India has never paid much for software, but that may be changing, according to a new Gartner report.

With the Indian software economy growing at a hearty 10% clip, there are signs that indicate India is growing out of the rampant software piracy that has long characterized the market. The question is whether or not this trend bodes well for vendors hoping to do business in other hot economies, too—like China.

India Is A Tough Slog For Software Companies

India has long been a difficult market for software companies. While Asia-Pacific (“APAC”) accounts for roughly 10% to 20% of revenues for established companies like IBM, Oracle, Adobe and Salesforce.com, “in general [India] makes up a very small percentage of APAC [revenue],” with the bulk of that revenue concentrated in a few large accounts, as Chirag Mehta, SAP’s VP of Product Management and Business Development, notes.

Part of the problem is piracy. Western nations, whose piracy rates hover between 20% to 30%, have long traditions of intellectual property. In the APAC region, including India, this simply hasn’t been the case. The tension between U.S. and Indian notions of intellectual property has simmered to a boil in recent years, particularly with regard to patents.

The irony is that things are actually getting better. For at least a decade, India’s rate of software piracy has been in steady decline. From 2005 (when 74% of all software was pirated) to 2008 (69%) to 2011 (63%), India’s rate of software piracy has been dropping off pretty consistently. The question is why, and whether India’s growing willingness to pay for software suggests other rising economies in the East will also pay for software.

India’s Software Boom

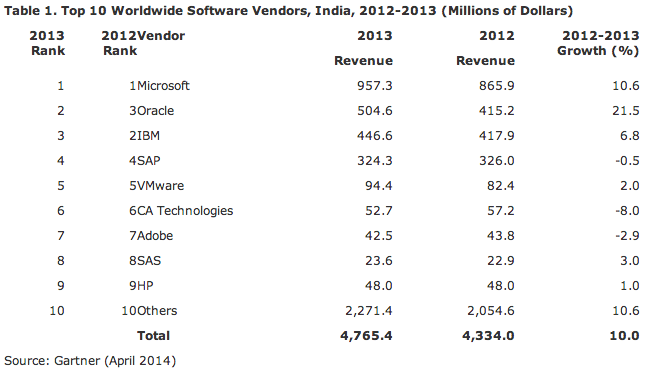

Though 63% of PC software in the country is pirated, India actually spends quite a bit of money on software. India software revenue increased totaled upwards of $4.7 billion in 2013, a 10% increase from the year prior, according to Gartner. That’s incredibly fast, especially when compared to other fast-moving software economies like Russia (8.9% growth), Brazil (7.8%), China (7.0%) and South Africa (6.3%).

That revenue isn’t evenly split. It tends to concentrate in larger firms offering complex, proprietary software that isn’t easily replicated by local software firms, as Gartner’s data shows:

So complexity sells, but what else? According to Gartner research director Bhavish Sood, “recent advances in IT communications infrastructure in the country has opened up new avenues for local consumption of IT software and associated services.” These investments point to an infrastructure that can more easily support a variety of network-based services like software-as-a-service, or SaaS, which is impossible to pirate.

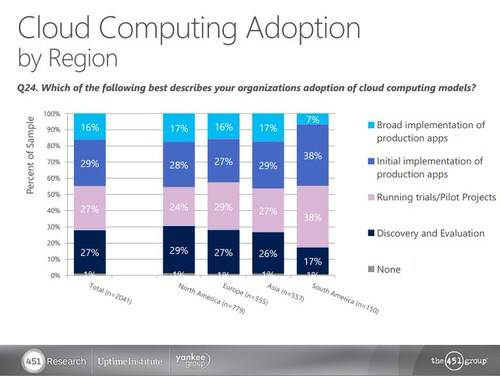

For companies that deliver SaaS, this suggests a potential gold rush could be coming, as APAC leads the world in cloud-based software adoption:

IBM and other software companies are betting big on India’s ability to prove this general APAC trend.

So What About China?

India’s march toward paid software might bode well for those that want to do business in China. Definitely, maybe.

China’s piracy rate, which was declining before it stalled in 2010, today roughly coincides with India’s piracy rate 10 years ago. It’s unlikely this will change overnight.

Like India, China has an abundance of highly skilled engineers. As such, China, like India, tends to use open-source software heavily, rarely paying for support subscriptions. But also, like their Indian counterparts, Chinese enterprises seem inclined to pay for complex, proprietary enterprise software that’s more advanced than domestic firms have yet developed.

But the question isn’t from whom China gets its software. The question is whether China will pay for that software at all.

The answer seems to be “yes, China will pay for software,” even if they’re doing it more for the technical support than the actual software.

While China would seem like a boon for open source vendors that sell support subscriptions, the requirements for competing in China are tough for non-Chinese companies. Thanks to government support and deep understanding of local business requirements, Chinese software companies were able to quickly take control of the market through the 1990s and 2000s. And this Chinese software offers multi-tiered, 24/7 support through large teams of customer support personnel, which is awfully tough for outsiders to match.

The other ways to make money in China’s software market involve selling hardware appliances (e.g., Huawei’s SAP HANA appliance) or hosted services (Salesforce.com has been doing business there since 2007).

Complex, Cloud Or Hardware

Making money in China is somewhat similar to making money in India: The software has to either be more complex than the local market has been able to build on its own, or it must be baked into hardware (through appliances), or the network (through SaaS).

Given the legacy-licensed software model is in retreat everywhere, the stars may be aligning to allow more Western software or software service vendors to break into India and China in a significant way. This will require considerable investment in understanding these local markets, of course, but the economies of China and India may make the effort worthwhile.

Image courtesy of Shutterstock.