Microsoft has its haters. Many of them, in fact, and most of them well-earned after the company’s years of stumbling around in the wilderness, desperate for a credible strategy. Hence, former Apple executive Jean-Louis Gassée is right to suspect Microsoft CEO Satya Nadella’s latest internal email is a “con” and John Kirk speaks truth when he suggests that “Microsoft is still fighting yesterday’s wars with yesterday’s no-longer-existing weapons.”

But both seem so focused on mobile that they forget Microsoft’s blindingly obvious strength in the cloud.

A Decade Of Serious Neglect

But first, the problems.

Let’s face it: Microsoft has many. The company has been late to every meaningful market party in the last few years, earning it negligible share in the markets that matter, from mobile to web (search, etc.) to, yes, cloud.

See also: Satya Nadella Proves That Microsoft Hasn’t Changed At All

Small wonder, then, that Gassée faults Nadella’s internal email as an overly broad mishmash of muddlespeak. It says nothing, or too little, and overlooks all the many areas where Microsoft is failing in order to make Microsoft employees feel that they’re actually winning … even as they lose.

Gassée goes on to suggest, Nadella may be,”making cryptic statements that are meant to prepare the troops for painful changes.”

For those of us watching at home, this would be welcome news. The industry could use a strong Microsoft and, as Kirk argues, Microsoft’s anti-strategy has yielded anything but that:

Microsoft has allowed their competitors to join forces and successfully scheme against them. Microsoft has responded to the successes of their competitors by forswearing their strongest weapons, abandoning their strongest defensive positions and rushing to attack their competitors wherever they may be, even if those battlefields were located where Microsoft was at its weakest and their competitors were are at their strongest. When these attacks inevitably failed, Microsoft resorted to wars of attrition. Yet in these wars of attrition, it was Microsoft, not their opponents, who suffered most, taking disproportionally greater losses than they inflicted.

In sum, “Microsoft’s approach is the very antithesis of a strategy.”

Microsoft’s (One?) Position Of Strength

Except there’s one key area that Microsoft’s detractors get wrong, which Nadella nailed. In his 3,000-word email to the Microsoft faithful, Nadella calls out Azure as a beacon of hope (emphasis mine):

Our cloud OS represents the largest opportunity given we are working from a position of strength. With Azure, we are one of very few cloud vendors that runs at hyper-scale. The combination of Azure and Windows Server makes us the only company with a public, private and hybrid cloud platform that can power modern business. We will transform the return on IT investment by enabling enterprises to combine their existing datacenters and our public cloud into one cohesive infrastructure backplane. We will enable our customers to use our Cloud OS to accelerate their businesses and power all of their data and application needs.

Everything in this paragraph is emphatically, powerfully true.

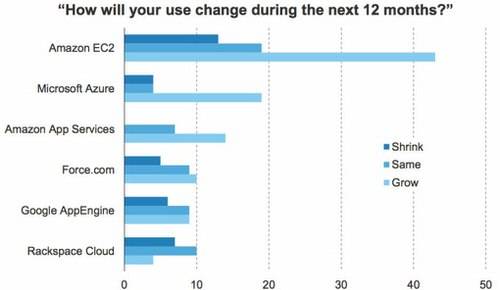

Yes, Amazon Web Services remains five times larger than the rest of the cloud computing pack combined in terms of utilized capacity. But it’s also true that Microsoft remains CIOs most trusted vendor. It’s not surprising, therefore, that Azure consistently clocks in as the second most popular Infrastructure-as-a-Service cloud, as Forrester and other surveys show:

The reason is that Microsoft, more than any other vendor, owns yesterday’s workloads. As enterprises look to shift (Windows) workloads from desktops and data centers to the cloud and as Microsoft improves the tooling for developers and operations professionals looking to move applications to the cloud (something that company announced in April, as covered here), Microsoft’s Azure will be a natural home for them.

This is something that AWS and Google can’t deliver. To be fair, it’s not clear that they want to, focused as they are on greenfield workloads. But there’s real strength in being able to move enterprises from yesterday to tomorrow.

As Gartner’s Lydia Leong notes:

Microsoft has brand, deep customer relationships, deep technology entrenchment, and a useful story about how all of those pieces are going to fit together, along with a huge army of engineers, and a ton of money and the willingness to spend wherever it gains them a competitive advantage; its weakness is Microsoft’s broader issues as well as the Microsoft-centricity of its story (which is also its strength, of course). Microsoft is likely to expand the market, attracting new customers and use cases to IaaS — including blended PaaS models.

Microsoft, in sum, is perfectly positioned to do well in the massive cloud market.

Winning In The World’s Least Sexy Market

Microsoft’s success in the cloud is perhaps to be expected. Microsoft, after all, isn’t the sexiest company around. It’s an older company with bona fides in the enterprise. Though it has been successful in the gaming market with Xbox, its real success has always come from the enterprise, where it has consistently won through superior tooling and overall ease of use.

Even for the most ardent believer in public cloud computing, it’s likely that we will shuffle through a decade (or more) of hybrid cloud computing as enterprises seek to move existing, data center workloads to the cloud. As Red Hat’s Alessandro Pirelli holds, it can take a year just to move 10 applications to the cloud.

If Microsoft can accelerate time-to-cloud, it will win. And win big.

Lead image: Microsoft executive vice president for operating systems, Terry Myerson at Microsoft Build 2014 by ReadWrite.