Online and mobile cash-based payment service Dwolla has launched its first API (application programming interface), which the company calls “Grid.” This tool allows for the integration of Dwolla’s cash-based payments service within other platforms and applications. The operation works somewhat like a Facebook Connect for payments – instead of merchants holding your personal data on their servers, that sensitive information is stored within Dwolla. How much of your data they can access is up to you, the consumer. The benefit here is that with less access to this data, there’s less risk of fraud.

What’s Dwolla?

If you haven’t yet heard of Dwolla, you should know that this company has no plans to be a minor player in the payments space. Its vision for a payments network is based on the idea that consumers should get to dictate how their payments network operates, not third-parties, says CEO and co-founder Ben Milne. And cash, not credit cards, is Dwolla’s inroad to its planned disruption. “Cash,” says Milne, “is a poorly represented market in electronic payments.”

With Dwolla, the payment network is devoid of personal information – the same information that’s the current source of $8.6 billion in credit card fraud annually here in the U.S. If Visa could blow up their current payment model and start over today, would they build a network that forces consumers to expose critical financial data in order to buy a bagel?,” asks Milne, in describing how Dwolla is different.

Like Facebook Connect for Payments

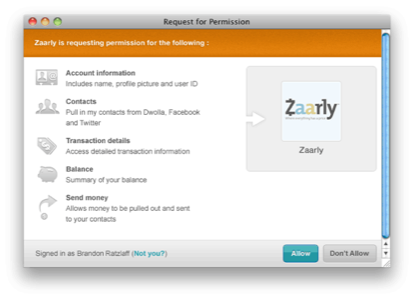

Instead, that personal information is held within Dwolla’s walls. When a third-party chooses to integrate Dwolla into their application, a familiar-looking dialog box appears. Much like how Facebook Connect asks you if an app can access your Profile information or your Friends List, Dwolla’s permission box asks you if the app can access your balance summary or your transaction details, among other things.

For example, if a service like Mint.com was going to use Dwolla, it may only need access to your transaction history. If a marketplace where you buy and sell things integrates Dwolla, it would need permission to send money.

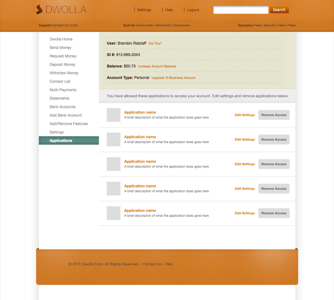

Also like Facebook, consumers can go in later and revoke an app’s access to their personal data.

Disruption: Electronic Cash, Cheaper than PayPal, Works over Facebook & Twitter

To make these cash-based payments possible, Dwolla has partnerships with The Veridian Group, a subsidiary of Veridian Credit Union, in Waterloo, Iowa, and The Members Group (TMG) another financial and credit union service organization owned by Iowa credit unions and their members. Through these organizations’, which hold the funds in Dwolla’s users’ accounts, people can send and receive money from their own bank accounts for a flat 25-cents per transaction, regardless of the transaction amount. That’s lower than PayPal’s 30-cents per transaction fee. Plus, there’s no additional percentage amount per transaction, even though PayPal currently charges an additional 2.9%.

For consumers, these cash-based payments can be shared with social networking friends on sites like Facebook and Twitter. To use Dwolla, you simply register for an account, add your friends from your social networks, then click over to a “Send Money” section on the Dwolla site to send a friend some cash. The friend is alerted to the transaction by way of a direct message on Twitter or Facebook wall post.

Businesses, including those operating online and brick-and-mortar retailers, wanting an alternative to PayPal can also use the service, which is now poised for integration into more applications and platforms through the new Grid API, which allows for this integration into third-party platforms. Because Dwolla uses standard Oauth technology, the number of platforms which could easily integrate its service include everything from mobile apps to banking platforms and more.

Square, Google Wallet & Others Could be Partners, Not Competition

As for other disruptive payment startups and services like Square, the credit card swiping dongle for mobile devices, Zaarly, the hot, new location-based, real-time mobile marketplace, and Google Wallet (Google’s wireless mobile payment service), Dwolla doesn’t see these as competition, but future partners. Dwolla could be integrated into Google’s Wallet app as the “cash” option, for example. It’s already in talks with Zaarly, too, with a deal expected.

And Dwolla has more up its sleeves, too. The company is working on other “unique solutions” alongside the Federal Reserve, which it won’t say much about at this point, only that “they will weigh heavily on user experiences and transactions.” Going forward, Dwolla also has its eye on the burgeoning couponing market, especially the local deals services which these days includes companies like Groupon, Living Social, Foursquare, Facebook Places, Google Offers and others. Says Milne, Dwolla will get more involved in this market over the next year.

In the meantime, the company is focused on spreading the word about Grid as well as FiSync, a service that allows banks to offer Dwolla to their customers directly, without the need for pre-loaded Dwolla accounts held elsewhere.

Anyone interested in trying Dwolla for themselves can do so here. Businesses can learn more here.