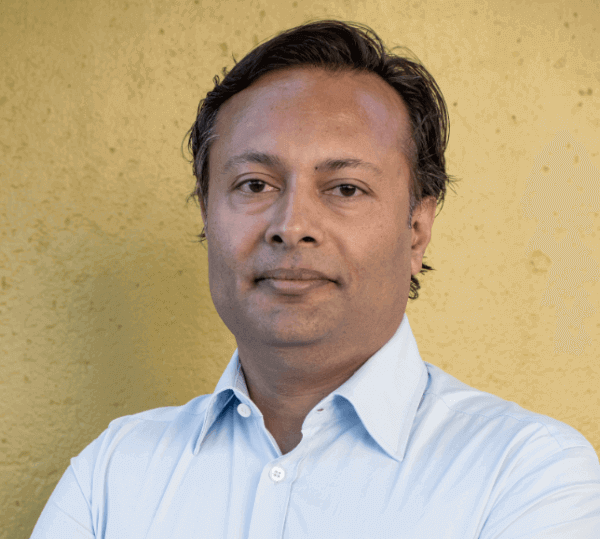

I was having a drink in San Francisco with Sanu Desai, a longtime Silicon Valley investment banker whose track record includes helping Amazon go public back in 1997. We were talking about how attention has been shifting away from business-to-consumer companies and back toward the business-to-business sector, when Desai said something startling: “We’re about to see a trillion-dollar transfer of wealth in Silicon Valley,” he said. “We’re still in the very early days of this.”

What he means is that if you add up the market valuation of the old-guard companies selling to the enterprise — Oracle, SAP, Microsoft, Cisco and so on — you’re looking at about $1 trillion in total. And those companies are about to get hit with a tsunami of competition as smaller, more nimble rivals rush into the market offering solutions that outperform the old guys at a fraction of the price.

Little by little, those upstarts will tear away market share held by the old guard and rob them of their market value. “A huge amount of wealth is going to get transferred over,” Desai said.

A Piece Of The Action

He aims to grab a slice of that wealth transfer by opening a Silicon Valley branch of London-based Torch Partners, a boutique investment bank that Desai says could become a modern-day version of his former employer, Hambrecht & Quist.

Like Hambrecht & Quist, Torch hopes to differentiate itself by forming relationships with promising companies early in their life cycle and serving as an advisor, helping them raise private equity rounds. Recently, Torch and Desai advised Fuzebox, a promising telepresence company, as it raised a $20 million round of venture funding.

In addition to Hambrecht & Quist, Desai’s resume includes posts at Morgan Stanley, JP Morgan Chase — and even a brief stint at Apple.

He said he’s amazed to see so many young companies raising venture funding wtihout bringing on an advisor. “If you sell your house, would you sell it yourself?” he said. “Startup culture is exploding all around the world. But nobody is helping companies raise money. There are more companies raising more money without any help than ever before.”

Desai said Torch can help startups find the right investors, and can negotiate better terms than a company might do on its own. Torch also can advise companies on mergers and acquisitions.

Get Ready For The Enterprise Boom

Enterprise customers have been locked into overpriced, underperforming software and equipment for a decade or more, and the’ve been loath to spend money to change things. But now it seems a huge transformation is about to occur, driven by mobile devices, cloud platforms and the software-as-a-service business model.

Is the same kind of boom that we’ve just seen in business-to-consumer companies now coming for a new generation of business-to-business companies? Desai thinks so. “We’re coming out of the fog,” he said.

Image courtesy of Shutterstock.