Forrester released its annual report on US consumer technology use on Monday, and the findings make encouraging reading for wearable developers, manufacturers and enthusiasts.

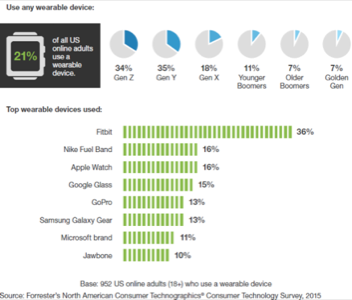

Twenty-one percent of all “online” adults in the U.S. now own a wearable device of some kind, with the younger generation leading the way in adoption.

It’s been a big 12 months for wearables, with interest peaking around the launch of the Apple Watch in March. Since then, Samsung, Pebble and Motorola have released new flagship smartwatches of their own, while fitness-focused companies such as Fitbit and Jawbone have also been busy getting new devices out to consumers.

That’s just the beginning.

The Birth Of A Trend

According to Forrester’s report, Fitbit is leading the charge, with 36 percent of the total number of wearables in use. That backs up figures released by IDC in August, which also showed Fitbit on top of the pile—and a 223 percent increase in wearable sales year-on-year for the market overall.

The Nike Fuel Band and the Apple Watch are tied for second at 16 percent, while the now-discontinued Google Glass still accounts for 15 percent of wearable devices in use. That’s a promising figure for Google, if it’s ever going to bring out version 2.0 of the augmented reality spectacles, as promised.

“One thing is clear—consumer adoption has taken off,” writes Forrester’s Gina Fleming.

Her colleague, Julie Ask, points to the growth of the smartphone market as the primary driver behind wearable adoption, an angle that’s tough to argue with: Without the iPhone, there would be no Apple Watch. Without Android, there would be no Android Wear.

Not only has the explosion in smartphone use driven down the cost of components and accelerated the miniaturization of electronics, it also gives consumers access to the apps necessary for wearable data to make sense. A Fitbit or Jawbone tracker is just a rather pointless bracelet without the software to go with it.

“The combination of machine learning, which gives consumers accurate data and insights, and the added apps layer, which allows users to act on those insights, creates a winning formula,” Ask writes. “The result is that fitness wearables have matured from a ‘fun to have’ gadget for those tackling a new goal, to a category impacting the financials of entire industries.”

There are plenty of challenges ahead—not least of which is getting consumers to keep using their devices once they’ve bought them—but Forrester’s is the second industry report in two months to point to promising growth. The Apple Watch may not have redefined a category in the same way the iPhone or iPad did, but it’s helping to push wrist gadgets toward the mainstream.

We’ve got a lot more to look forward to over the next 12 months, as well: Improved hardware designs, more apps with greater capabilities, and a slew of VR devices that should help us all get more comfortable with wearing gadgets on our bodies.

Images courtesy of Fitbit and Forrester