As Hewlett-Packard, Dell, Lenovo, and other manufacturers nervously place bets on the PC, server, and tablet markets, they’re playing more and more with Intel’s chips. And that means one thing: Intel stands to win no matter what.

Intel yesterday reported a 25% profit decline on revenue of $12.6 billion, which the company blamed on the general blahs plaguing the PC market. But two numbers stood out: a 6.6% drop in PC microprocessor revenue, and a 7.5% increase in revenue from data centers.

Playing Both Ends — Maybe All Three

What does this mean? At the moment, PC sales are in free fall as consumers rush toward tablets. But as customers snap up mobile devices, tapping into cloud-hosted apps, demand for the servers that power those data centers increases.

Meanwhile, Intel is moving farther into phones, tablets, and networking, where further profits beckon. The bottom line is this: if consumers chase mobile apps, Intel will be there, powering cloud data centers. If they stick to the PC, or shift to new lightweight ultrabooks, Intel stands to benefit thanks to its 80+ percent market share. And if Intel can convince more phone and tablet makers to buy into its chip offerings, it’ll win there, too — though that’s much more of a gamble at the moment.

Intel CFO Stacy Smith told analysts that the company’s second-half outlook looks stronger than expected because of two things: a stronger macroeconomic environment, which would boost overall spending, plus Intel’s presence in PCs, servers, phones and tablets.

To that, Intel chief executive Paul Otellini added a third component: price. “We have a certain spec for ultrabooks, and that is the product that Stacy said is going to be centered at as low as $599 with some [products] to $499,” Otellini said. “If you look at touch-enabled Intel based notebooks that are ultrathin and light using non-Core processors, those prices are going to be down to as low as $200 probably.”

Intel’s Hole Card: Mastery Of Moore’s Law

Otellini, who will retire in May, can fairly be criticized for not investing in tablets and other mobile devices earlier. But from an operational standpoint, Intel is winning. The company continues to leverage its core asset: manufacturing, creating a ripple effect that continues to carry the company into new markets.

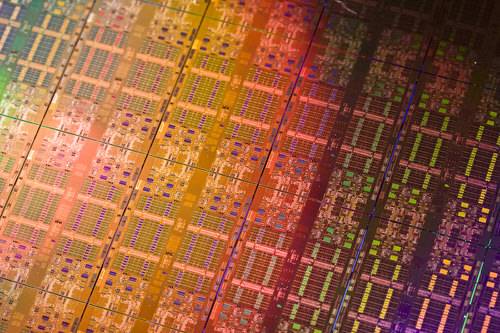

In May, Intel will launch “Haswell,” its next-generation 22-nm chip. Rival AMD is a generation behind, at 32 nm. This forces AMD to out-engineer Intel — again — in terms of chip design to keep up, and AMD arguably hasn’t done that. “This leadership in materials science and manufacturing technology is the foundation on which our future success will be based, arming us with the world’s lowest power and lowest cost transistors,” Otellini said, and he’s right.

Normally, a drop in PC consumption, and thus lower manufacturing demand, would imply a decline in revenues. Not so. Smith said that Intel simply pulled older manufacturing equipment and accelerated a shift toward its next milestone, 14-nm manufacturing, and saved $1 billion in capital costs in the process. It also struck a “foundry” deal with Altera, in which it agreed to manufacture Altera chips on unused Intel equipment. If demand picks up, Intel can simply turn on production lines again.

Mobile and Tablets Still Hold Potential

After fumbling its StrongARM technology in 1997 — the processor architecture which now powers basically every phone on the planet — Intel shocked many by announcing X86 phone designs with Lenovo and other Asian manufacturers in 2012. Is Intel poised to take over the phone market? Absolutely not. But simply demonstrating the capability makes it a company to watch, and its reach may slowly grow over time.

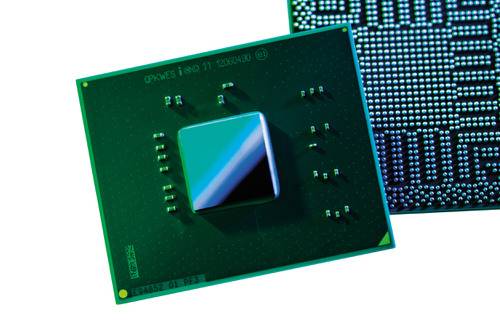

So far, the “Clover Trail” Atom chip Intel debuted last fall for a new generation of convertible Windows tablets has barely left a ripple, hampered as it was by poor computing performance and a general disdain for Windows 8. In phones, however, Intel is combining Clover Trail with an applications processor and an LTE baseband chip into what’s known as a system-on-a-chip, a tidy all-in-one package. First-quarter tablet volume doubled, and Intel expects it to double again — from a little to a little more than a little, one might expect. Still, it’s a start.

Tablets, though, could be Intel’s future. In the second half of the year, Intel plans to launch “Bay Trail,” a quad-core Atom chip. (Intel brands its PC processors using the “Core” name; the non-Core chip Otellini referred to inside the $200 PCs is almost certainly Bay Trail.) If that’s true, a $200 Windows-based tablet almost moves into impulse-buy territory.

What Intel’s irresistible progress in manufacturing technology means is that it almost doesn’t matter whether Clover Trail or Bay Trail are successful. Intel should enable the combination of performance, power, and/or price that should offer Windows tablets some true competition to Android and iOS. Will ARM be able to keep ahead? If we’re talking $200 price points, how much will it matter?

Meanwhile, Intel’s hold on the enterprise market remains secure, as the vast majority of servers are powered by Intel X86 chips. Here, too, ARM chips have declared war, claiming that their low power offers a more cost-effective solution to Intel’s power-hungry Xeon chips. Intel has deployed “Centeron,” an optimized Atom chip for servers, in response. And software-defined networking, which steals some of the intelligence from a network router or switch and puts it inside a server, benefits Intel, too.

What Intel does best, though, is double down and double again, using manufacturing to make up for any shortfalls in design that its competition might otherwise exploit. It might not be the most elegant solution, but so far it’s proving brutally effective.

Image source: Intel