Back in October, I bought $20 worth of Bitcoin for a ReadWrite article. Since then, I’ve watched my meager 0.119 coins soar in value.

When my stash peaked at $71 this week, I determined to sell out. I settled on buying a gift card from Gyft.com, which handles Bitcoin payments through BitPay. Unfortunately, everyone else must have had the same idea, and my Bitcoin was refunded more than 24 hours later. By then, its value had dropped significantly.

This isn’t meant to disparage BitPay. This week, just about every Bitcoin trader or handler has been crippled by volume overload. As the value of a Bitcoin shot up to $600, then $900, then back down to $500, all within a couple of days, the market has been overloaded with eager buyers and panicked sellers alike.

What’s Going On?

In the last week, Bitcoin’s value has tripled. While there’s no single factor behind the rise, demand in China, as well as publicity generated by the U.S. Senate’s current Bitcoin hearing, certainly helped.

Richard Weston, the DC Bitcoin Users’ Group organizer who sold to me in the first place, says the Senate hearing has turned the DC Bitcoin market upside down. His in-person Bitcoin exchange business has been booming.

See also: I Bought Bitcoin In Person And Here’s What Happened

“There’s no doubt this is a bubble,” he said. “Bitcoin was overbought because of the hoopla around the Senate hearing.”

Weston chided me for trying to sell my bitcoins in a panic. What he’s doing with his stash, and what he’s advising newbies to do, is to save for a rainy day.

Even though Bitcoin has dropped in value from $900 on Monday to the mid $500s on Wednesday, Weston isn’t worried.

“[What just happened] was a healthy drop,” he said. “It’s called consolidation. Bitcoin was overbought, and the market corrected itself.”

Still, the general trend is upwards. Bitcoin’s value stays high because people are still willing to buy at this price. And as Bitcoin millionaires come out of the woodwork more and more frequently, the demand for Bitcoin is growing.

A Currency You Don’t Spend

If you want to know if Bitcoin investments are paying off for people, just take a look at Reddit’s r/bitcoin community. Here, users are bragging about the sometimes-thousands of dollars they’ve made just by saving their bitcoins.

The best investment method for Bitcoin seems to be to simply forget it exists. A Norwegian man who forgot about buying $27 in Bitcoin in 2010 is a millionaire today.

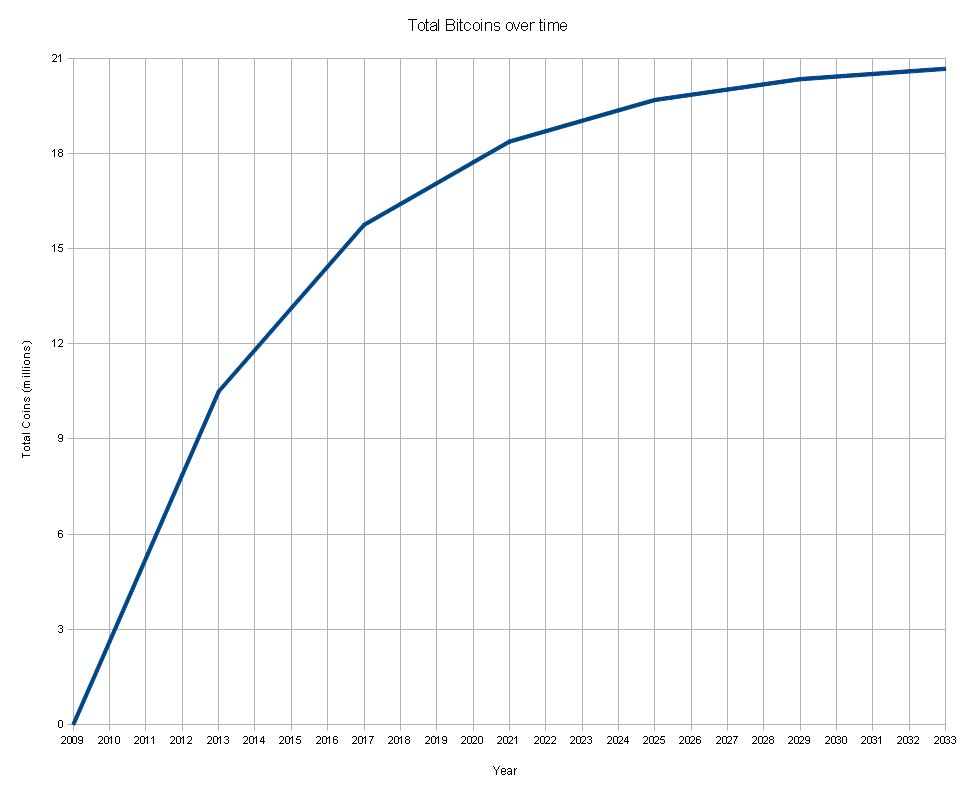

Bitcoin bubbles build and burst, but the simple factor of scarcity is making the price higher all the time. When Bitcoin was invented in 2009, it was worth pennies. Now, the Bitcoin to dollar ratio has all but flipped.

Of course, this is all going according to pseudonymous Bitcoin founder Satoshi Nakamoto’s plan. Only a finite number of Bitcoins can ever be “mined“—21 million. And over time, as computers continue to mine Bitcoins by hashing increasingly complex algorithms, it requires more and more effort and processing power. Basically, the more Bitcoins that are mined, the more difficult mining Bitcoins becomes.

Already, half of the Bitcoins in existence are being saved, not spent, says Nicholas Weaver, a senior staff researcher at the International Computer Science Institute in Berkeley who studies emerging technologies.

From the Winklevoss twins’ multimillion investment to the mysterious Nakamoto’s unspent Bitcoin fortune, it seems that many of the biggest players in Bitcoin aren’t spending a single Satoshi.

“This is indeed one of the fundamental problems of Bitcoin,” said Weaver. “If you believe in Bitcoin, the only rational thing to do is not to spend your Bitcoins, ever. Yet how can you have a currency where the only rational thing to do is not to spend your currency, ever?”

In Weston’s opinion, Bitcoin is less like the dollar and more like gold—an investment asset more than a transactional currency.

“One of the misunderstandings about Bitcoin is that it’s meant to be spent,” he said. “The Chinese have the right idea. They’re stockpiling it the way you’d store value in gold, real estate, equity, or stocks. They see it as another asset class.”

This is the key difference between Bitcoin’s biggest believers and everyone else. The same way people value gold far above its ability to conduct electricity, Bitcoin devotees value Bitcoin more highly than what it can be used to buy today.

“Bitcoin lets you send money anywhere in the world with a very low transaction fee, free of censorship and relatively free of fraud. People can find a way to steal Bitcoin, but they can’t counterfeit it,” Weston said. “Bitcoin definitely has intrinsic value. People who say otherwise don’t understand Bitcoin.”

Photo by fdecomite on Flickr. Graph by BTC by the Numbers.