Digitalization is a trend that has embraced our generation to the fullest and steadily. Digitalization among mobile users is piercing through all the sectors. If we talk about how financial transactions have impacted by digitization, it’s immense. Here is the rise and rise of mobile payment technology.

The augmentation of smartphones further fuels digital transactions.

Today, it’s expected that the mobile payment market will grow at an annual rate of 33%, and by 2026, it will hit the $457 billion mark, as per a report by Global Mobile Payment Market. Clearly, digitalization has propagated the banking industry, primarily through mobile payment functionality.

Mobile payments is a subset of digital payment that allows payment through a mobile handset. We have every reason that pushes mobile payment methods to overrun traditional methods.

A convenient mode of transaction to the added layer of security, mobile banking has transformed the way we handle our banking transactions.

How Mobile Payments All Started?

Interestingly, the mobile banking trend was kick-started by Coca Cola when the company allowed its customers to purchase drinks via text message. Then in the same year, Exxon Mobile came up with the contactless payment, and since then, the shift to text and RFID mobile payment options are on a roll.

It was in 2006 that we witnessed the arrival of PayPal’s dedicated mobile payment service in the U.S. and the UK. market, which carved an ideal headway for the mobile payment technology. With its soaring popularity, the online payment giant gained trust and awareness among the digital payment realms. And it resulted in the prevalence of payment through digital means resulted in the era of mobile wallets.

What Exactly is a Mobile Wallet?

Mobile Wallet is a type of digital wallet that allows the user to process payments, access account information, and pay for services through an app over a smartphone. To speed up the whole process of payment, the mobile wallet stores the payment card information on the device itself.

Many people get confused between mobile and digital wallets, which may sound similar, but in reality, there is a difference between the two. The most significant variance between a mobile wallet and a digital wallet is that the digital wallet can be accessed over a computer or a mobile device, whereas, a mobile wallet can only be operated on a smartphone.

The concept of the mobile wallet was swiftly embraced due to its ease of use. The user just has to download a mobile wallet app and register himself with the app. After that, mobile payments can be pulled off within seconds.

Types of Mobile Payments

The mobile payments are not limited to mobile apps, but there are multiple ways through which we can accomplish mobile payments. The following are some of the best-known mobile payment types:

- Pay Per SMS or Phone Number: It is one of the simplest ways of making a mobile payment, as the user operates within a single platform. The user needs to enter the mobile number of the recipient and the amount to be sent.

- QR Payments: The payment through QR codes gained popularity due to the mushrooming in the number of paying retailers. In this method, the user scans a code from the phone’s camera and enter the sum of the amount that has to be transferred.

- Cloud-Based Payments: The cloud is an internet-based platform that allows payment gateways over the internet and doesn’t require a physical device.

- Near Sound Data Transfer (NSDT): NSDT is a sound-based mobile transaction technology that requires a mobile generated electronic signature for a secure transaction.

- Near Field Communication (NFC): NFC is a technology that enables two NFC enabled devices to connect via a set of communication protocols. This method is quite secure as compared to other methods because the payment details are stored in an interim token form.

Presently, the QR payment and cloud-based payment method are broadly in use and occupy a major chunk of the total number of mobile payments.

The Rising Usage of Mobile Wallets

The mobile wallets are on the rise for sure, and the reason behind its wide acceptance can be credited due to the increasing number of smartphones. As Statista claims, by the end of 2019, there will be almost 14 billion mobile devices. Therefore, the more the number of smartphones, the more mobile wallet usage will be there.

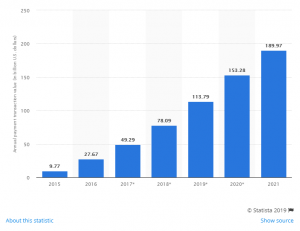

In 2019, the mobile payments market stands to be around $114 billion, and by 2021, the number is expected to go past $190 billion mark. The below graph by Statista underlines the proximity mobile payment transaction value in the US from 2015 to 2021.

Heading: Proximity mobile payment transaction value in the United States from 2015 to 2021 (in billion U.S. dollars)

Going at the current pace, the mobile payment transaction in the US will be around $153 billion by the end of next year.

Why is Mobile Payment Preferred Over Other Methods?

When everything is mobile, so why not the payments. With Millenials make up the largest part of the working community, it makes more sense to use mobile payment methods. And there are reasons that make mobile payments a favored pick.

The following are the points that give mobile payment an edge over other conventional payment methods:

-

Aids Banking Infrastructure

As per a report by The World Bank, about 1.7 billion adults lack a bank account, and the table is topped by China and India with 224 million and 191 million people without an account, respectively.

Places where the banks can’t reach or where the banking is not feasible, mobile wallets can help financially underserved users with banking services. It will also help the government to keep track of the unaccounted money.

-

Abates Financial Scam

The primary modus operandi behind the recent financial frauds works after the card details of a user are siphoned off. The cybercriminals then transfer funds using the four-digit secure code. But in mobile payment, there are fewer chances of any such mischance.

Furthermore, mobile wallets can be secured with biometric systems like Face ID, fingerprint scanner, or voice authentication. Here are some advanced ways which are deployed to make mobile payments more secure:

- Keystroke Dynamics: Algorithms tracks the user’s typing, specific shifts between keys, and the typical mistakes that are usually made.

- Gait Analysis: Algorithms detect authenticity by analyzing the user’s style of walking.

- Signature Verification Analysis: Algorithms maps specific design features of the signature.

This way, mobile wallets become tough to crack and wins over the conventional mode of payments.

-

Faster Transaction Time

If we dive into the technicality of the payment done through a card, then we can say that it roughly takes 15 seconds to complete one transaction. But if we consider mobile payment, it is done exactly in 6 seconds, which is almost half the time taken by a card to process a payment.

Also, there is no requirement for an extra physical device to make the payment. The user can take out his smartphone and make the payment anywhere and at any given time.

-

Acceptance Among Masses

The world evolved from hard cash to soft cash, and now it’s digital. To avoid unnecessary hassles of finances, the major retailers have already shifted to digital payment methods; mobile payment is one of them.

-

Mobile Wallets Bonus Programs

With the availability of services like Apple Pay, PayPal, Venmo, Google Pay, and more, the competition in the mobile payment services has become fierce than ever. And to counter this competition, companies are offering various loyalty programs like transaction bonuses, add-on coupons, and loyalty points.

It directly encourages people to go for mobile payment services.

What’s the Future Hold for Mobile Payments?

Nowadays, people are making more use of mobile banking services to pay for their daily chores, and with the evolving technology, the usage is bound to swell. Thanks to advanced bio-metrics plus AI algorithms, mobile payment services are more secure than ever.

Absorbingly, mobile payment technology is moving ahead of smartphones and making headway to other mobile devices like smartwatches. The shift to smartwatches is witnessed at a time when about 12% of global online adults already own a smartwatch.

The ballooning demand for the smartwatch and the considerable switch to the cashless transactions is proving to be a boon for mobile payment technology, and it will further amplify the wearable payment market.