One false tweet from a hacked Associated Press Twitter account wiped $200 billion off the stock market, but most tweets don’t move markets one way or another. In fact, there appears to be little rhyme or reason for Twitter’s effect on individual stocks.

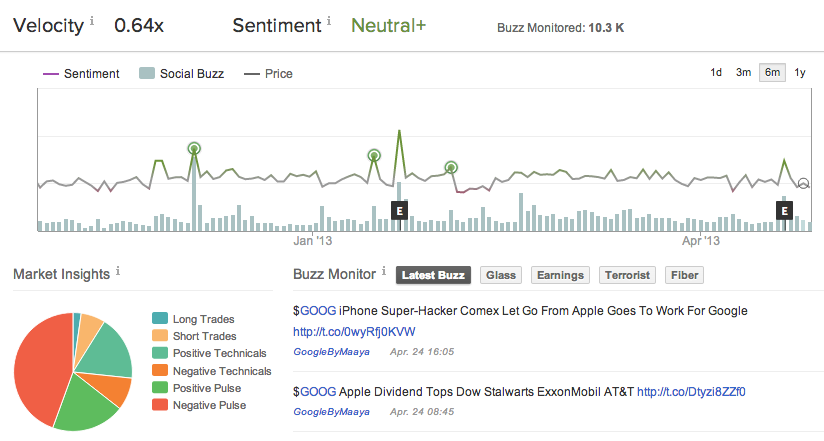

Take Google. While its stock has been on a six-month tear, growing 19% in that period, its “social stock” has been anything but over the same timeframe:

Or what about Cisco? Stock is up 19% over the last six months too, while Twitter reflects 82% bearish sentiment. Apple? Stock is down 33% in the last six months, while Twitter sentiment remains neutral.

Granted, some stocks like Microsoft accurately reflect their Twitter sentiment: Microsoft is up 23% in the last six months, with 71% of tweets cheering the company on. And while Red Hat jumped in the last six months, it has settled into roughly the same position it held in November 2012. Social sentiment? Neutral.

In other words, while it may be wise to consult a financial advisor when investing in stocks, consulting your 500 million Twitter friends? Not so much.

Not everyone, or every hedge fund, agrees. Derwent Capital has spent two years analyzing a subset of tweets to gauge sentiment around a stock. That lasted all of a month, but allegedly because it was so impressive (returning 1.86% in that month) that the Derwent team in 2012 decided to build a trading platform around the idea. It’s unclear how well that went since its website… no longer exists. Hardly a sign of blistering success.

Which is not to suggest that Twitter isn’t a good way to get a finger on the pulse of social sentiment. It is. I use it daily in my work, and find it a great predictor of sentiment around various brands I follow. But it’s unclear, at best, that such sentiment translates into winning stock picks. Now if there were a way to segment out of the general Twitter noise the tweets of those that matter most to discerning a company’s chances?

That just might work.

Image courtesy of Shutterstock.