Gartner has finally come out and said it: The PC market is dying.

Except it hasn’t said that, quite. But it is, and saying so is really important.

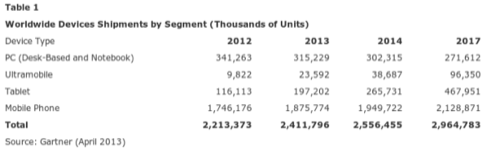

The market-research firm predicts a 7.6% decline in PC sales this year, to 315 million units (including desktops and notebooks) from the roughly 341 million PCs sold in 2012. The real knife in the PC’s heart, though, is that Gartner is now finally willing to predict a long-term decline: 302 million PCs in 2014, falling to 272 million in 2017, approaching the sales levels of 2006 and 2007.

“While there will be some individuals who retain both a personal PC and a tablet, especially those who use either or both for work and play, most will be satisfied with the experience they get from a tablet as their main computing device,” said Carolina Milanesi, research vice president at Gartner, in a statement. “As consumers shift their time away from their PC to tablets and smartphones, they will no longer see their PC as a device that they need to replace on a regular basis.”

Gartner predicted that tablet sales would outpace the PC market sometime between 2014 and and 2017. By then, the firm predicted, manufacturers will sell 468 million tablets, almost double that of the PC market. Phone sales will top 2 billion units.

What Gartner Can’t Say, And Why

Gartner, however, can’t bring itself to say the PC market is shrinking toward irrelevance. Instead, it describes the PC market as “transitional,” in much the same way companies firing large swathes of their workforces insist that employees have been “downsized.” If Gartner was a brokerage firm, its analyst would have placed a “hold” rating on the PC market, with all the wishy-washy implications that word connotes.

“Transitional” is one of those wussy words that says nothing. Here it’s designed primarily to protect the lucrative relationship that Gartner has with its clients. If Gartner declares an industry dead, why should a company like Dell spend thousands of dollars a pop for a report that says so?

“An analyst cannot issue a sell rating because he doesn’t want to lose access,” former securities analyst Tom Larsen told Bloomberg in 2007. Exactly.

To Gartner’s credit, the company began hedging its bets way back into 2010, when the company noted five “disruptive forces” challenging the PC industry, which I’ve condensed to three below:

- Stale “mature markets” like the United States;

- Thin clients;

- A shift in consumer purchasing habits to tablets and other mobile devices that would displace PC sales and incline companies and individuals to keep PCs longer.

Only that last point appears prescient today — and only if you forget that Gartner issued its report in Nov. 2010, seven months after Apple launched the iPad.

Why Gartner’s Hedging Matters

On balance, then, Gartner’s report is nothing more than a reactive sell-side Wall Street analyst which issues a “sell” recommendation after a company has already issued bad news that’s tanked its stock. The PC industry is dying, so let’s move on.

But we actually need a company like Gartner to declare the PC dead — or at least to release data that supports that view, as it’s just done, because companies across all industries use reports from Gartner, IDC, and others to justify their investments.

In order to develop a new PC version of TurboTax, for example, Intuit must demonstrate that there’s a market for it. Gartner’s report indicates that Intuit and other PC developers should consider abandoning the PC in favor of either a Web service or dedicated applications for various mobile platforms, at least if they want to address a market that’s growing instead of shrinking.

We’ve known since 2010 that mobile devices would play an ever increasing role in our lives. But it’s become increasingly clear that the cycle may be accelerating.

Over at his blog Tech-Thoughts, analyst Sameer Singh noted recently that developers are already picking up on this:

[T]he growth of Windows 8 apps has noticeably slowed in Q1 2013. According to the data, the Windows Store is expected to top 50,000 apps by the end of March, but MoM [month-over-month] growth has slowed to just 10-15%.If the trend continues, the reasons for buying a new PC also decline. Microsoft has begun paying small developers a pittance — $100 per app — to develop for the Windows 8 platform. But that’s barely going to pay for a round of beer and appetizers at the end of the day.

“Microsoft’s promotion is primarily aimed at low-end publishers,” Singh wrote. “Their prime concern at the moment isn’t app quality, but quantity. Unless the app growth on the Windows Store remains strong, Microsoft has very little chance of attracting many major developers to the platform.”

Gartner’s data would indicate that Microsoft faces long odds there. Even if Gartner’s too scared to say it.

Image via Flickr/Qfamily