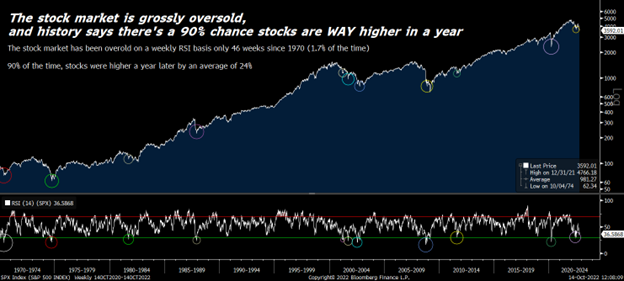

- The S&P 500’s weekly RSI has been oversold during only 46 weeks over the past 50 years — and we’re oversold today.

- This technical indicator successfully predicted the ending of the COVID-19, 2008 financial crisis, and dot-com crashes.

- Whenever the market does become oversold on a weekly basis, it tends to be working through a bottoming process after a terrible crash.

Stocks don’t rise forever. They also don’t fall forever.

While everything you read on Twitter and see on CNBC these days will likely make you feel like this stock market crash will never end, you need to know that at some point, it will. And when it does, we’re going to get a generational buying opportunity.

One closely watched technical indicator suggests the stock market crash could end quite soon.

This indicator has flashed twice recently. It also flashed at the stock market bottoms of March 2020, March 2009, and November 2002.

That’s right. This technical indicator successfully predicted the ending of the COVID-19, 2008 financial crisis, and dot-com crashes. Now, it’s predicting the end of the 2022 market crash.

If right again, this indicator could be your “golden ticket” to market fortunes over the next year.

Here’s a deeper look.

Current Oversold Conditions

The indicator we’re talking about is the weekly Relative Strength Index for the S&P 500.

This metric gauges the weekly buying pressure in the stock market. And it tells us how overbought or oversold stocks are in any given week using a reading from 0 to 100. Overbought conditions are typically quantified by levels over 70. Oversold conditions are typically quantified by levels less than 30.

We’re oversold today. Not at this exact moment – but back at the summer lows, the weekly RSI on the S&P 500 dropped to 30 for the first time since March 2020.

That’s noteworthy because the stock market rarely spends time as oversold. The S&P 500’s weekly RSI has been oversold during only 46 weeks over the past 50 years. That means the market has been oversold on a weekly basis only 1.5% of the time.

Weekly oversold conditions in the market are incredibly rare. They’re also incredibly bullish.

Whenever the market does become oversold on a weekly basis, it tends to be working through a bottoming process after a terrible crash. Indeed, 90% of the time, stocks are higher 12 months later – and not by a little. The average gain in the 12 months following a weekly oversold reading is about 24%!

The only exceptions? Late 1973 and early 2001. But back in 1973, the market was dealing with 10%-plus inflation that was rising rapidly. In 2001, the market was still trading at a very rich valuation multiple of 21X forward earnings. Today, inflation rates are at 8% and falling, while the forward earnings multiple is just 16X – below its 5-, 10-, 20-, and 30-year averages.

In other words, history says we’re either at or very close to a stock market bottom. It would be unprecedented for stocks to be this oversold and undervalued and keep falling… unless a so-called “black swan” risk emerges.

And we don’t foresee any of those risks on the horizon. As such, we think that a bottom is close. And so is a generational turning point.

The Final Word

Bear markets are weird.

In good times, investors are always telling themselves: “Yeah, when that next stock market crash happens, I’m going to buy the dip and make so much money.”

Yet, when that next stock market crash does come, that usually doesn’t happen. Instead, we get scared.

And I get it. Bear markets are scary. When stocks are crashing, it seems like there must be a sinister reason for it. Investors fear the worst – as if the economy is about to blow up.

Of course, it never actually blows up. The economy, the markets, and stocks all take a couple hits and then bounce back.

The investors who make money during bear markets are the ones who realize this and don’t panic. They are the ones who buy, hold, and wait for better times.

As it turns out, waiting is actually the most valuable thing you can do in the stock market, especially during bear markets!

The great Charlie Munger – Warren Buffett’s right-hand man – once said that the big money in the stock market isn’t made in the buying or the selling but in the waiting.

So, here’s my two cents on this market crash. Buy high-quality growth stocks at huge discounts today… then, wait.

Sounds simple, I know. But sometimes, the simple answer is the best one.

That’s certainly true in this situation.

If you believe so, too, I highly urge you to click here.

Published First on InvestorPlace. Read Here.

Featured Image Credit: Photo by Anna Nekrashevich; Pexels; Thank you!