Only one open-source company that’s so far managed to break $1 billion in annual revenue. But that’s not stopping venture capitalists from spreading billions around in the hopes of helping create the next Red Hat.

See also: The Open-Source Cloud Takes A Step Toward Simplicity

Too bad Amazon Web Services (AWS) is out there waiting for them.

Let The Venture Money Flow!

Over the past two years, the sums pouring into open-source enterprise software companies have been remarkable. Last year MongoDB (full disclosure: my employer) raised $150 million at a reported $1.2 billion valuation, while NoSQL peer DataStax took in another $106 million, valuing the company at $830 million.

Meanwhile in Hadoop Land, investors handed Hortonworks $100 million at a reported $1 billion valuation, after which Cloudera pulled in a monster $900 million round, most of it from Intel, at a nosebleed valuation reported to be around $4.1 billion.

See also: Red Hat May Be Stacking The Deck Against Its OpenStack Rivals

And we’re not done yet. On Tuesday, Mirantis—which offers software and support for OpenStack, a collection of open-source tools companies can use to build their own clouds—raised $100 million from a variety of investors including Intel Capital and Ericsson. Nobody disclosed a valuation.

This kind of Oprah money has fewer companies to flow into these days. Many standalone OpenStack and open-source cloud startups have already been gobbled up by large vendors, mostly for nominal sums. Oracle scooped up Nimbulus last year. HP recently bought Eucalytpus, EMC acquired Cloudscaling and Cisco bought Metacloud.

That leaves Mirantis standing in an industry with some very big players as competitors, in a market that seems to be Amazon’s to lose.

Mirantis, of course, is not the only open source company competing with Amazon. In a world increasingly gone cloud, every software vendor, open source or otherwise, competes with AWS.

Amazon: The New Microsoft?

There must be something in the water around Seattle, as the area keeps breeding hegemons. Microsoft dominated desktop and data center computing for decades. Now it’s Amazon’s turn.

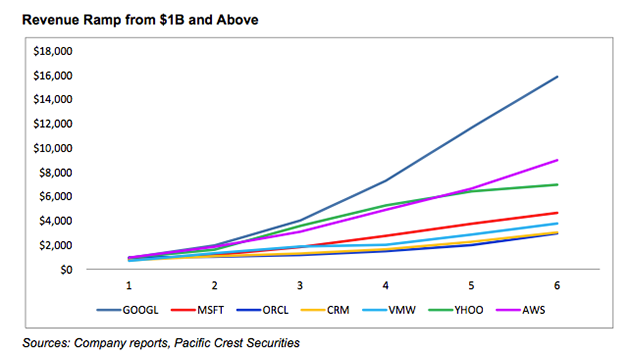

Amazon Web Services is perhaps the fastest-growing software business in history, ramping to $1 billion and beyond at a torrid pace, as Pacific Crest Securities estimates:

Now that Amazon CTO Werner Vogels has made it clear that Amazon is in the “enterprise pain management” business, and won’t be content to merely provide infrastructure services, no area of software is safe from AWS’ deflationary grasp. Yet hard as it may be to compete against AWS with a proprietary licensing model, in some ways it’s harder with an open source model.

Just ask MySQL, once a burgeoning developer of the popular open-source database of the same name.

At the time of its $1 billion acquisition by Sun in 2008, MySQL was doing roughly $100 million in sales. That’s not bad, but it pales in comparison to how much AWS was making on that same MySQL code, both in terms of RDS and MySQL-related EC2 revenue.

While there are no official numbers from AWS on its cloud business, I’ve heard from inside sources that AWS made several hundred million in revenue at the time of the MySQL acquisition, and I would venture that its RDS + MySQL-related EC2 revenue is now approaching the $1 billion mark.

It’s not just MySQL, of course. Amazon is also the world’s largest Linux vendor, the largest Hadoop vendor and so on. Importantly, AWS has done what no open source company has ever managed to do: make money off all otherwise free open-source software. By turning open source software into managed services, AWS can turn any open-source code into cash.

A Quixotic Mirantis Counterattack

Now Mirantis and its investors hope to stem that tide. The good news is that Amazon has no interest (so far) in selling OpenStack private cloud services.

That’s also the bad news.

When I talked to Mirantis CEO Adrian Ionel about why VCs would pour money into an AWS competitor, he didn’t hold back:

We have seen strong customer traction and out-sized business results, and we are working with some of the best brands in the world, including Home Depot, Wells Fargo, and PayPal. Earlier this year, we closed the largest OpenStack deal in history with Ericsson (more than $30 million in software licensing revenues over five years). We are becoming known as a the breakaway independent OpenStack leader, and it’s exciting to see the momentum build.

That may be true, but it’s not yet clear that Mirantis and its 450 engineers have much chance against AWS. Ionel is quick to point out that Mirantis can hold its own against other OpenStack contenders like VMware, HP, Oracle, Red Hat and possibly Cisco-via-Metacloud: “We already have the largest OpenStack customer base of any vendor, and dominate Web/SaaS, service provider, and enterprise markets.”

He further notes, “Customers routinely tell us that they chose Mirantis because there was no proprietary agenda, which means so that they can avoid the lock-in of traditional IT.” But those same customers are actively embracing AWS, with GE the latest poster child.

Fighting The AWS Beast

In fact, as I’ve argued before, OpenStack’s best chance at relevance is likely Red Hat, which has the broad open source portfolio to make it a potential contender against Amazon’s array of services. Ionel disagrees, saying that “The ‘benevolent dictator’ model may be past its prime,” and that “Other models can be more powerful, like an open, market-driven meritocracy combined with deep user engagement in R&D.”

This still doesn’t answer the AWS threat. To that Ionel retorted,

OpenStack lets them fine-tune their cloud to their needs. By contrast, AWS is a much simpler “one-size-fits-all” platform which standardizes everything to the lowest possible denominator for its customers. Although this makes sense for some enterprises and workloads, it cannot make sense for all of them.

Maybe, maybe not. But I seriously doubt most enterprises today are concerned with the “one-size-fits-all” epithet and instead view it as a convenient way to get to the cloud fast. Until OpenStack can deliver a deep cloud experience as easily as AWS does, $100 million isn’t nearly enough.

Lead photo by kayugee