Intel’s success and a shrinking PC market have seriously hurt the No. 2 chipmaker. Does it have enough fight left to reinvent itself?

The Basics

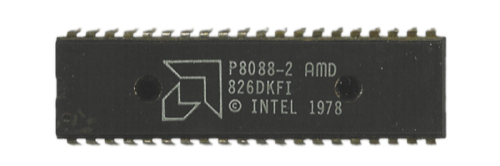

In 1982, Advanced Micro Devices cut a deal with Intel to provide secondary manufacturing services for IBM. Under the terms of the agreement, AMD could manufacture Intel’s 8088 chip, which IBM used for the now-legendary IBM PC. The agreement created a rivalry that would last through more than a decade of court challenges, as AMD continued to manufacture low-priced chips based on Intel’s designs.

In the mid-1990s, AMD began to find its own identity with the K5 processor, a Windows-compatible chip based on in-house designs. The K5’s low price gained it some acceptance from PC manufacturers and hobbyists building budget systems. In 1997, AMD released the much more powerful and successful K6 chip, which offered a substantial performance edge for the money over Intel’s Pentium II. The K6 created major demand in both the budget and gaming sectors, and its price/performance advantage made AMD a solid second option for PC owners. AMD strengthened that reputation at the high end when it merged with graphics processing specialist ATI Technologies in 2006, adding Nvidia to its list of competitors. For much of the early-to-mid 2000s, AMD was the go-to for high-end gaming systems, both custom-built and vendor-sourced.

When it acquired ATI, AMD was on top of the world, with a market cap topping $18 billion. But the realities of the integration softened the joy, the recession of 2008 took a toll, and 2012 has been brutal. Last fall, AMD laid off 12% of its workforce on lower-than-expected numbers. This year, it’s cutting another 15% after losing $137 million in the third quarter. As of November 20, AMD’s stock has tumbled more than 75% in just six months. A Reuters article recently revealed that AMD has enlisted the services of JPMorgan Chase & Co to “explore options” that could include a sale of all or part of the company. Officers have downplayed the significance of the bank’s work, stating that AMD is “not actively pursuing a sale of the company or significant assets at this time.” But they haven’t pulled it off the table, either.

The Problem

AMD has pointed to a number of temporary and very correctable issues that have contributed to its current troubles. For example, a glut of Llano chips on the market is dampening demand for upcoming products. While that certainly doesn’t help, AMD’s real problems are simpler and more intractable:

AMD is a PC company. Intel is winning the PC war And the PC pie is getting smaller.

In its PC CPU space (still the company’s bread and butter), AMD has dropped the ball. Bulldozer was a massive disappointment, Intel has strung together a couple of clear winners with Ivy Bridge and Sandy Bridge, and the performance crown won’t be leaving Santa Clara any time soon.

Could AMD fight its way back to desktop dominance? Maybe, if Intel stumbles and AMD knocks it out of the park – but at what cost? These days, hard drives, graphics processors or other components are more likely to be the performance bottleneck – so the CPU maters less than it used to.

Worse, the PC market is shrinking fast. Just ask Intel, which lost its shirt on miserable ultrabook sales. Tablets are already 22% of non-phone device sales and growing, while laptop and desktop shipments can’t keep up. A losing position in a legacy market market isn’t much to build on.

This is neither a secret nor a surprise. AMD management has seen it coming for some time. It just haven’t reacted fast enough. In AMD’s latest earnings report, CEO Rory Read acknowledged that “It is clear that the trends we knew would re-shape the industry are happening at a much faster pace than we anticipated. As a result, we must accelerate our strategic initiatives to position AMD to take advantage of these shifts and put in place a lower-cost business model. Our restructuring efforts are designed to simplify our product development cycles, reduce our breakeven [sic] point and enable us to fund differentiated product roadmaps and strategic breakaway opportunities.”

In other words, AMD needs to do something new, and fast.

The Prognosis

AMD can’t – and shouldn’t – abandon its CPU business unless it finds a serious buyer, but it will almost certainly focus elsewhere, looking to its embedded products for growth. It looks like the company will try to crack the mobile handset market, as well, but based on the beating TI took before recently calling off the mobile charge, that could be an expensive, low-probability gamble.

As others have pointed out, selling AMD outright would open a very large, well-funded can of worms and could fan the flames of a legal war. Still, discrete pieces of the company’s intellectual property could generate lots of cash.

Can This Company Be Saved?

There’s only one way AMD gets out of this more-or-less intact. If a large enough company with substantial legal resources and a presence in the PC, tablet and smartphone markets wanted to diversify its hardware options, AMD would be a relatively cheap and easy way to do it. Unfortunately, there are only two potential buyers who meet those criteria, so there aren’t a lot of options.

Updates On Previous Deathwatches

Sharp: Sharp has had to turn away applicants from its early retirement program after receiving many more applicants than expected. It will add a $311 million charge this quarter as a result.

To see more ReadWrite DeathWatches, check out the ReadWrite DeathWatch Series, which collects them all, the most recent first.

Chip image courtesy User:ZyMOS.