Amazon’s AWS dominates cloud computing. That should surprise no one. What is perhaps surprising, however, is how dramatically it dominates. According to a new Gartner analysis, AWS offers five times the utilized compute capacity of the other 14 cloud providers in the Gartner Magic Quadrant. Combined.

Even more surprising, it has spent less than Google and Microsoft building out its infrastructure.

Money Can’t Buy Me Love

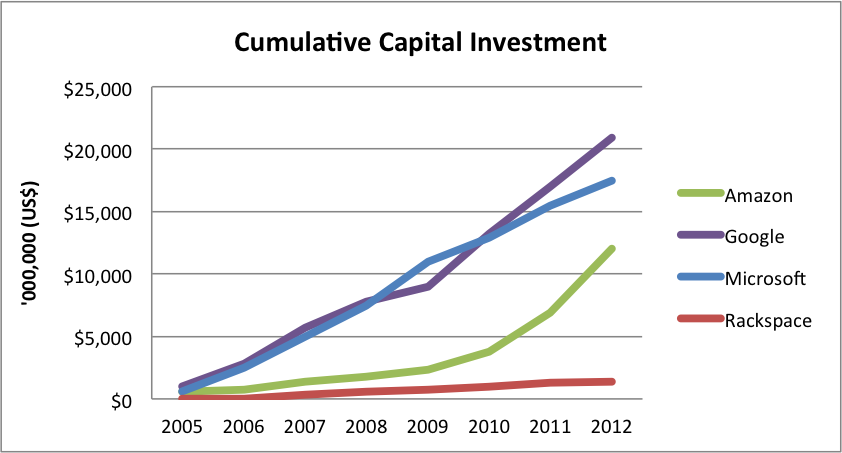

How much less? Dramatically less. Since 2005, Google has spent $20.9 billion on its infrastructure. Microsoft? Just shy of $18 billion. Amazon? Roughly $12 billion.

While more than Rackspace’s $1.4 billion cumulative capital expenditures, Amazon’s spending is a far cry from what both Google and Microsoft have spent.

Keep in mind that we’re not talking about generic capital expenditures here, used to run these companies day-to-day businesses. Amazon, after all, has spent heavily on infrastructure to power its ecommerce site, and to good financial effect, but that’s not the number tracked above.

No, we’re talking about the total investment in real and virtual revenue-generating IT assets, according to Gartner analyst Lydia Leong, who authored the report. And the implication? As The Register‘s Jack Clark highlights:

It could get worse, too, for Amazon’s competitors. After all, Amazon’s capital investments are accelerating relative to its peers. If it managed to get 5X the utilization of the combined totals of its top 14 competitors, what happens when it spends even more money? While financial analysts have worried for years about Amazon’s capital expenditures, the company seems to get more value from them than competitors.

Changing The Rules Of The Game

This may be why we’re seeing competition to AWS take different forms. Google’s cloud offering, for example, isn’t really about matching AWS service-for-service. Instead, Google brings over a decade of operational excellence to bear, creating a high-performance cloud that leapfrogs AWS in various ways, including sub-hour billing, shared core instances, advanced routing and large persistent disks.

Softlayer, now part of IBM, sets itself apart by offering far more granular control over one’s cloud infrastructure. Microsoft, for its part, is beloved by enterprise IT, which is giving it a lot of runway to get Azure right. As IDC analyst Matt Eastwood points out, over 50% of the Global 100 already run Azure. That number will continue to grow. Rackspace continues to tell its story of exceptional support to help wary enterprises into the cloud, coupled with community outreach through OpenStack.

And CSC’s cloud, ranked second in Gartner’s Magic Quadrant? Gartner writes that “unlike other traditional data center outsourcers, CSC has fully embraced the highly standardized, highly automated cloud model, successfully blending the benefits of a true cloud service into an enterprise-ready offering.” In other words, CSC succeeds by making cloud more palatable to enterprise buyers.

Advantage: Amazon… For Now

Amazon Web Services has what appears to be an unassailable lead, built not on superior capital expenditures but rather on a keen understanding of what developers want. By making AWS relatively painless to use, and inexpensive, AWS has punched above its financial weight.

To maintain that lead, Amazon looks to be pressing down on the investment accelerator. So long as this extra financing corresponds to a continuing focus on what Redmonk analyst Stephen O’Grady labels “the most important feature of cloud computing: a low barrier to entry,” and an emphasis on developers, Amazon will maintain its lead, if not extend it.

But it’s now competing against other companies with a history of developer outreach, including Microsoft and Google. Perhaps that’s why it’s having to significantly grow spending.

Or maybe it’s just trying to slam the door on competition.

Image courtesy of Shutterstock.