The ReadWrite DeathWatch is known for serving up plenty of doom, gloom and grumpiness. But for the Holiday Season, we’re taking a slightly different tack – highlighting companies and technologies that Cheated Death. Companies that might have died, but didn’t.

At the plate this week is ARM Holdings, a company that was never going to go out of business, but very well might have settled for a comfortable position in a single market. Instead, it built on the low-power processing that gave it dominion over all things mobile, and now it’s poised to attack Intel on the chip giant’s own turf.

Where ARM Was

From its founding in 1990, Advanced RISC Machines (later changed to ARM Holdings) was a different kind of processor company. Unlike fellow chip designers IBM and Intel, ARM didn’t actually manufacture or sell the chips it created. Instead, like (pre-Nexus) Google and (pre-Surface, pre-XBox) Microsoft, ARM licensed its designs and its relationships with foundries to semiconductor companies. It even

Where ARM Is Now

ARM technology powers more than 90% of cell phones and 80% of digital cameras. It has a less-dominant but still substantial position in embedded devices, such as toasters, TVs, pacemakers and everything else in the Internet Of Things.

And then there are the tablets. The iPad uses an ARM chip. So do the Samsung Galaxy Tab, the Kindle Fire and the Google Nexus. Even Microsoft hedged its bets with the Surface RT, the lower-cost, lower-power sibling to the Intel-based Surface Pro. Theres a war going on, and ARM is selling everyone guns. If a device doesn’t have a keyboard, there’s probably an ARM design inside.

New Platforms

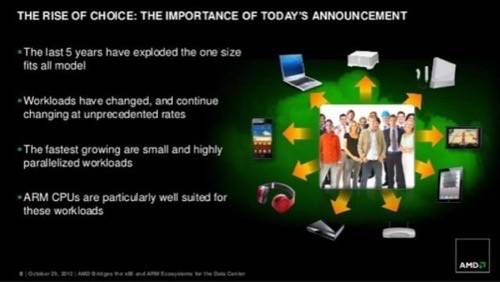

It’s good to be king, but where do you go once you’ve cornered a market? You find another market. Instead of resting on its laurels and waiting for its lead to erode, ARM has spent the last year recruiting allies that bring the fight to Intel’s doorstep.

While the Surface RT got less-than-glowing reviews, Microsoft’s tentative support could eventually lead to more head-to-head competition for Windows devices.

There’s also been talk of a shift toward ARM-based Macs, though you shouldn’t hold your breath. Consumer Macs and Windows PCs are both on the long-term horizon, particularly in the ultraportable market, but power-gulping Intel chips still outperform ARM by a wide margin, and performance is still important for many computing applications. Surprisingly, then, the far more likely near-term expansion for ARM is in the datacenter.

March Of The Wimps

According to a Gartner report, energy accounts for 12% of all datacenter expenditures, and that percentage is growing. Huge arrays of low-power, cooler-running chips are a natural fit, and ARM’s minions are rushing to own the microserver market. Samsung has licensed ARM’s 64-bit server chip designs for a 2014 release, and struggling AMD is pinning much of its recovery hopes to ARM-based Opteron chips the same year.

Can ARM Stay On Top?

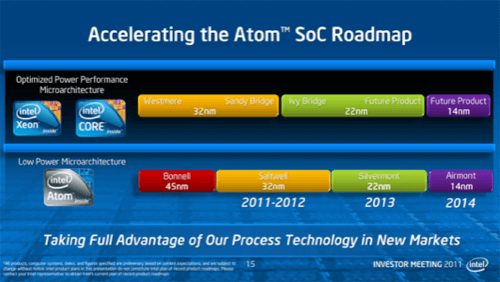

Intel sees the opportunity in mobile and embedded devices, and it haven’t conceded anything. It continues to push its low-voltage Atom processors toward those markets, and its 14nm Airmont chip (also scheduled for a 2014 launch) could be very competitive. Intel also claims to be focused on the microserver market, though that may be causing some internal conflict.

One way or another, ARM will likely lose at least some of its mobile and tablet market share to Intel. The question is where. An Apple move on the iPad or iPhone would be surprising, as would a Samsung defection on anything running Android. Intel’s immediate fortunes in the space are probably tied to Microsoft, as always.

Meanwhile, any losses ARM suffers to Intel in its core markets should be more than offset by the overall rising tide and ARM’s potential to attack Intel’s core strengths.

To see more ReadWrite DeathWatches, check out the ReadWrite DeathWatch Series, which collects them all, the most recent first.