the crypto charge.

Many write off cryptocurrency adoption as part of a self-fulfilling ecosystem that doesn’t impact people outside of enthusiasts and speculators. In earlier years, that could have been argued. Today, I think you would have difficulty making that case. Why? Because technology titans across multiple industries are not just integrating cryptocurrency, they are featuring it prominently.

One example from the investments arena is Robinhood, which created a standalone cryptocurrency investing product, Robinhood Crypto, in early 2018.

The fast-growing fintech company, which has over 4 million customers, reported 200,000 signups per day when Robinhood Crypto launched. The crazy signup numbers hint that there was quite a bit of pent up demand for cryptocurrency within Robinhood’s core millennial market.

Again, we can see that this is not just a U.S. only phenomenon. The popular European fintech Revolut, which boasts 2 million customers, launched cryptocurrency trading on their platform in late 2017. In an interview with CNBC, Revolut’s CEO Nikolay Storonsky mentioned that the “cryptocurrency feature has definitely played a part in our growth” and noted it is part of their broader financial marketplace offering.

Then there is Square, headed by Twitter founder Jack Dorsey. Referencing Bitcoin in a call with Market Watch Dorsey said that “We do believe that this [Bitcoin] is a transformational technology for our industry, and we want to learn as quickly as possible.” Square added Bitcoin as a feature to its popular CashApp in early 2018, initially to select states, and later broadened access to all 50 states. Square further cemented its ambitions in cryptocurrency when it applied for a “cryptocurrency payment network” to be used between customers and merchants.

The last frontier: Wall Street.

The most innovative technology companies in the world adopting cryptocurrency is a considerable development. But there is one big domino, that when knocked over, will have the most significant impact on crypto adoption in the next decade:

Wall Street going all-in.

Long considered an enemy of cryptocurrency, Wall Street is finally starting to see cryptocurrency as more friend than foe. Leading the Wall Street pack is Fidelity, who launched a standalone business in Fidelity Digital Assets in 2018. Right behind them was Bakkt, a creation of New York Stock Exchange parent company Intercontinental Exchange (ICE). Bakkt raised $182 million at the end of 2018 to build a regulated cryptocurrency exchange.

Then there is JPMorgan. The Wall Street giant went from calling Bitcoin a “fraud” in 2017 to announcing their own cryptocurrency six months later. You can’t make this stuff up. As more and more Wall Street players enter the game, expect these reversals to become more common.

Like many industries, traditional finance has a herd mentality. When the big guys make a move, other companies competing with and underneath them move as well.

Bitcoin and cryptocurrency have a long way to go before realizing their wildest ambitions of dominating the internet and the global financial system. But few would have predicted we would have come this far a decade ago, and I suspect few comprehend how far crypto will go ten years from now.