The OpenStack faithful gathered in Atlanta this week, and their faith is leading to serious action in the form of real-world deployments.

See also: Red Hat May Be Stacking The Deck Against Its Open Stack Rivals

For a long time, the most potent criticism of OpenStack was that it was long on hype and short on production deployments. No more. According to the latest OpenStack survey, there are over 506 OpenStack deployments with 34% running within companies that employ more than 1,000 people.

Intriguingly, unlike the server market, so far enterprises don’t seem to be graduating to Red Hat from Canonical’s Ubuntu. Is this a trend?

The State Of Open Stack In 2014

This year more than 5,000 people showed up to the OpenStack conference, and 1,780 people filled out a survey that drills into how they’re using OpenStack. Many of the respondents (60%) came from companies that employ fewer than 500 people, while a dwindling percentage was derived from users at companies that employ more than 1,000 people, compared to the October 2013 user survey (34%, down from 39%).

This almost certainly reflects an increase in the overall OpenStack ecosystem, and not diminishing interest from larger companies.

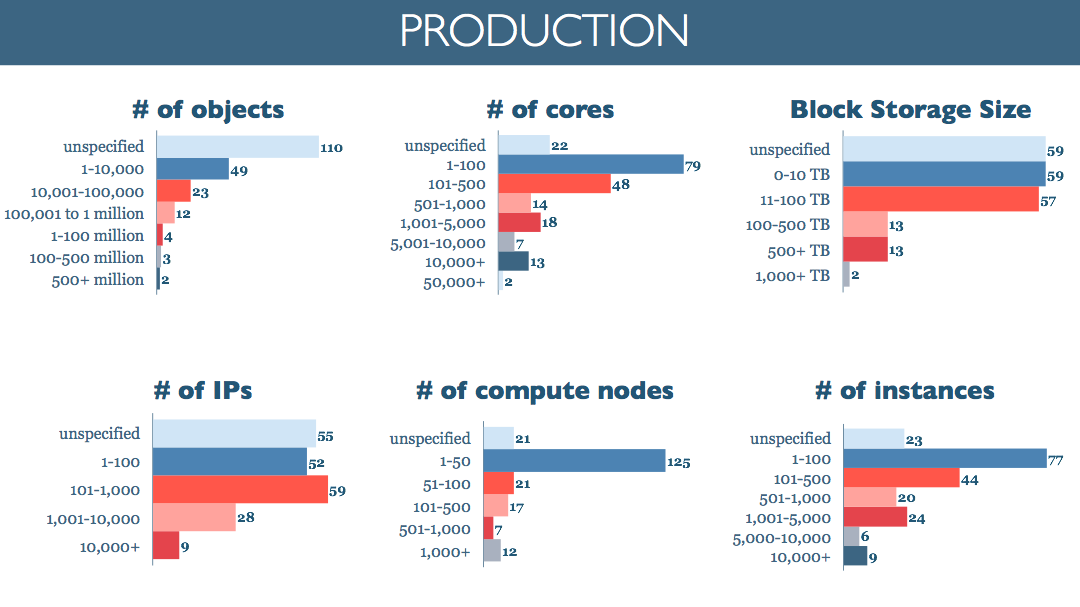

This skew toward smaller companies, however, may help to explain why production deployments also tend to skew relatively small:

One thing is clear: Canonical’s Ubuntu Linux currently dominates the OpenStack cloud.

Is this Ubuntu’s Game To Lose?

The percentage of companies using Ubuntu is actually in decline, though it’s not clear the decline is meaningful. In the October 2013 survey, 55% of those running production deployments were running Ubuntu. Today, that number is 53%, but this gap falls within the survey’s margin of error.

At 55%, Ubuntu’s OpenStack dominance is close to Red Hat’s dominance of the data center, which is 64%, according to IDC.

However, as Neil Levine argues, it may be too soon to draw any conclusions. Levine sits in an interesting position, given that he formerly ran Canonical’s enterprise business and currently is vice president of products at Inktank, which Red Hat announced an agreement to acquire:

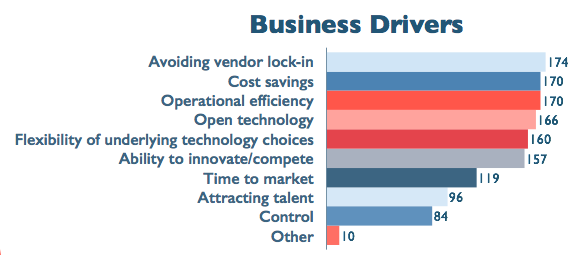

Even so, the driving business reasons for turning to OpenStack plays perfectly to Canonical’s story:

Red Hat Clouds The Ubuntu Picture

Ubuntu’s momentum will also be impacted by Red Hat’s decision to selectively support Red Hat Enterprise Linux (RHEL) on rival OpenStack distributions. Though The Wall Street Journalinitially reported that Red Hat wouldn’t support RHEL customers running on any alternative OpenStack distributions, Red Hat executive Paul Cormier has since clarified the issue, stipulating that “users are free to deploy Red Hat Enterprise Linux with any OpenStack offering, and there is no requirement to use our OpenStack technologies to get a Red Hat Enterprise Linux subscription.”

Well, not exactly.

Cormier goes on to call out its work with competitors that share its ability to deliver an “enterprise-class experience,” given “engineering teams and a quality assurance process that we feel comfortable with.” This suggests Red Hat likely won’t support alternative OpenStack distributions that don’t meet its quality standards.

Ultimately, however, Red Hat is always going to privilege its own distribution given the “tight feature and fix alignment between the Kernel, the hypervisor, and OpenStack services” that Red Hat’s integration provides. This isn’t surprising, though some have seen Red Hat’s end-to-end approach is anti-competitive.

Blocking And Tackling Ubuntu

Red Hat’s approach may not be anti-competitive, but it is anti-competitor. It’s an anti-open source move by Red Hat, but it strikes me as simply a way for Red Hat to increase its competitive differentiation while remaining true to open source.

As much as some may grouse, the reality is that OpenStack has needed a dominant vendor for some time: someone to help drive development in a way that benefits real-world customers, not merely science projects.

All of this means that life in OpenStack Land is suddenly very interesting. Ubuntu leads by a considerable margin in production deployments—but that’s today. But whether it can maintain that lead will depend on its ability to build up an ecosystem to rival Red Hat’s. In the data center, it’s way behind. But in the OpenStack cloud, it’s a much more even playing field, with Canonical recently expanding its partner footprint with Microsoft, IBM and others.

It’s a new market. Canonical hasn’t won anything yet, of course, but this is the most level playing field it’s had in a decade. Game on.

Lead image courtesy of Aaron Hockley on Flickr