What is PayPal? A new update to its mobile apps, set to be unveiled today, had me thinking about that question. If PayPal executes well on the opportunities it’s exploring, it may have many millions of its users rethinking the money-moving service, too.

The brief version is that the old PayPal, born on the Web and raised on e-commerce, is making way for the new PayPal, a service that lets you pay in stores and restaurants as easily as you pay online. Actually, perhaps more easily than you do online.

A Brief History Of PayPal

I opened my PayPal account on June 25, 2000. PayPal actually stores my complete account history, and wading through it was a treasure trove of financial nostalgia.

There was a $17.50 payment to my brother, which earned us both a sign-up bonus. A transfer to my skeptical editor, who was so loathe to embrace online finance that he refused to set up an account and returned the money. Recurring monthly payments to a friend who once hosted my website—a sad reminder that he passed away years ago. eBay auctions, of course, and countless other online stores that earned my custom over the years.

But it was all transactional, either. It seems I’ve never used PayPal in a physical store, a service it has offered for years. There just wasn’t a reason to.

That’s because PayPal solved many problems in e-commerce—chiefly, the notion of handing your credit card over to a no-name store or an individual seller. When PayPal came along, online payments were genuinely broken, because of a lack of consumer trust and the difficulty of accepting payments online. (Remember when Amazon let wary consumers phone in their credit-card number, or mail a check to establish an account balance?)

That was exciting 13 years ago, when PayPal was a startup. Now, as the most important arm of eBay, PayPal is looking for other problems to solve.

Payments Aren’t Broken—So Stop Trying To Fix Them!

Those problems, it turns out, aren’t payments. For years, payment startups have been telling us that our system of payments is “broken,” and that they have the fix. Pay by touch! Face recognition! NFC (whatever that is)!

The truth is that payments aren’t broken. Most consumers are pretty happy with cash or credit and debit cards. And merchants, though they complain about fees, don’t see an alternative that saves them enough time and money. Square, often cited as a payments innovator, succeeded because it rode on top of the existing credit-card infrastructure. (It counts Visa and JP Morgan Chase as investors.)

So let’s set aside the notion that payments—moving money from point A to point B—are somehow a problem in need of fixing.

Paying, however, is sometimes a problem. It’s awkward to hand a credit card to a taxi driver, wait for a receipt, and sign it. It’s frustrating to wait in a restaurant for a waiter to pick up your bill. Coupons and loyalty cards are just annoying.

Hill Ferguson, PayPal’s vice president of global product, recently gave me a tour of the new app in actual PayPal-taking locations in San Francisco. He bought me tea at T-Wea, a tea shop, and I paid him back (with PayPal). He ordered lunch for a colleague at Ironside, a San Francisco restaurant near ReadWrite headquarters, and it was ready within minutes of our arrival.

In short, PayPal’s in-store future is here. And it’s already working.

At Last, PayPal Has An Alibi

The first thing I noticed about PayPal’s new mobile app as Ferguson demonstrated it is that it’s actually decent-looking, with a clean blue-text-on-white-background look that’s eerily similar to iOS 7, the forthcoming version of Apple’s new operating system.

Lest you think “decent looking” is damning with faint praise, PayPal’s old apps were shockingly ugly—so unbecoming that they simply lacked a valid explanation for their homeliness, save that PayPal used to be run by a guy who majored in accounting. (Ferguson’s boss, PayPal CEO David Marcus, seems far more focused on PayPal’s product and users.)

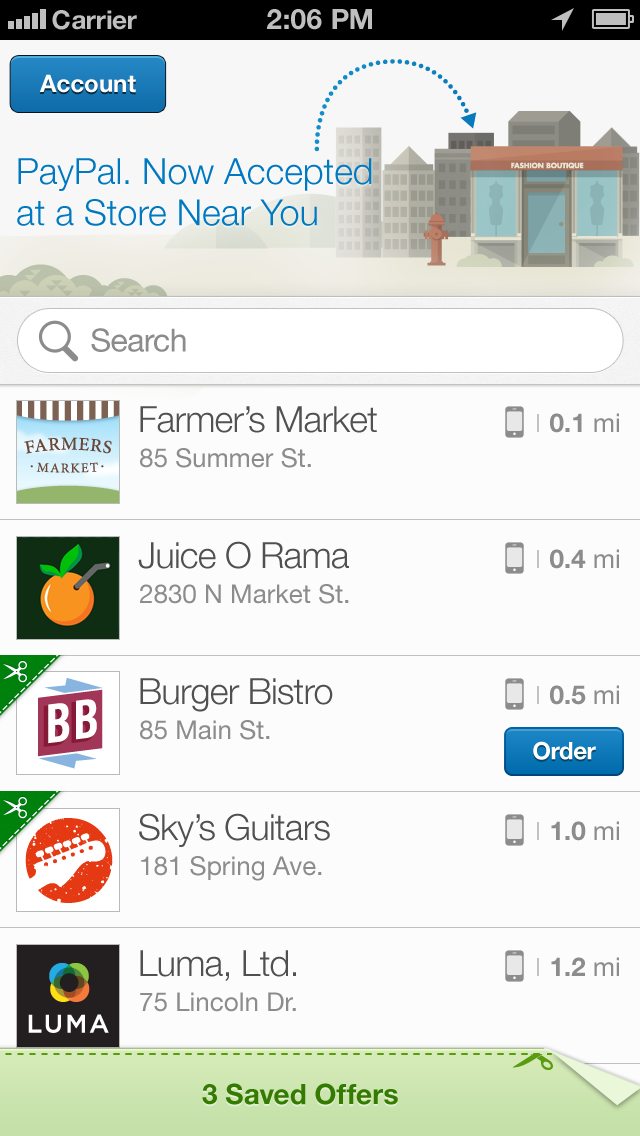

The next thing you notice is that you’re not confronted by a “log in or die” screen demanding your mobile PIN. Instead, PayPal shows nearby businesses that accept the payment service, based on your current location. The point of the app is no longer to complete payment for an eBay auction on the go: It’s to get you to walk into a store. When you get closer to paying, that’s when you log in.

Once you’re in a store you can get ready to pay with a left-to-right arced swipe that’s a signature gesture throughout the app. Ordering ahead for takeout or delivery, checking into a store to pay just by giving them your name and checking your bill at a restaurant all involve the same swipe. That’s a thoughtful consistency missing in PayPal’s earlier mobile efforts.

In every case, the payment, authorized by your touch, happens online, processed by PayPal and billed to your stored balance, bank account, or credit or debit card, depending on how you’ve set up your account. If there’s a special offer or you have a coupon, it’s taken off the total immediately.

Those are all reasons to use the app in the physical world—ones that PayPal certainly hopes are compelling. While PayPal offered some of these services before, they were buried in a “Local” tab of the app and presented confusingly. PayPal, in short, now has an alibi, an excuse, a reason for taking up valuable icon space on your smartphone’s screen.

Paying The Bills

I’m excited about the potential for PayPal to replace the annoying dance with check holders and credit cards that currently takes place at the end of a restaurant meal. But PayPal’s current setup for paying at restaurants isn’t as elegant as other in-store payments. It relies on a kludgy partnership with NCR, which makes restaurant point-of-sale systems. And as a result, suddenly the easy app swipe no longer suffices.

Instead, paying the bill requires your server to print up a special code on the restaurant’s NCR hardware and bring it to you so you can then enter it into your PayPal app. You can’t just give the server your name, as you would at a store—which seems silly, considering that restaurants do this thing called taking reservations, using your name. Why not make your reservation and take care of payment details in one fell swoop? Ah, but that would involve reprogramming restaurant systems, and that’s not as easy as updating an app.

Where PayPal has the most promise, though, is where it essentially works as it did on the Web—as a cloud-based service that takes care of payments behind the scenes, without requiring you to take out a credit card. Restaurant bills aside, that’s the experience it’s now offering. Being able to skip cash-register lines and pick up a Jamba Juice smoothie or a Caesar salad actually saves you time. And that’s worth more than cash. (PayPal handles takeout orders through a partnership with Eat24, which powers a similar function in Yelp’s app.)

More Mobile Frontiers

Where the new PayPal still seems weak is in the emerging world of services apps. That same skip-the-credit-card ease is being powered by other companies. Despite years of effort by PayPal, lesser-known payments companies like Braintree and Stripe seem to have a lock on the affections of app developers like Uber and Postmates. PayPal says it’s improved customer service by lowering the number of accounts it freezes on suspicion of fraud, but that’s only one of the complaints developers have. New, simpler ways to access PayPal as a back-end payments service are still in beta.

At the very least, by having an app that doesn’t look hideous and is reasonably functional, PayPal can communicate to developers that it speaks their language and gets their concerns. PayPal has fixed its mobile app, and handed consumers a reason to give it a fresh look. Now it needs to get PayPal embedded in the rest of the mobile world.

Photos by Kim White