What is Open Banking?

Open banking is a business model wherein banks and other financial institutions can exchange data within the financial ecosystem to create better financial products and services for customers. Banks are setting up an infrastructure where customer data can be safely shared only with consent.

Customer consent is mandatory for sharing data outside the bank or financial institution.

Open banking will benefit the banks and prove beneficial for the customers as well as businesses. With the use of data, banks and other financial service providers can innovate and launch new products and services for customers they have been looking for.

Open Banking for Businesses

For businesses, open banking will offer efficient and effective financial tools that will reduce manual tasks.

Open Banking for Customers

For the customers, open banking will allow them to make well-informed financial decisions; they will be in a better position to make the right decisions for investing, borrowing, and saving.

The Rise of Open Banking

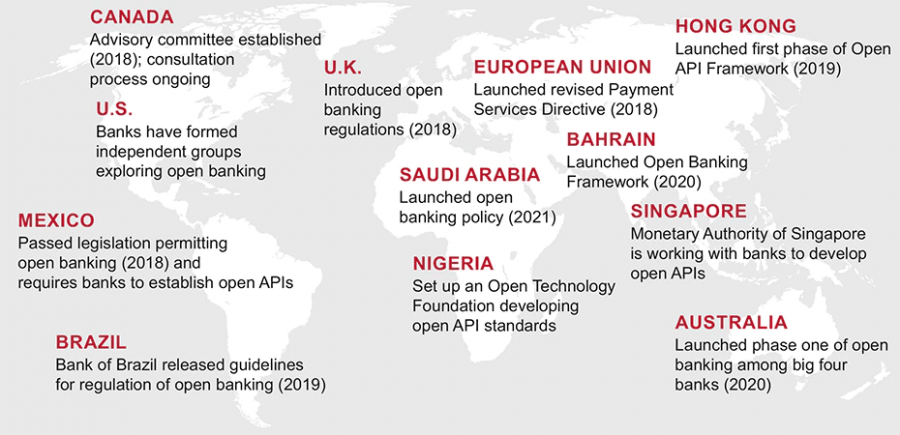

Open banking has been on the rise for a few years now. However, with the regulatory framework in place in many countries, open banking is now taking over the world of traditional banking.

While the UK is known as the pioneer of open banking, other countries have been catching up with this new disruptive way of banking. Today, many countries have launched open banking regulations, which have helped banks and fintech to initiate open banking.

The UK and Europe have the revised Payment Services Directive (PSD2) in place for open banking.

PSD2 allows third party providers to access payment service users’ online payment accounts, provided the customer has given their explicit consent. It further requires Account Servicing Payment Service Providers (like banks) to allow access to information through a dedicated interface built on APIs. The nine largest banks in the UK are required by law to share data with third parties in a secure manner only if the customer has given their consent.

The United States is yet to bring in a formal law or a regulation pertaining to open banking.

Currently, initiatives like the Financial Data Exchange are opening up open banking opportunities; however, they will face hurdles due to the country’s absence of open banking regulation.

Open banking in the Asia Pacific is also catching pace.

Countries like Singapore, Japan, India, Hong Kong are prioritizing open banking. There is no formal policy for open banking in most of the Asian countries; however, initiatives like an API playbook by the Money Authority Singapore (MAS), an obligation to publish API policies by the FSA are helping countries move towards open banking.

Australia has one of the most innovative approaches when it comes to open banking. The country has introduced a Consumer Data Right Act (CDR), which will allow customers to share their data with their choice of third parties.

A lot more countries are now adopting open banking and are looking into how they can create regulations and policies that will benefit the industry. Here’s a look at the rise of open banking globally.

Source: Strategy&

With open banking, a lot of countries are also debating consumer rights over data protection and privacy. To ensure that open banking benefits customers in the best possible way, it is necessary that policymakers integrate open banking laws with consumer data rights.

This will allow customers to opt out of the open banking technology and not share their data with other financial providers other than their primary bank. However, with the promise that open banking offers, it is to the benefit of the customers to opt-in and shares the financial data.

Open Banking and the Payments Industry

While open banking has a huge impact on the banking industry, other related industries are expected to undergo a huge change as well. One of the other industries is the payments industry. With the implementation of open banking policies and data sharing, the way people will make payments and receive them will transform.

Open banking allows financial institutions and fintech to develop APIs around the existing banking infrastructure and offer a host of new innovative payment solutions to customers.

With APIs in place, innovative apps will be created which will help consumers get an overview of the payment options they have, a view of their spending, and the various financial services that can be opted for.

There is no doubt that open banking is set to personalize finance.

No one would have ever thought of receiving personalized financial products; however, it is now possible to get only financial products and services designed for you with open banking.

These APIs, when integrated, will also help customers get a whole list of the banks and other financial institutions that they can sign up with.

The consumer might have multiple bank accounts, and he might also have signed up with a couple of non-banking financial institutions, and with the help of open banking APIs, the consumer will be able to view all data in one place.

This gives them a better idea of their financial standing and, based on their spending activity, it gives businesses a chance to offer clients services that match their needs.

There is no doubt that the open banking trend will transform the payments industry with all this said. Let’s dig into how the payments industry will change for the good.

Unbundling Traditional Banking Services

With neo banks trending all over the world, consumers today sign up with multiple financial services providers. As a result, they have multiple financial relationships for loans, credit cards, mortgages, payments, etc.

Previously, all these services were offered by banks only. You could apply for a credit card or a loan from a bank only or pay via your bank account or card. Today, you can avail of all these services through a non-banking financial institution.

Add to this mix the concept of open banking, and you have personalized financial products and services that you can benefit from.

Open banking with the help of fintech has attracted a lot of consumers.

Today, people are willing to try new services offered by modern providers, and most importantly, they are ready to trust their money with these non-traditional service providers. With open banking, all traditional financial services are unbundled and offered to consumers in one place rather than physically visiting bank(s).

Furthermore, with open banking services, the volume of online transactions has increased immensely. People are ready to make payments online without any hesitation. While the pandemic has played a huge role in this shift, open banking has also had an impact.

Use of Technology

World Economic Forum report in collaboration with Economic Intelligence Unit (EIU) report states that 87% of countries have some form of open APIs in place. This is one of the fundamental blocks of open banking, with the help of which the payments industry can be transformed.

When banks and other third-party providers have consumer financial data with them, they can create products and services around consumer liking. There is nothing better than creating a product that matches the consumer’s needs.

The payments industry will hugely be impacted by the use of technology that open banking requires.

This includes open APIs that will help banks and third-party providers to collaborate and share data. The use of AI analytics will also play a huge role in the transformation of the payments industry. These analytics will assist banks to access data insights internally and offer personalized products based on the results.

Advanced technologies like the use of the cloud will be another stepping stone for the transformation of the payments industry.

Financial institutions will be able to store data efficiently and use it to their benefit. With mobile apps, consumers will be able to view their dashboard anywhere, anytime, and send/receive payments instantly.

Lastly and most importantly, open banking has given rise to security concerns, and with the use of technology, this has been taken care of too.

Financial institutions have high-security controls in place, including authorization, authentication, etc., to make sure that security concerns are addressed efficiently.

Request to Pay

Request to Pay (RtP) is one of the most exciting features that open banking offers. As the name suggests, this feature allows users to request payments from other bank accounts proactively. Debtors will receive a notification via a mobile banking app regarding the amount due and the payment date. This feature is particularly beneficial for small businesses, merchants, and self-owned businesses.

While the debtor will benefit from a simple and efficient way to reconcile their account, it will also revolutionize the way invoicing is done and payments are made. For debtors, this feature is extremely convenient and flexible as it will allow partial payment options as well.

Open banking will provide them with a better view of their outstanding amounts and will provide them with a simple way of making payments.

On the other hand, the payees will be able to view their cash flows in a comprehensive manner which will help them inaccurate forecasting and reduce billing costs. Open banking provides them with a complete view of payments on a single platform, thus helping them manage their time efficiently and bringing down their invoicing costs.

Savings for Merchants

With the pandemic accelerating online and digital payments, merchants will be the ones that will benefit the most with this shift through open banking. The costs associated with handling/mishandling of cash, the credit/debit card processing fees, transaction fees, etc., will be reduced once open banking is implemented throughout the payments industry.

Transaction costs will be lower, and consumers will be ready to adopt this new change. As a result, the transaction volume of cashless payments will increase, which will bring down the fees even more. When merchants will save and earn more through this shift, they will be able to pass on the benefits to the end consumers creating a win-win situation for all.

Disruption of the Traditional Banking System

Open banking is on the verge of replacing the traditional banking system. Be it the BACS system in the United Kingdom or the ACH system in the United States. While these two methods account for the majority of bank payment settlements in their respective countries, open banking is set to disrupt them.

Open banking allows aggregators to make payments directly to the end-user.

For instance, a payroll provider will be able to send payments directly to the employees rather than using the BACS or ACH system to clear payments. Not only will this reduce time, but open banking will also bring down the associated costs to a huge extent.

The payments industry will also see a revolution in the real-time payments sector. Open banking is set to enable instant transactions between the retailer and the consumer, removing the time barrier. No more waiting for three to five business days to settle a payment. Everyone will be able to send and receive payments instantly.

Future of Open Banking

Open banking is not only disrupting the local payment industry but the cross-border payments industry as well. The future will see seamless global payments that can be sent and received within minutes, if not seconds.

The traditional banking system is expensive and tedious.

Not only do international payments take time, but the local payments sector is also cumbersome. The idea of open banking is creating a lot of opportunities for the payments industry to get rid of the traditional system and adapt to the new technologies. While the adoption of open banking is taking up the pace, there is still a long way to go.

A lot of countries still need to formulate policies and regulations regarding open banking.

Once the legal framework is in place, there is nothing that can stop open banking from taking over the traditional banking system. With the digital transformation underway in the payments industry, consumers are likely to take the leap of faith in an instant and will trust the technology more than they trust their banks.

Image Credit: Tima Miroshnichenko; Pexels; Thank you!