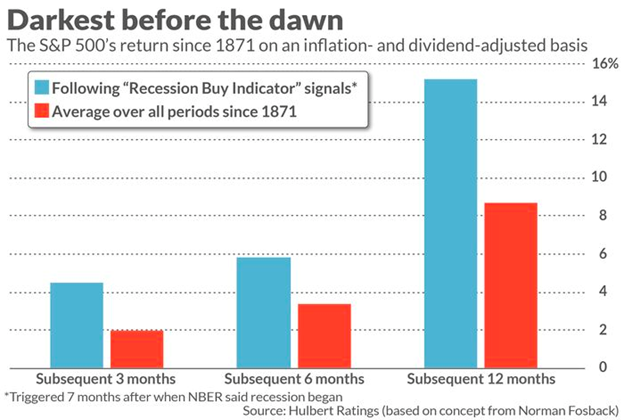

- The Recession Buy Indicator broadly states that the best time to buy stocks in a recession-driven selloff is about seven months in, around the time everyone starts realizing the economy is in rough shape and may already be in a recession.

- Stocks drop well before a recession becomes obvious, and they rebound well before an economic recovery becomes obvious.

- Typically, you want to buy stocks seven months into a recession, once the world starts thinking the economy is actually in a recession — which is where we are right now, according to the data.

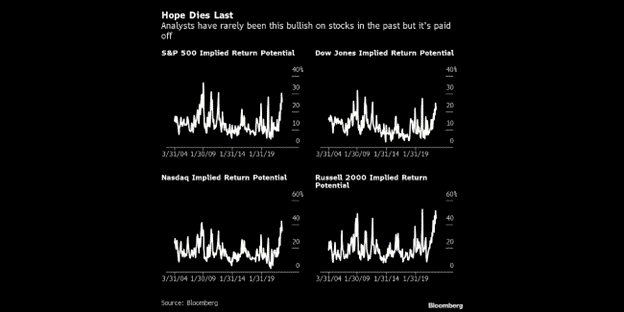

- Now to mention, there’s a huge gap between stock prices and analyst price targets, implying massive upside potential in equities.

Everyone’s talking about the U.S. economy falling into a recession. But believe it or not, it may already be in one. And oddly enough, that may be the best reason ever to buy stocks today.

Follow me here…

A recession is technically defined as back-to-back quarters of negative GDP growth. First-quarter GDP was negative. Sure, it was negative due to an odd trade imbalance. But it was still negative.

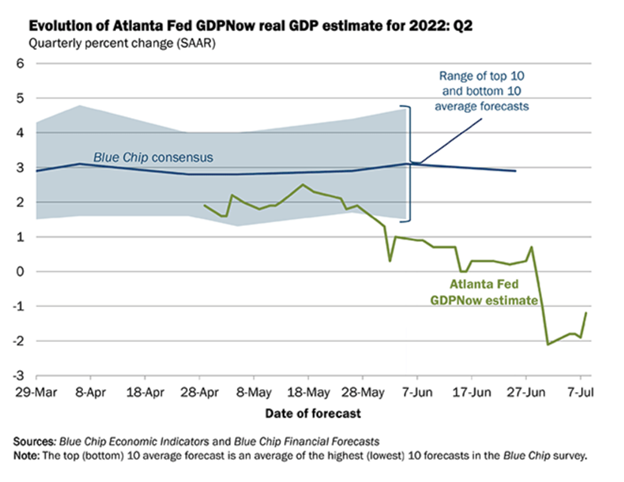

The Atlanta Fed’s real-time GDPNow model is forecasting for second-quarter GDP to fall 1.2%. That would mark two consecutive quarters of negative GDP growth for the U.S. economy. If true, then the U.S. economy technically entered a recession back in January.

Spooky, yes. But for investors, that realization actually screams opportunity.

Wall Street is at a point in this selloff cycle where, historically, the recession is already priced in. Typically, what comes next is a big stock rally where the entire market tends to roar 15- to 25%.

So, forget all the recession talk. That will scare the average investor. Indeed, average investors are running away from the market. But smart investors – those who sold back in December 2021 – are now returning to the market. And they’re already preparing for a big rebound.

In short, it’s time to buy the dip.

Here’s a deeper look.

The Famous Recession Buy Indicator

One of the financial world’s best-kept secrets is a largely unknown contrarian market indicator called the “Recession Buy Indicator.”

The Recession Buy Indicator was developed by renowned economist Norman Fosback in the 1970s. The theory broadly states that the best time to buy stocks in a recession-driven selloff is about seven months in. That’s around the time everyone starts realizing the economy is in rough shape and may already be in a recession.

The thinking is that because the stock market is a discounting mechanism, stocks drop well before a recession becomes obvious. And they rebound well before an economic recovery becomes obvious. Per Fosback’s research, this “inflection point” tends to happen about halfway through a recession. That’s usually around month seven since the average recession is about 14 months long.

The theory is more than just talk. It’s backed by 150 years of data.

Since 1870, stocks have produced ~2X returns every time the Recession Buy Indicator is triggered — seven months after the economy entered a recession.

Average three-month returns? Over 4%, versus 2% for three-month windows. Average six-month returns? About 6%, versus ~3% for all time periods. Average 12-month returns? Around 15%, versus ~8% for all time periods.

It’s Time to Buy Now

The evidence is clear. The Recession Buy Indicator works. Typically, you want to buy stocks seven months into a recession, once the world starts thinking the economy is actually in a recession.

And according to the data, that’s exactly where we are today.

It looks like the U.S. economy entered a recession in January. It’s July now — month seven. Meanwhile, over the past few weeks, every major financial media outlet has been writing about how the U.S. economy may be in a recession.

The Recession Buy Indicator is flashing right now.

Historically, that means we’re in the midst of a great buying opportunity. And stocks should power meaningfully higher over the next 12 months.

That’s bullish.

But it’s far from the only bullish indicator flashing right now.

Analyst Price Targets Imply 25%-Plus Returns

While stocks have crashed over the past eight months, Wall Street analysts have remained resolutely optimistic.

In other words, stock prices have dropped a lot in 2022. But stock price targets haven’t dropped by much. The result? A huge gap between stock prices and price targets, implying massive upside potential in equities.

This is a rare occurrence that is exceptionally bullish.

Specifically, the analyst consensus price targets for various stock market indices — the S&P 500, Dow Jones, Nasdaq, and Russell 2000 — are all 20%-plus above current index levels. Such a large gap has only occurred four times since 2000. Three of the 4 times, stocks rallied over the next 12 months. The average gain? An impressive 25%!

In other words, analysts are rarely as bullish on stocks as they are right now. When they have been this bullish before, stocks popped an average of 25% over the next 12 months.

Coupled with the Recession Buy Indicator, this data constitutes a pretty compelling “buy the dip now” thesis.

Stocks have been crushed this year. Consequently, lots of investors are running away from the markets to hide from the damage. But there’s a growing mountain of evidence that suggests the worst of the market selloff over. And a massive market rebound is on the horizon.

So, don’t run away from the markets. Run toward them. Buy the dip in stocks positioned to lead a massive second-half rebound.

One such stock is a tiny, $3 technology stock that I think may be the single most compelling 12-month investment opportunity in the market today.

The world’s largest company — Apple (AAPL) — is reportedly set to announce a brand-new product in the coming months.

No. I’m not talking about another iPhone, Apple Watch or iPad. I’m talking about an entirely new product that could be bigger than all those products combined.

And per my analysis, the company behind this $3 tech stock is positioned to secure a partnership with Apple. It will supply a critical piece of technology to make this new product work.

Quick market tip: Apple supplier stocks don’t trade for $3. Just look at Skyworks (SWKS) stock. That’s a major iPhone parts supplier. Its stock is trading for $100. But at one point in time, it was trading for $3, too.

The tiny potential Apple supplier stock I’m talking about could easily trade for $100 in the near future. And it’s just $3 today.

This is a stock you simply must hear about right now.

Fortunately, it is also a stock I want to tell you all about.

Published First on InvestorPlace. Read Here.

Inner Image Credit: Provided by the Author; Thank you!

Feature Image: