A new report released today by Forrester Research is predicting that enterprise spending on Web 2.0 technologies is going to increase dramatically over the next five years. This increase will include more spending on social networking tools, mashups, and RSS, with the end result being a global enterprise market of $4.6 billion by the year 2013.

This change is not without its challenges. Although there is money to be made in the industry by vendors, Web 2.0 tools by their very nature are defined by commoditization; as is much of the new social media industry, a topic we touched on briefly here, when discussing how content has become a commodity.

For vendors specifically, there are 3 main challenges to becoming successful in this new industry, including:

- I.T. shops being wary of what they perceive as “consumer-grade” technology

- Ad-supported web tools generally have “free” as the starting point

- Web 2.0 tools will have to now compete in a space currently dominated by legacy enterprise software investments

What is Enterprise Web 2.0?

Most technologists segment the Web 2.0 market between “consumer” Web 2.0 technologies and “business” Web 2.0 technologies. So what does Enterprise 2.0 include then?

Well, what it doesn’t include is consumer services like Blogger, Facebook, Netvibes, and Twitter, says Forrester. These types of services are aimed at consumers and are often supported by ads, so they do not qualify as Enterprise 2.0 tools.

Instead, collaboration and productivity tools based on the concepts of web 2.0, but designed for the enterprise worker will count as being Enterprise 2.0. In addition, for-pay services, like those from BEA Systems, IBM, Microsoft, Awareness, NewsGator Technologies, and Six Apart will factor in.

Enterprise marketing tools have also expanded to include Web 2.0 technologies. For example, money spent on the creation and syndication of a Facebook app or a web site/social network widget could be considered Enterprise 2.0. However, pure ad spending dollars, including those spent on consumer Web 2.0 sites, will not count as Enterprise 2.0.

Getting Past the I.T. Gatekeeper

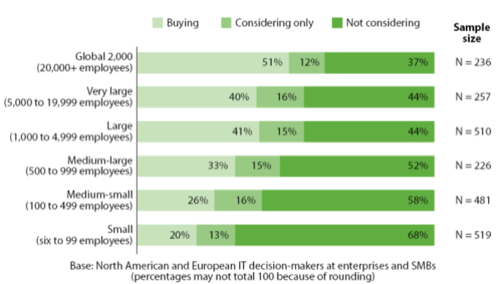

One of the main challenges of getting Web 2.0 into the enterprise will be getting past the gatekeepers of traditional I.T. Businesses have been showing interest in these new technologies, but, ironically, the interest comes from departments outside of I.T. Instead, it’s the marketing department, R&D, and corporate communications pushing for the adoption of more Web 2.0-like tools.

Unfortunately, as often is the case, the business owners themselves don’t have the knowledge or expertise to make technology purchasing decisions for their company. They rely on I.T. to do so – a department that currently spends 70% of their budget maintaining past investments.

Despite the absolute mission-critical nature of I.T. in today’s business, the department is often provided with slim budgets, which tends to only allow for maintaining current infrastructure, not experimenting with new, unproven technologies.

To make matters worse, I.T. tends to view Web 2.0 tools as being insecure at best, or, at worst, a security threat to the business. They also don’t trust what they perceive to be “consumer-grade” technologies, which they don’t believe have the power to scale to the size that an enterprise demands.

In addition, I.T. departments currently work with a host of legacy applications. The new tools, in order to compete with these, will have to be able to integrate with existing technology, at least for the time being, in order to be fully effective.

Finally, given the tight budgets, there is still a chance that even if a particular tool does meet all the requirements to get in the door at a particular company, I.T. or other company personnel utilizing the service may try to exploit the free version of the service if the price point for the “enterprise” version gets to be too high. They may also choose to look for a free, open source alternative.

Enterprise 2.0 Adoption

How Web 2.0 Will Reach $4.6 Billion

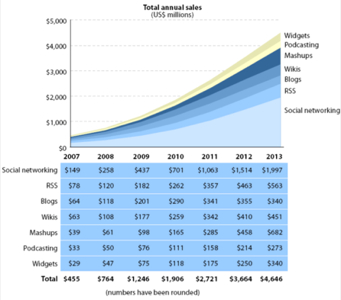

All that being said, the Web 2.0 market, as small as it is now, is, in fact, growing. In 2008, firms with 1000 employees or more will spend $764 million on Web 2.0 tools and technologies. Over the next five years, that expenditure will grow at a compound annual rate of 43%.

The top spending category will be social networking tools. In 2008, for example, companies will spend $258 million on tools like those from Awareness, Communispace, and Jive Software. After social networking, the next-largest category is RSS, followed by blogs and wikis, and then mashups.

The vendors expected to do the best in this new marketplace will be those that bundle their offerings, offering the complete package of tools to the businesses they serve.

However, newer, “pure” Web 2.0 companies hoping to capitalize on this trend will still have to fight with traditional I.T. software for a foothold, specifically fighting with the likes of Microsoft and IBM. Many I.T. shops will choose to stick with their existing software from these large, well-known vendors, especially now that both are integrating Web 2.0 into their offerings.

Microsoft’s SharePoint, for example, now includes wikis, blogs, and RSS technologies in their collaboration suite. IBM offers social networking and mashup tools via their Lotus Connections and Lotus Mashups products and SAP Business Suite includes social networking and widgets.

What this means is that much of the Web 2.0 tool kit will simply “fade into the fabric of enterprise collaboration suites,” says Forrester. By 2013, few buyers will seek out and purchase Web 2.0 tools specifically. Web 2.0 will become a feature, not a product.

Enterprise 2.0 Spending

Other Trends

Other trends will also have an impact on this new marketplace, including the following:

External Spending Will Beat Internal Spending: External Web 2.0 expenditure will surpass internal expenditure in 2009, and, by 2013, will dwarf internal spending by a billion dollars. Internally, companies will spend money on internal social networking, blogs, wikis, and RSS; externally, the spending patterns will be very similar. Social networking tools that provide customer interaction, allowing customers the ability to create profiles, join discussion boards, and read company blogs, for example, will receive more investment and development over the next five years.

Europe & Asia Pacific Markets Grow: Europe and Asia Pacific will become more substantial markets in 2009. Fewer European companies have embraced Web 2.0 tools, leaving much room for growth. Asia Pacific will also grow in 2009.

Web 2.0 Graduates from “Kids’ Stuff”: Right now, it’s people between the ages of 12 and 17 that are the more avid consumers of social computing technology, with one-third of them acting as content creators. Meanwhile, only 7% of those 51-61 do the same. However, this is another trend that is going to change over the next few years. By 2011, Forrester believes that users of Web 2.0 tools will mirror users of the web at large.

Retirement of Baby Boomers: As with many things, it takes the passing of the older generation from executive status into retirement before a true shift can occur. Over the next three years, millions of baby boomers will retire and the younger workers brought in to fill the void will not only want, but will expect similar tools in the office as those they use at home in their personal lives.

What It All Means

For vendors wanting to play in the Enterprise 2.0 space, there are a few key takeaways to be learned from this research. For one, they can help ensure their success in this niche by selling across deployment types. That is, plan to grow beyond just selling to either the internal or external market.

Another option is to segment the enterprise marketplace by industry and then by company size. Some industries are more customer-focused than others when it comes to the external market, so developing customized solutions for a particular industry could be a key to success. For internal tools, focusing efforts on deploying enterprise grade tools that include things like integration or security will help sell products to larger customers. Other levels of service can be designed specifically for the SMBs, featuring simple, self-provisioning products to help cut down on costs.

Finally, vendors looking to grow should consider making a name for themselves in the Europe or Asia Pacific markets, where the opportunity comes from the expected increased investment rates for Web 2.0/Enterprise 2.0 in those geographic regions.

However, the most valuable aspect of this change for vendors is the knowledge they obtain about how to run a successful SaaS business – something that will help propel them into the next decade and beyond and, ultimately, will provide more value than any single Web 2.0 offering alone ever will.