This past week produced an intriguing illustration of the black market’s influence on Bitcoin valuation.

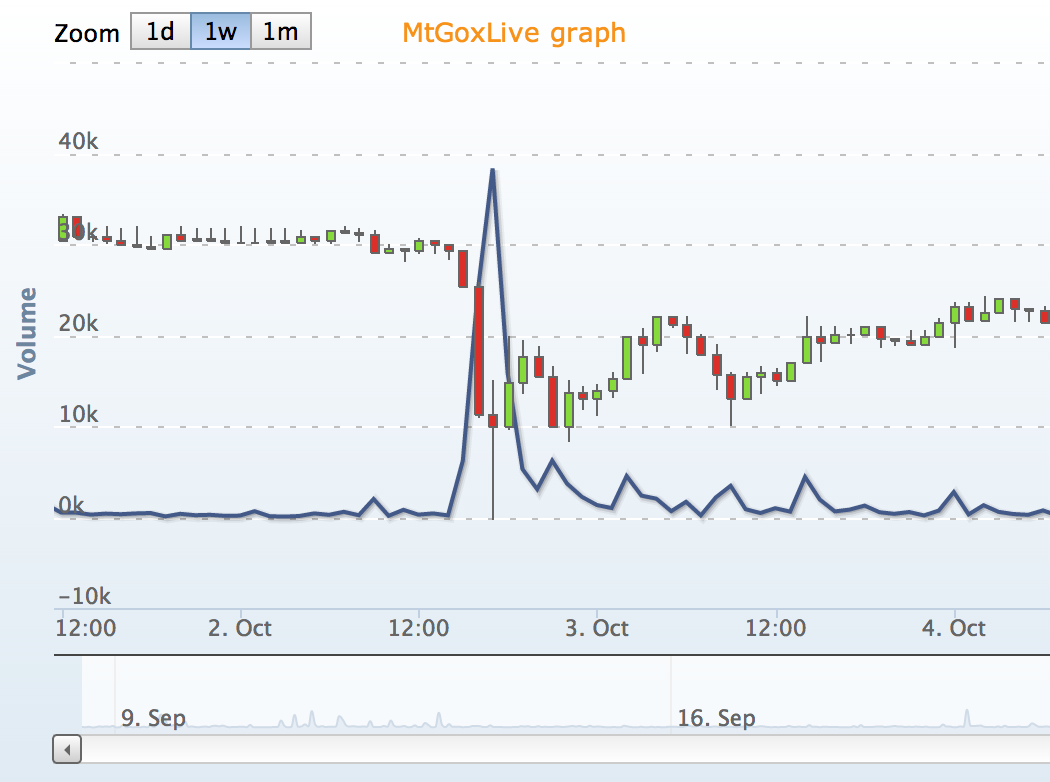

The anonymous crypto-currency’s value dropped suddenly last Wednesday after federal law enforcement agencies shuttered Silk Road, an online black market used to buy and sell illegal drugs with Bitcoins. According to Mt. Gox, one of the most popular Bitcoin exchange services, the value of the virtual currency plunged from $140 to $129 the day Silk Road closed down. Trading volume in Bitcoin simultaneously skyrocketed.

Bitcoin evangelists have long insisted that the currency really has nothing to do with illegal activity, but instead offers users lower fraud risk and increased privacy. But criminals have found that Bitcoin’s unregulated status makes it ideal for money laundering and the buying and selling of illegal goods. This use, or rumors of this use, became so widespread that Thailand made Bitcoin illegal.

After a reporter first investigated Silk Road in 2011, Jeff Garzik, a member of the Bitcoin core development team, shot back that Bitcoin remains on the right side of the law.

“Attempting major illicit transactions with Bitcoin, given existing statistical analysis techniques deployed in the field by law enforcement, is pretty damned dumb,” Garzik told Kotaku.

See also: What’s Bitcoin Worth In The Real World?

Indeed, Garzik’s three-year-old prediction turned out to be true, as Silk Road and its alleged founder, Ross William Ulbricht, discovered the hard way this week. The shutdown came just two months after the U.S. government vowed to turn an eye toward Bitcoin regulation.

Even if Garzik and the rest of the core development team had only the purest of intentions for Bitcoin use, it appears that many users aren’t on the same page. The decline in Bitcoin valuation suggests that a number of users don’t value Bitcoin as highly after the end of Silk Road. There could be several reasons for this.

For instance, if a large fraction of Bitcoin users were criminals, they might no longer have a use for Bitcoin without a black market. On the other hand, Bitcoin quickly made back much of the value it lost in the immediate wake of the Silk Road shutdown, so unless these criminal users quickly migrated to other lesser-known black markets, odds are that this explanation is incomplete at best.

Alternatively, innocent users might have sold off bitcoins because they were concerned that they’ll be suspected of being criminals. Or they might have figured that the move against Silk Road presaged a more general crackdown on Bitcoin.

Finally, Bitcoin might simply have suffered a classic panic sell-off fueled by the unexpected FBI raid and general anxiety over the legality of the currency. In such an atmosphere, some people stampede for the exits, convinced that it’s best to get out while the getting is good.

Most likely, all these explanations played some role in the sudden decline. In any case, the fact that a single event like the Silk Road shutdown could trigger an 8% decline speaks volumes about Bitcoin’s volatility and the depth of legal concerns many of its users appear to hold. Even if it’s not the biggest drop the cryptocurrency has experienced in the past year.

According to Mt. Gox’s charts, Bitcoin still hasn’t fully recovered from its Wednesday decline, although it has risen to close in the range of $135 to $137 for the past several days. Given Bitcoin’s volatility, this in itself isn’t unusual. It’s just the latest dramatic price change in a nascent currency users and lawmakers alike are still trying to understand.

Image courtesy of btckeychain

Revised at 5:41pm PT: This article has been revised throughout to more accurately characterize the likely connections between Bitcoin use and illegal activity.