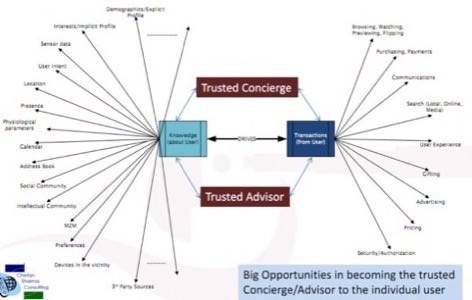

Researchers for the Chetan Sharma Consulting group have put together a 2011 State of the Global Mobile Industry mid-year assessment and have come up with some very interesting results.

The entire global mobile market weighs in at about $1.3 trillion or close to 2% of the world’s gross domestic product. Of that giant $1.3 trillion pie, about $300 billion is expected to be through data revenues. That means that people are starting to use data at much higher rates and Americans are on the forefront of data usage even as India and China are the fastest growing mobile markets in the world.

The report notes that mobile is fundamentally changing the way people interact with the world and is a heavy influence on how people buy goods and services. Here is the money quote concerning mobile applications in the report.

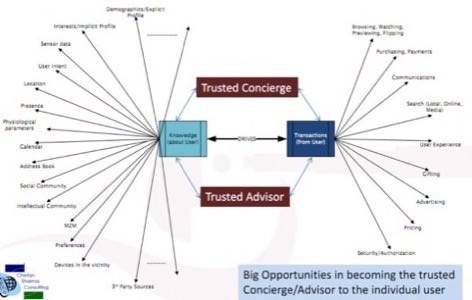

“Mobile is fundamentally reshaping how we as consumers spend from housing and healthcare to entertainment and travel, from food and drinks to communication and transportation. Mobile not only influences purchase behavior but also post purchase opinions. When the share button is literally a second away, consumers are willingly sharing more information than ever before. Mobile is thus helping close the nirvana gap for brands and advertisers who seek to connect advertising to actual transactions. The long-term battle is however for owning the context of the users. Having the best knowledge about the user to help drive the transaction is the simply the most valuable currency of commerce.”

There will be more than six billion mobile subscriptions by the end of 2011. According to the report, it took 20 years of mobile development to reach one billion connected devices. The jump from five billion to six billion took 15 months.

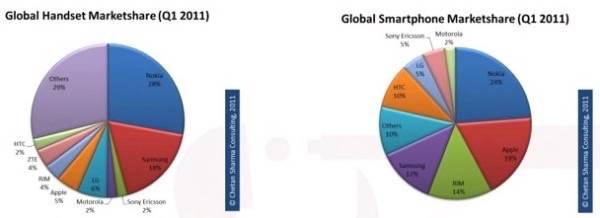

The global market for smartphone users stands at 26% of all phones (which are a subset of total “mobile devices”). The U.S. recently passed the threshold of 50% of every new phone purchase is a smartphone. The Sharma group predicts that the U.S. will be the first market to eclipse 50% smartphone ownership (it stands at 38% currently).

Here is a graph of the largest telecom operators by revenue.

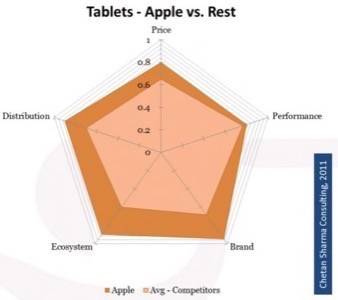

The Sharma group notes that Apple is dominant in the tablet space and that is not going to change any time soon. This, as we know, is not news and the report does not say anything that we do not already know (a Windows 8 tablet could make inroads and cheaper Android tablets will eventually gain market traction).

In terms of smartphones, the report says that the battle is now on for third place behind Android and iPhone, respectively. Nokia/Windows Phone and Research in Motion are the contenders for third place, which actually is being very kind to Nokia/Windows and bearish on RIM’s prospects. HP Palm gets a nod for finally bringing products to the market but also says the “lack of an effective ecosystem means lack of traction in 2011.”

When it comes to actual devices made, Nokia still has the global lead, tough its numbers are down from the last several years when the Swedish cellphone maker was absolutely dominant.

In terms of market dynamics, Sharma notes that the landscape is difficult to judge because everybody wants a slice of the pie and certain companies want certain slices where they may not have traditionally created revenue. AT&T is now going after former partner Cisco in enterprise and unified communications. Verizon and Visa have been traditionally separated from each other as market leaders in different industries but are not clashing as in the mobile payments realm. Mobile has muddied the waters of the traditional industry model. That tends to happen when $1.3 trillion (and growing) is on the line.