Big companies talk about “operating like a startup,” but few actually do. Hamstrung by bureaucracy and organizational friction, the Fortune 500 make lots of money but generally play it safe with technology, buying from the same incumbent vendors they’ve always used.

Or do they?

I wanted to dig into the technology choices the world’s biggest companies use, and see how they compare to the technologies our leading startups use, as per Leo Polovets’ findings. The TL;DR? Bigger is definitely not better when it comes to technology.

Discovering What The Fortune 500 Buys

There is no easy way to discern the various technologies a large corporation like Chevron might be using. After all, the bigger the corporation, the more glacial its technology approval processes are likely to be as the company seeks to retain control of the flow of technology into and out of the company.

Within such bastions of inertia, shadow IT—that is, technology deployed without the knowledge, much less approval, of the IT department—reigns. As I’ve written, shadow IT is at least 10 times as big as we assume. Skyhigh Networks, which helps companies root out and track shadow IT, found companies that assume they have ~90 systems actually have over 1,000.

See also: Shadow IT: Far Bigger, Less Manageable And More Important Than You Think

In other words, no matter what an enterprise reports in terms of technology adoption, the number is almost certainly way off. About the only thing the CIO will know for sure is how much money she pours into mega-vendors like Oracle and HP each year.

Jobs As A Proxy For Technology Adoption

One way to figure out which technologies a company uses is to analyze their job postings. While imperfect for all the reasons stated above, jobs reveal significant interest in a technology, evincing more than a passing phase by a random department buried in the bowels of the corporation.

So who is the Fortune 500 hiring?

See also: How To Code Like A Startup

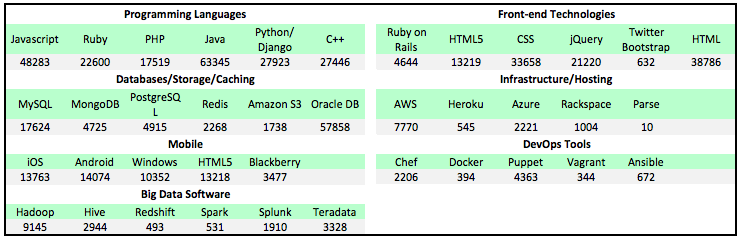

Using Polovets’ list of hot startup technologies, and punching the top five technologies into a search of all Fortune 500 job postings, along with a sixth column (where applicable) for a highly popular enterprise technology as comparison, we get the following:

Not surprisingly, enterprises use proportionately less of the hottest startup technology than those startups do.

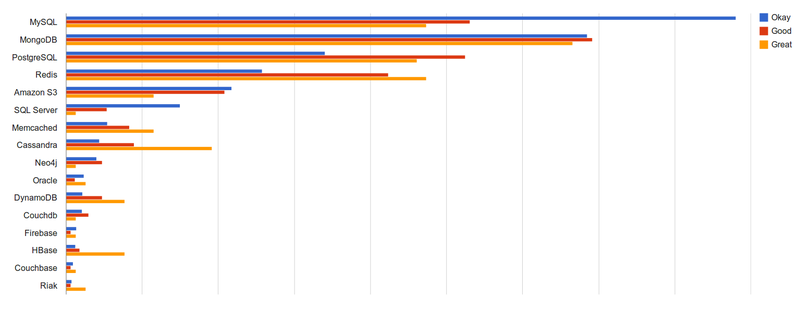

Take, for example, databases. Polovets’ analysis of AngelList data shows huge adoption of MySQL and virtually none for Oracle. While MySQL has a respectable showing in Fortune 500 jobs data, its presence is a fraction of Oracle’s.

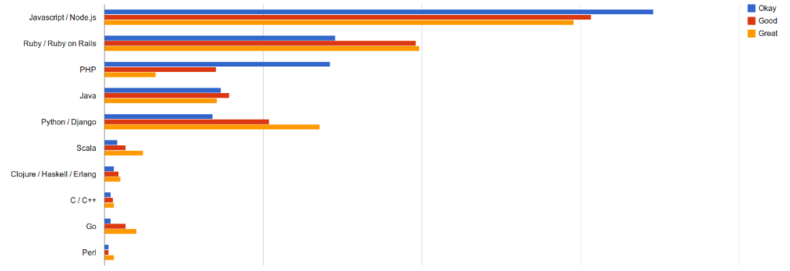

Or take programming languages:

Both enterprises and startups converge on Java (perhaps because of startups’ use of Android?), but they’re worlds apart on Javascript and C/C++.

Assuming startup technology is a leading indicator of tomorrow’s enterprise adoption, what should the Fortune 500 be doing?

Embrace The Shadow

Cisco and HP are among the Fortune 500 that have figured out ways to track adoption of new technologies and embrace them. According to the Wall Street Journal, these and other companies have turned to tools like the aforementioned Skyhigh Networks to track shadow IT.

But rather than block it, they’re looking to embrace it.

As Rebecca Jacoby, CIO of Cisco Systems, puts it, “Some organizations use [tools] so they can stop people from doing things, but we use it to help shape our portfolios.”

While it’s likely easier to track services like Amazon Web Services than, say, adoption of Elasticsearch, savvy enterprises will figure out where their technology portfolios are heading by tapping into the technology their innovators are using, and embracing it.

Lead image by Peter Rivera