Guest author Derek Brown is a technology executive and analyst who blogs at One Blind Squirrel.

Pinterest is a three-year-old start-up with what is rumored to be no revenue to date. Zero. In fact, by all accounts, it hasn’t even attempted to generate revenue yet. In three years! Hard to fathom in this day and age, isn’t it?

And, yet, some of the sharpest minds in the venture capital community are so confident in Pinterest’s team and business that they recently invested in the company at an eye-popping valuation of $2.5 billion. Yes, billion!

If you were involved in the Internet economy of the late-1990s, as was I, you may be rolling your eyes right about now and muttering to yourself about Pets.com, Kozmo, Webvan, theGlobe.com, govWorks, Boo.com, eToys and all the other so-called-companies that were, for one brief moment in time, valued as if they had discovered the cure to cancer, only to be out of business a few short quarters later. Ahh… the memories.

Assuming that Pinterest’s investors share many of the same recent memories (or, more aptly, nightmares), what could be so compelling about the company and opportunity that would justify their support of such a lofty valuation this time around?

Passion At Scale

In short, I believe it is the economics of passion at scale.

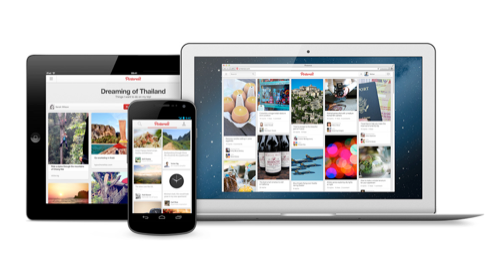

Pinterest, in its own words, is “a tool for collecting and organizing things you love).” (Italics mine.) By pinning images from around the Web to their own board(s) or browsing others’ pinboards for images (which can then be “liked” or “re-pinned” to their own board(s)), users are able to create, manage, share and discover highly personalized image collections that define their passions.

Vintage fashion. Wind surfing. Gourmet cooking. Disneyana. Digital photography. Wedding gowns. Home decor. Camping. Italian design. Rolex watches. Travel planning. Architecture. Mid-century furniture. Urban farming. Knitting. Cross-Fit… The list of people’s passions is literally endless; and, Pinterest helps its users collect, organize and maintain all of them. On their own (or, with the help of the broader community). In granular, image- and/or SKU-specific detail.

Self-identified passionistas on a product-by-product basis — are you kidding? I’m not sure a marketer or merchant could dream of more fertile ground among a set of unknown people, short of seeing a prospective customer standing directly in front of items on a shelf, with cash already in hand. And, I’m not even convinced that would be more compelling on a long-term basis.

What could possibly be better? How about having that level of insight into the interests and intents and aspirations of not hundreds of thousands, but tens of millions, of people per month! According to press reports, Pinterest is already doing just that, hosting roughly 30 million unique monthly visitors who are generating more than 2.5 billion page views, the majority of which are likely coming through little more than domestic word-of-mouth promotion.

Fast forward three years and I think it’s entirely reasonable to assume that Pinterest is successful at growing its user base and traffic flows by 5 times, fueled by existing users continuing to build out their identities, waves of more mainstream domestic users finally catching on and contributions from millions of new pinners (their word, not mine) in overseas markets. That’s a lot of passion under one roof!

Passion Pays

On the business side of the house, passion pays. Extremely well.

Advertising, alone, could generate several hundred million dollars of revenue per year. Let’s say, hypothetically, that Pinterest follows in the footsteps of virtually every sizable media company on the planet, by introducing advertisements of some sort across its pages in the next few years. With marketers across every vertical likely salivating at the prospect of reaching into the company’s massive, impassioned and finely segmentable audience, it seems more than plausible that advertising rates across the company’s site could be at least 50% higher (if not considerably more) than the current industry average. Accordingly, with 12.5 billion page views per month (three years from now) and a site-wide CPM of, say, $4, Pinterest would generate advertising revenue of roughly $50 million per month, or about $600 million per year.

And yet, despite this sum, Pinterests more intriguing revenue opportunity at Pinterest lay in its role as a direct facilitator of online commerce.

Passions, as we all know, cost money — lots of it, over extended periods of time; and, it is money that we are, on some level, actually excited to spend. So, whether it’s a weekend warrior who pins a Burton snowboard, or a hobbyist portrait photographer pinning a Zeiss lens, or a budding interior decorator who pins the perfect accent table on Fab, Pinterest has the potential to become an economic kingmaker when these enthusiasts transition into consumers looking to purchase the goods/services that bring their passions to life.

Projecting Pinterest’s Numbers

To appreciate the financial implications of Pinterest’s role in the transaction cycle, think of the service as a massive affiliate that gets paid for delivering customers to online merchants. If just ~3% of its 150 million+ users (three years from now) decide to indulge in their passions by clicking from a “want-to-have” product image on one of their own Pinterest boards to a relevant online merchant, the company could claim a direct role in driving 4.5 million transactions per month. Assuming an average transaction size of $200 (remember, people are buying their passions, not everyday staples), Pinterest’s users would account for ~$900 million worth of monthly purchases. Were the company to receive a 7% affiliate “take”/lead fee/commission on these sales, it would generate transactional revenue of about $60 million per month, or $720 million per year.

As if annual revenue of $1.3 billion (from just two sources) weren’t enough, the company’s margin profile has the potential to be the envy of most. Based on my 15+ years of experience evaluating a wide variety of online marketplace business models, it wouldn’t surprise me if Pinterest were able to sustain gross margins of 90% or more and adjusted EBITDA margins comfortably in excess of 25% (even while continuing to invest heavily in future growth). At these levels, the company would generate adjusted EBITDA of approximately $325 million per year.

Worth It? Or Not?

So… were Pinterest’s investors ultimately wise to value the company at $2.5 billion? No comment.

Will the company generate any annual revenue, let alone $1.3 billion, and adjusted EBITDA of $325 million in a few short years? I don’t know.

Will Pinterest eventually be worth $5 million or $50 billion? I can’t wait to find out.

Those purposeful vagaries aside, though, I clearly see the underpinnings of a company with tremendous potential and, if I squint just enough, a business that could be the driver of billions of dollars of passion-fueled online commerce each year — and that’s a position that few companies ever even have the chance to dream about.