Taiwan-based Foxconn, the world’s largest contract electronics manufacturer, has announced its withdrawal from a $19.5 billion semiconductor joint venture with Indian metals-to-oil conglomerate Vedanta. This decision deals a blow to Indian Prime Minister Narendra Modi’s plans to establish a robust chipmaking industry in the country.

The joint venture, signed between Foxconn and Vedanta last year, aimed to establish semiconductor and display production plants in Modi’s home state of Gujarat. However, Foxconn’s exit from the partnership is a setback for India’s ambitions to attract foreign investors and develop a domestic chip manufacturing ecosystem.

The Foxconn-Vedanta Joint Venture

Foxconn decided to withdraw from the joint venture with Vedanta after over a year of collaboration between the two companies. The partnership aimed to transform a promising semiconductor idea into a reality, but both parties have mutually agreed to terminate the venture. As a result, Foxconn will no longer be associated with the fully-owned Vedanta entity.

The joint venture’s dissolution is a significant setback for Prime Minister Narendra Modi, who has prioritized chipmaking as a key component of India’s economic strategy. Modi envisions a “new era” in electronics manufacturing, with the development of a robust domestic chip industry to attract foreign investment and promote local chip production. However, Foxconn’s withdrawal from the Vedanta partnership poses challenges to the realization of these ambitions.

Foxconn’s Expansion into Chips

Foxconn, renowned for its assembly of iPhones and other Apple products, has been diversifying its business in recent years by expanding into the chip manufacturing sector. This strategic move aims to reduce the company’s reliance on contract manufacturing and tap into the growing demand for semiconductors. By entering the chip market, Foxconn aims to strengthen its position as a leader in the electronics industry and explore new avenues for growth.

Challenges Faced by the Modi Government

The dissolution of the Vedanta-Foxconn joint venture is not the only hurdle the Modi government faces in its pursuit of a thriving chipmaking industry. Previous reports revealed that the project faced challenges, with talks to involve European chipmaker STMicroelectronics as a partner reaching a deadlock.

While Vedanta-Foxconn had engaged STMicro for licensing technology, the Indian government insisted on the European company having a greater stake in the partnership. However, STMicro was reluctant to increase its involvement, leading to an impasse in the negotiations.

India’s semiconductor market is projected to reach a value of $63 billion by 2026. In light of this potential, the Indian government launched a $10 billion incentive scheme to attract investments in chip manufacturing.

Besides the Vedanta-Foxconn joint venture, two other applications were submitted under this scheme: a proposal by global consortium ISMC, which includes Tower Semiconductor as a technological partner, and a plan by Singapore-based IGSS Ventures. However, both the $3 billion ISMC project and IGSS Ventures’ $3 billion plan faced obstacles that resulted in their suspension.

The ISMC project stalled due to Intel’s acquisition of Tower Semiconductor, while IGSS Ventures halted its plan to re-submit the application. These challenges highlight the difficulties faced by the Indian government in realizing its chipmaking ambitions and attracting foreign investments in the sector.

Implications for India’s Chipmaking Industry

Foxconn’s withdrawal from the Vedanta joint venture poses significant implications for India’s chipmaking industry and the country’s broader economic strategy. The partnership dissolution hampers the development of a domestic chip manufacturing ecosystem and undermines the government’s efforts to make India an attractive destination for foreign investors in the semiconductor sector.

The establishment of a thriving chip industry in India would have several benefits. Firstly, it would reduce the country’s dependence on imported chips, bolstering its self-sufficiency in electronics manufacturing. Additionally, it would create job opportunities, promote technological innovation, and contribute to India’s overall economic growth.

Looking Ahead: Reviving India’s Chipmaking Ambitions

While the dissolution of the Vedanta-Foxconn joint venture is undoubtedly a setback, it does not mark the end of India’s chipmaking ambitions. The Modi government remains committed to fostering a favorable environment for semiconductor manufacturing in the country. To revive and accelerate these ambitions, several key steps can be taken:

- Investment Incentives: The Indian government should enhance and streamline its investment incentives to attract global semiconductor companies. These incentives could include tax breaks, affordable land, and infrastructure access, and simplified regulatory procedures.

- Strengthening Partnerships: Collaborating with established global chip manufacturers and technology leaders can bolster India’s domestic chip industry. The government should actively engage with companies with chip manufacturing expertise and seek mutually beneficial partnerships.

- Research and Development: Investing in research and development (R&D) facilities and promoting collaboration between academia and industry can drive innovation in the chipmaking sector. Encouraging R&D centers to work closely with domestic chip manufacturers will help India develop cutting-edge technologies and stay competitive in the global market.

- Skilled Workforce Development: The government should prioritize the development of a skilled workforce by establishing specialized training programs, and educational initiatives focused on semiconductor manufacturing. A well-trained workforce will attract investments and contribute to the growth of the domestic chip industry.

- Infrastructure Development: Building state-of-the-art semiconductor fabrication facilities and investing in supporting infrastructure, such as power supply, transportation, and logistics, is crucial for the success of India’s chipmaking industry. The government should collaborate with private sector partners to develop world-class infrastructure that meets the requirements of chip manufacturers.

By implementing these strategies and addressing the challenges faced by the industry, India can revive its chipmaking ambitions and establish itself as a global player in the semiconductor sector.

Conclusion

Foxconn’s withdrawal from the Vedanta chip venture is a blow to India’s chipmaking ambitions and the government’s plans to attract foreign investments. However, this setback should not discourage India from pursuing its goal of establishing a robust domestic chip industry.

By implementing targeted strategies and addressing the challenges faced by the sector, India can revive its chipmaking ambitions and position itself as a leader in the global semiconductor market. The government’s continued commitment and proactive measures are crucial in realizing India’s vision of a thriving chip manufacturing ecosystem.

First reported on Indian Express

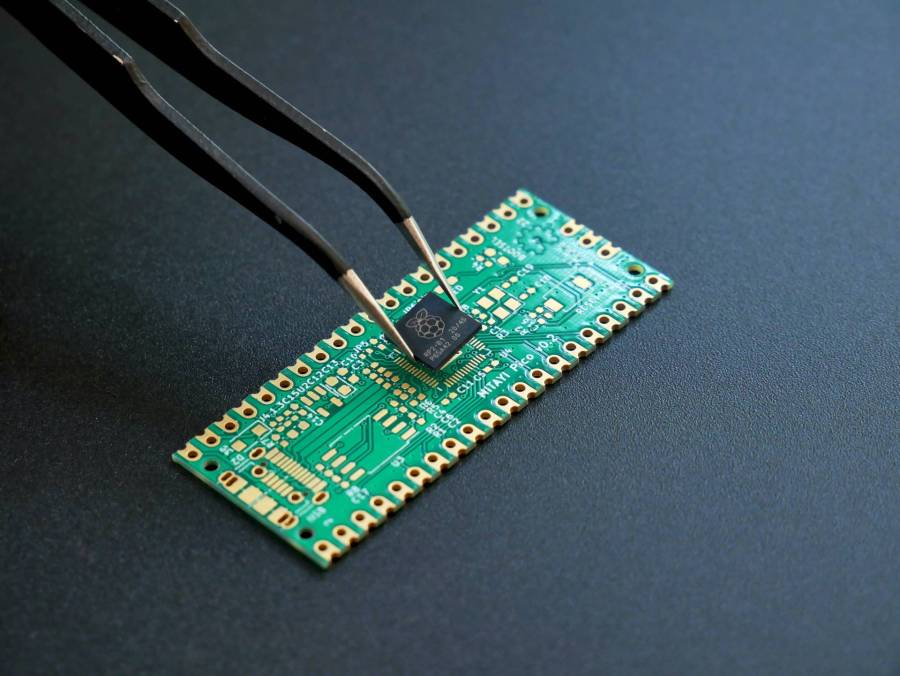

Featured Image Credit: Pexels; Thank you!