Legacy enterprise IT vendors may be scrambling to spread the blame in the wake of earnings misses, but one mega-vendor is not, and it’s the one open-source advocates have argued for years was doomed to imminent oblivion: Microsoft. For all its stumbles in mobile and online, Microsoft continues to soar in core enterprise infrastructure sales.

The reason? Microsoft pressures the Oracles and HPs of the world in much the same ways that open source and cloud do.

Low Cost, High Value

By most measures, Microsoft’s Server and Tools business is booming:

- Product revenue up 11% (Multi-year licensing revenue up 20%)

- Enterprise Services revenue up 11%

- System Center revenue grew 22%

- SQL Server revenue grew 16%, outpacing the market

And while growth has slowed a bit in fiscal year 2013 compared to fiscal year 2012, it’s still impressive growth, especially in light of the struggles other enterprise IT vendors have had recently.

Why is Microsoft different? Most obviously, because Microsoft tends to make complex infrastructure affordable and easy to use, while appealing to developers. This has long been Microsoft’s recipe for success: lowering the bar to use complex software while also lowering costs.

In other words, Microsoft keeps chugging along in the enterprise because makes life easier for enterprise IT, similar to what cloud and open source do. Or as Apprenda vice president Rakesh Malhotra puts it, “it’s less about licensing and more about the complexity/cost/value.”

And while Microsoft persists with its proprietary license model, a model out-of-favor in a market trending toward open source and cloud, it still tends to be much cheaper than alternatives like Oracle in the database market. As BMO Capital Markets analyst Karl Keirstead recently opined in a client note, “Countless customers have told us that the cost advantage of SQL Server is so compelling that their deployment of Microsoft SQL Server databases is ramping.”

In short, Microsoft improves enterprise value and lower costs, relative to the other legacy IT vendors.

But What About Mobile?

Ironically, Microsoft has thus far failed in mobile precisely because it has taken the opposite strategy: while Apple and Google (Android) have essentially lowered the cost of mobile operating system licenses to $0.00, Microsoft has continued to try to impose license fees. When that hasn’t worked, it has sued Android licensees to try to raise costs to match Microsoft’s.

It hasn’t worked.

Microsoft has a lot of work to do to catch up in mobile. But in core enterprise infrastructure? Microsoft may be the vendor to beat.

Not Shrinking From The Cloud Fight

Not that Microsoft rests easily. After all, with trends shifting IT spending to mobile and cloud, Microsoft’s traditional Server and Tools division stands to take a beating. According to a new Baird Equity Research Technology study, Amazon, in particular, is siphoning off dollars from the legacy IT pie:

We estimate that for every dollar spent on [Amazon Web Services], there is at least $3 to $4 not spent on traditional IT, and this ratio will likely expand further. In other words, AWS reaching $10 billion in revenues by 2016 translates into at least $30 to $40 billion lost from the traditional IT market.

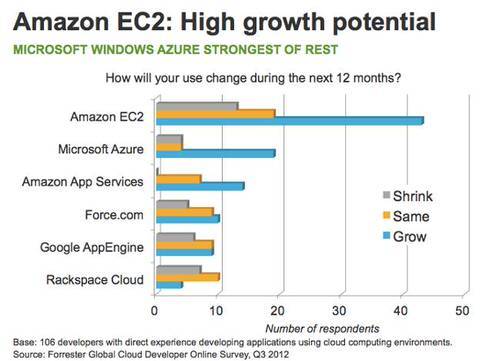

In this, however, Microsoft is playing a solid offense, and stands a good chance of succeeding. Among both enterprise developers and CIOs, Microsoft remains their go-to vendor, according to both Piper Jaffray and Evans Data surveys. More pertinently to Amazon, these same enterprises plan to expand their Microsoft Azure adoption significantly, according to Forrester:

Breathing Room…For Now

Amazon stands clear as the 800-pound cloud gorilla, but Microsoft is no slouch. By embracing the cloud early and by continuing to pressure its proprietary peers with low-cost, high-value infrastructure software like SQL Server, Microsoft has kept itself top of mind with CIOs. These same CIOs are therefore willing to give Microsoft breathing room as it transitions its business to the cloud.

This could get interesting.