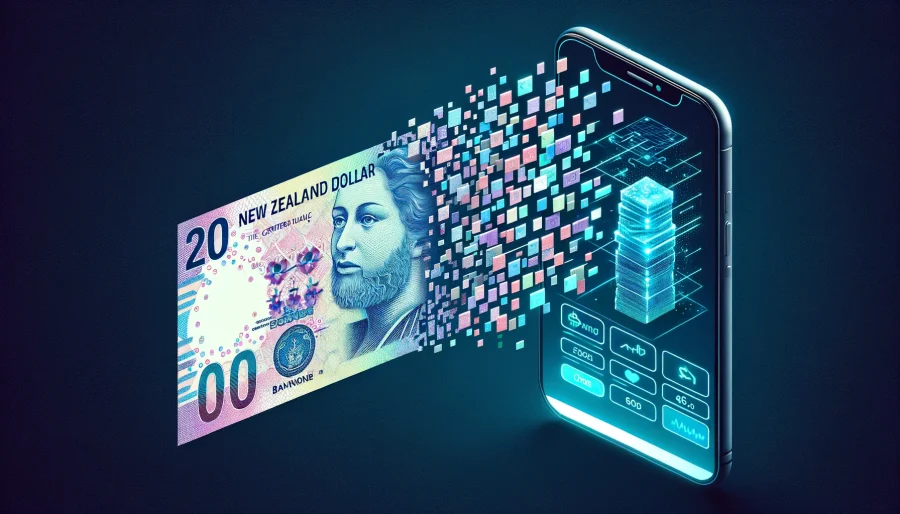

The Reserve Bank of New Zealand (RBNZ) has announced that it is exploring the introduction of a central bank digital currency (CBDC), often referred to as “digital cash.” This move comes as the RBNZ aims to address the challenges posed by innovations in money and payments to New Zealand’s monetary sovereignty.

According to Ian Woolford, the RBNZ’s director of money and cash, the digital cash would coexist with physical cash options and would not require a commercial bank account for usage. Instead, users would only need a digital wallet, payment card, or mobile app. Woolford claimed that the digital cash would enhance privacy, security, and trust for users, and noted that the central bank “will not control or see how you spend your money.” Woolford also explained that it would work offline:

It would also work via Bluetooth, so you could make payments without connecting to internet. This would be useful in an emergency, or when the power is out.

The RBNZ has launched a consultation period, which will last until July 26, 2024, to gather public input on the high-level design of the digital cash. This marks the initial phase of a multi-stage exploration process that is expected to extend until approximately 2030, with ongoing opportunities for public engagement.

The decision to explore a CBDC follows comments made by Adrian Orr, the governor of the Reserve Bank of New Zealand, who has been critical of stablecoins. Orr has described stablecoins as “the biggest misnomers” and “oxymorons,” expressing skepticism about their ability to replace traditional currency and their inherent instability.

The RBNZ’s exploration of a CBDC aligns with a growing global trend, as central banks around the world are investigating the potential benefits and challenges of issuing their own digital currencies. As the financial landscape continues to evolve, the RBNZ’s move to explore a CBDC underscores its commitment to maintaining New Zealand’s monetary sovereignty and ensuring the resilience of its financial system.

What is a CBDC?

A CBDC is a digital form of a traditional currency, issued and backed by the central bank. Unlike cryptocurrencies, which are decentralized and not controlled by any central authority, a CBDC is a centralized digital currency that is fully integrated with the traditional financial system.

The key features of a CBDC include its digital form, issuance and control by the central bank, legal tender status, centralized control, and potential to improve financial inclusion. The primary goals of a CBDC are to modernize the financial system, enhance payment efficiency, improve financial inclusion, and maintain the central bank’s control over monetary policy in the face of challenges posed by new digital payment technologies.

The introduction of a CBDC is being considered or actively worked on by countries including the United Kingdom, China and the European Union.