Last night we wrote about Forrester’s prediction that online holiday retail sales will grow 8% this year to $44.7 billion. comScore had similar numbers about the growth of online retail – toy web sites grew 9% in October, as did the retail apparel segment. Online personal finance service Mint.com has joined the festive statistics parade, with data analyzing some of the U.S.’s leading retailers.

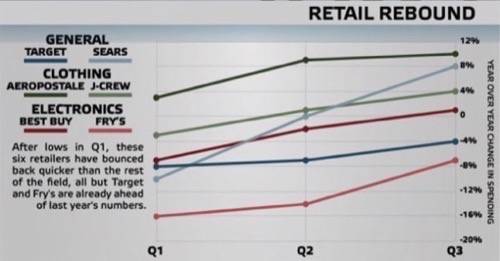

Mint analyzed spending data and compared it to one year ago. The data is for top performers in the third quarter this year, based on “average monthly spend per user versus recession lows.”

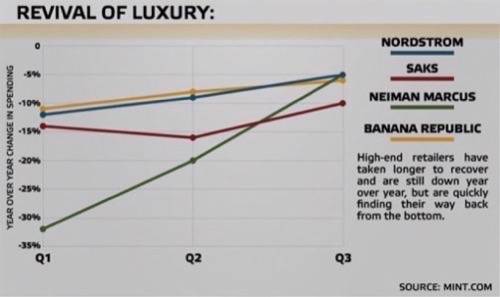

Interestingly, Mint’s data says that Q4 sales will not be as good as last year – which is the opposite of what Forrester predicts. However Mint does say that consumer electronics and clothing are set to rise in Q4.

Check out the charts below and compare them to Forrester and comScore’s data.

The highlights, via Mint.com:

- Aeropostale – the clothing retailer is up 10% year-over-year, having grown consistently quarter over quarter.

- Best Buy – the electronics retailer is up 1% Q3 year-over-year, hit a recession low of -7%.

- Fry’s – while competitor Best Buy’s sales exceed where they were at this point last year, Fry’s remains down -7% year-over-year (though it’s up from a -16% recession low).

- J.Crew – the clothing retailer’s lowest point was -3%, but it has since entirely corrected and even improved sales 4% year-over-year.

- Sears – the department store’s sales are up 8% over this time last year, having dipped to -10%.

- Target – after an initial drop to -8% in Q109, Target has halved that loss and is currently down only -4% year-over-year.

See also: