Taking out any loan for your business or personal use is easy nowadays, but it is highly essential that you take out a loan that makes sense. No one wants to fall into a debt trap making life difficult. If you’re going to be stress-free then you should consider your need and most importantly the different scenarios before you take out a business loan to fund your startup. A startup should take out a business loan that makes sense.

You may need money, a lot of it, for starting a business or for expanding.

When you consult other businesses, friends, family or mentor about borrowing you will come across a series of varied opinions.

- You will come across a group of a traditional pessimist who will tell you about all the cautionary anecdotes that they can think of, and they will warn you from taking out a loan.

- On the other hand, you will be greeted by others who will encourage you to go ahead suggesting that a business loan has blessed them.

You may be in a situation where you will face a dilemma in determining the feasibility of taking out a loan for your business.

Since the negatives make a more significant and more effective impact in human minds, you will be apprehensive about a situation when you will have to face the trauma of carrying unmanageable debts. In such circumstances, like most people you’ll look out for ways in which you can find relief from your debt. You’ll consider debt and loans from different reliable and tested sources such as nationaldebtreliefprograms.com.

Doing all of the research necessary will eat up your time and energy.

You may feel you could have devoted this amount of time to other vital areas of your business ensuring more productivity and growth.

To avoid such situations, it is crucial that you consider the different factors that will influence your decision to take out a business loan for your startup. You must also find several other things such as:

- The particular stage of your business when you need the money

- The specific purpose of the loan and whether or not you can postpone it or manage it with an alternative

- The credit history of your business

- The amount that you are eligible to

- The rate of interest you will have to pay on the business loan and

- Your ability and cash flow to repay the loan on time with interest without any defaults.

It is only after considering all situations that you will know the difference between a good and a bad loan.

Replenish your inventory.

There may be times when you may need to replenish your business inventory which by it is perhaps the most significant expense for any business. Moreover, if you are into seasonal business, you will need even more money to buy a considerable amount of it in bulk well before the seasonal sale starts.

If you do not have considerable funds on hand or in the bank you will need to take out a business loan. These loans are called an inventory loan. To make sure that you take a wise step there are a few things that you should consider beforehand such as:

- Comparing your sales projections this year with that of the last few years

- Comparing the cost of the business loan with your current sales projections and

- Finding out the prevailing as well as upcoming market condition as these are extremely volatile.

However, when you consider your future sales prospects and make a projection this year make sure that you are cautious, calculative and most importantly a bit conservative. This will help you to know the feasibility of taking out such a loan.

Other situations to consider.

Apart from your inventory purchase, there are a lot of other situations when you may need to borrow money for your startup. A few of these are:

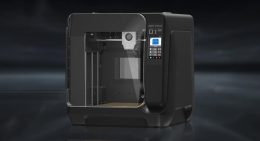

- Need to purchase equipment:Irrespective of the type of business, you will need specific equipment. It may be IT tools or machinery, but you will need these to make your business operations more accessible and add to efficiency and productivity. Taking out a loan in such situations is a possible decision because the equipment that you purchase will be the collateral itself. Having a guarantee to hold against a loan will lower the rate of interest but make sure that the material itself is worthy enough to invest on.

- Need to expand office:When your workforce outgrows the available space in your current office, you may feel it is the right time to expand it and take up a larger space altogether. Larger accommodations involve an enormous cost of leasing a new real estate, picking and moving, overhead and other allied expenses. If you do not have immediate cash in hand, talking out a business loan is an excellent option to deal with the numerous financial aspects. However, consider the potential vagaries in revenue due to such relocation, especially if you are into a retail business.

-

Need fresh talent:

When your business grows, you will need to hire more people as few people wearing too many hats at work affects productivity negatively. A lot of startups get a loan to recruit new talent to keep their business running, innovative and competitive.

However, you should be wise enough to evaluate the revenue generated later on so that it is enough to cover the debt as well as its costs. Remember, it is essential that you make future projection at present as the impact of fresh talent is not visible immediately. Thinking ahead will help you to see the bigger picture.

-

Grab an opportunity:

Sometimes, you will need to grab an opportunity which is too costly to let go, but you may not have the money to go ahead. Take a loan if you think that the return will cover the burden of debt.

If you want to build your score sometimes taking out small business loans and repaying it successfully will help in building your score so that you can take a bigger loan in future if required. It all depends on your prudence and the reason for taking a business loan.