Massachusetts needs money. These days, every state is looking for ways to scrape out more revenue for failing budgets and costly infrastructure projects.

But Massachusetts looked at its burgeoning technology sector and thought that it could squeeze at least $160 million a year out the Commonwealth’s startups and established technology firms for funding of a transportation bill.

So, the Massachusetts “Tech Tax” was born. It was a vaguely written and a potentially harmful burden to startups in and around Boston. When technology firms in Boston figured out exactly what the Tech Tax was, they fought back. And, for once, the Massachusetts legislature listened. This week, the Tech Tax was repealed by a 38-0 vote in the Commonwealth senate a day after it was also rejected by the House of Representatives 156-1.

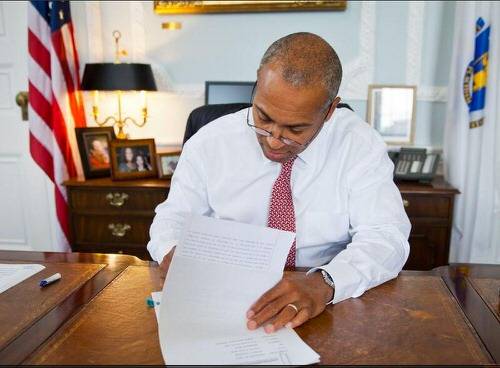

Today, Patrick made it official and signed the repeal of the tech tax. He likely did so with a sigh as the tax essentially started in his office because he, like many other state executives across the country, looked at the startups in his state and saw nothing but dollar signs.

Deval Patrick To Startups: “Make Money”

“Make money,” the governor said to me as he shook my hand.

In March of 2012, I was at a startup event in Boston at a club downtown. The party was a feel-good “pay it forward” type of thing where the Boston startup ecosystem gets together and congratulates itself on how awesome it thinks it is. In attendance was Massachusetts Governor Deval Patrick, espousing how Boston and the Commonwealth government were welcoming of tech startups.

After a short speech on stage, Patrick exited the event with his usual coterie of lackeys where I was standing outside chatting with a friend. “Governor,” I said, “a quick question?”

That is when he shook my hand and said, “make money.” And then walked away.

Patrick thought I was some startup employee or founder, his target audience for the night. Patrick’s administration has been very proactive in creating a comforting environment for startups in Boston. The Commonwealth helped build a new “innovation district” down by the Seaport and everything Patrick has said publicly has been supportive of emerging businesses.

His actions, however, have been another thing entirely. To Patrick and Massachusetts government officials, the state’s startups are not about creating better products or a better world. They are about one thing:

“Make money.”

Tech Tax Hurt Massachusetts Innovation

Massachusetts had a good reason for wanting to funnel some money from the burgeoning technology economy in the Commonwealth. Massachusetts’ transportation infrastructure could use a serious cash influx to repair roads and bridge, update the “T” subway system and keep Boston moving efficiently.

Earlier this summer, the Commonwealth of Massachusetts approved a new set of tax hikes to finance its transportation initiatives. Cigarettes and gasoline were among the products getting more taxes, among several other dozen sundry items. Included in this tax hike was a “software tax” that was extremely confusing and opaque. Nobody really knew what to make of it other than that it would make it much more difficult for technology companies operating in Massachusetts to avoid the Commonwealth’s revenue barons.

The gist of the Tech Tax was that the Commonwealth would extend its 6.25% sales tax on custom software and network design services. Essentially, if a development or technology consultant firm farmed work out of state or had out-of-state customers, the additional 6.25% sales tax would apply (the law is more opaque and confusing than that, creating much handwringing among the state’s technology firms, startups and developer centers over if and how to comply).

The Tech Tax was estimated to bring in up to $160 million annually into the Commonwealth’s coffers. Yet, because of the vague wording of the bill, some estimated that the burden to Massachusetts companies could be up to $500 million. Opponents said that it was “the most far-reaching tax on software services in the country.”

In a press release announcing a petition to repeal the bill, Michael Widmer, president of the Massachusetts Taxpayers Foundation, said that the tech tax was “the most anti-competitive piece of legislation in my 21 years as head of the Foundation and will cause incalculable damage to job creation and the Massachusetts economy.”

So much for Patrick’s call to “make money.”

Boston Tech Fought Back

The Tech Tax was the brainchild of the Massachusetts legislature and Governor Patrick’s office. During the drafting and implementation of the transportation bill, hardly any of the prominent Massachusetts technology players were consulted.

And then it was too late.

The new taxes went into effect in the Commonwealth the first week of August. Consternation and confusion was immediately expressed by Boston’s large technology sector. Out-of-state tech companies that do a lot of business in Massachusetts looked even more warily on a state that has long had the reputation as “Taxachusetts.”

When the repercussions of the Tech Tax became known, Boston tech companies kicked into gear. The Massachusetts Technology Leadership Council (MassTLC) led the fight, organizing local technology companies both large and small to fight the tax. A group of 20 businesses signed the petition to repeal the Tech Tax and threatened to bring it up for a vote as a statewide ballot in November (state politicians generally dislike these types of votes where the public overturns their policies and are seen as bad press for their eventual reelection bids).

MassTLC has created tools to petition local lawmakers and organized informational meetings and summits on how Massachusetts companies can handle the Tech Tax and its repeal.

The efforts have gained momentum. Governor Patrick has reversed his position on the Tech Tax and is now calling for its repeal. Commonwealth lawmakers on Boston’s Beacon Hill are expected to vote next week to repeal the tax.

Massachusetts Tech Companies Need Protection

If a software tax like the one in Massachusetts were introduced to the denizens of San Francisco and the extended Silicon Valley area, it would be national news. The big tech companies in California would have their top-dog lawyers and lobbyists on it the moment it was announced and browbeat the California state government into dropping its plans.

Massachusetts does not have that same type of organization in its technology sector. Many people looked towards MassTLC. Yet, the organization said time and again that it was not a lobbying organization and did not have the resources to continually monitor what is happening on Beacon Hill.

One of the problems is the nature of how bills are passed. The “Tech Tax” was essentially a line item in a much, much larger transportation bill. Organizations like MassTLC don’t have the money and resources to monitor every bill that passes through the Massachusetts legislature and how it might effect the local startup ecosystem.

The startups and technology sector of Boston and Massachusetts do not have a single group looking out for it. At the same time, it showed that it can come together to defend itself when it believes the Commonwealth is not looking out for its interests.

Images: Massachusetts State House courtesy Wikipedia Commons. Governor Deval Patrick via Massachusetts.gov. Unconference via MassTLC.