PayPal is recognized as the dominant player in the online payments sector, but upstart WePay is attempting to beat PayPal on two key fronts that make a big difference to small businesses.

WePay is counting on ease-of-use and lower costs to draw the interest of smaller merchants who may be strapped for cash and Web expertise.

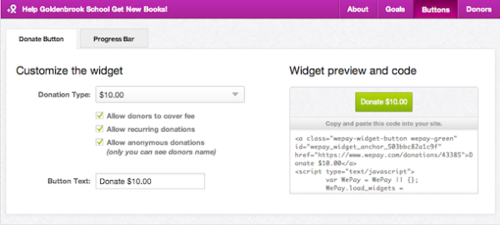

Part one of the new strategy is the launch of embeddable payment buttons for retailers’ websites. The code for the buttons is generated by WePay after the retailer enters all the pertinent information about the product to be sold. The WePay service then generates an embed code that can then be cut and pasted directly into the merchant’s website.

Simplicity is what WePay is going for here, according to COO and co-founder Rich Aberman. “If you can embed YouTube videos, you can embed these buttons,” Aberman quipped.

PayPal, for instance, offers a similar service with its Buy Now and Donate buttons, but the instruction manual for incorporating these tools and other PayPal services into a website is 464 pages long – 92 pages of which cover just the Buy Now and Donate button steps.

Don’t Leave Me!

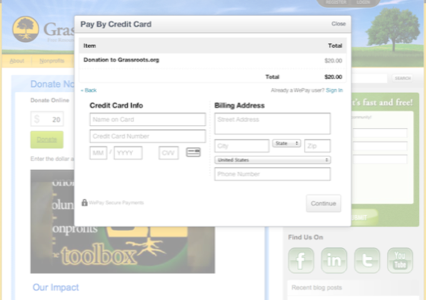

Another key difference – according to Aberman – is that PayPal redirects ecommerce customers to the PayPal site to complete the transaction before returning them to the merchant’s site.

WePay’s system keeps the customer right on the merchant’s site, using a JavaScript modal popup window that overlays the screen to complete the transaction. The payment form within the popup is contained in an iframe, which means PCI security that’s required for online transactions will be present as well.

The WePay code will also enable “add-to-cart” and “shopping cart” functionality within the on-site pop-up, so users won’t have to purchase individual items one at a time, as some early payment systems forced buyers to do.

Keeping customers on the merchant’s site is an important feature in Aberman’s view. “You don’t want them to leave your site. It looks unprofessional, and you run the risk of abandonment [of shopping carts],” he said.

WePay’s 1% Solution

PayPal does this redirect not because it isn’t technically incapable of creating an easier-to-use system, Aberman believes, but because the redirect is an important part of its revenue model.

PayPal, Aberman explained, makes profit on the arbitrage between what it charges merchants for every transaction (currently 2.9% plus $0.30) and what it costs for PayPal to debit money from PayPal user’s bank accounts – which is cheaper than paying credit card interchange rates.

Merchants who use PayPal will pay the 2.9%-plus fee no matter how the customer pays. But in the redirect screen, PayPal can encourage online buyers to sign up for a PayPal account. Once signed on, PayPal users are encouraged to connect their bank accounts to PayPal for direct transactions. If the customer uses the bank account, PayPal’s transaction expense is lower, and it pockets the difference.

WePay’s other piece of ammo against PayPal announced today: variable pricing for transactions, based on how the customer pays. Merchant fees for credit-card transactions will match PayPal’s fees, but if a WePay customer uses their bank account to pay, the merchant fee drops to 1% plus $0.30.

Aberman hopes these features will make WePay compelling for small businesses who need online payments but don’t have the technical expertise to manage a complicated system or are willing to pay more. Thus far, that’s a sector of the market that PayPal has not given much attention, and WePay’s new tools may make that glaringly apparent.

Lead image courtesy of Shutterstock.