For any kind of provider of network service, every five years or so, the infrastructure procurement problem becomes a long-term guessing game. Where will we be in six years’ time? And can we afford today the bandwidth that we’ll need in six years, because it takes time to build out and deploy this infrastructure, as well as recoup the costs?

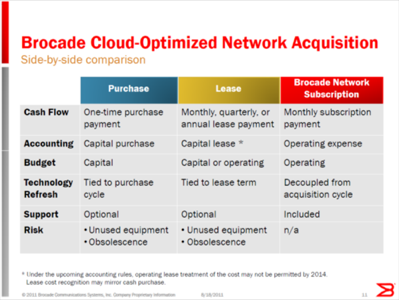

This is where Brocade Networks – for years the up-and-comer in the enterprise switch and router market – aims to differentiate itself. Today the company is announcing an alternative revenue model for providers seeking to build bandwidth for their own services. Rather than make them procure enough infrastructure to hold them for the next six years, Brocade will begin offering a subscription model that it calls “cloud-optimized.” With this alternate model, customers can pay for the infrastructure they need on a pay-as-you-go system, by the month.

“This is a new way to acquire cloud-optimized Brocade network infrastructure,” the company’s senior marketing solutions manager Robert Grasby tells RWW. “We’re providing an open-ended acquisitions and network support model. We’re giving customers a way to acquire network capacity, network infrastructure outside of the traditional buying cycle, with operating dollars as opposed to capex dollars. As a result, we’re better aligning that network capacity with the changing business needs, and we’re doing so with minimal risk to our customers.”

The infrastructure acquisition strategy for businesses today, Grasby believes, is sloppy. “When you buy or lease network infrastructure, you’re committed to that. You’ve made a time commitment if you’re leasing it; if you purchased it, you’ve got a capital cycle, and you’re committed to that infrastructure through that cycle. When you go to acquire a network, you’re facing a capital expense, whether it’s a purchase or a lease. The changes in the accounting rules will force leases to be reflected on a company’s balance sheet.”

We definitely recognize the challenge. Whether you’re a CFO, a CEO, or a CIO, there is a push always to align your cost structure with your revenue structure and your demand. The key message to a CFO here is that we’re giving them a way to align capacity with demand.

The rules changes Grasby is referring to affect every business, everywhere in the nation. Proposed last year by the Federal Accounting Standards Board (FASB) and set for implementation in stages between next year and 2014, the way operating leases are treated and recorded will change drastically. What matters most in this instance is that under-utilized capacity can no longer be sloughed off. Whatever a business leases, whether it be real estate or network infrastructure, must be fully capitalized as though it were being fully utilized.

As a report from real estate consultant Collier’s International puts it, “The legislation will result in a substantial increase in assets and liabilities on corporate balance sheets. This will likely result in material impacts to management effectiveness ratios. Time will tell as to whether the result will materially impact financial covenants, credit ratings, capital access, and ultimately market capitalization for public companies.”

For many businesses, leases will have to be treated like cash purchases. Brocade is hoping that a mass exodus from leases in general could be the rising tide it needs to break out in the infrastructure market, and a way to finally pull toward par in the networking market against Cisco. Certainly its $3 billion acquisition of high-end switch manufacturer Foundry Networks in July 2008 was not the breakout moment Brocade had hoped it would be.

As businesses shift their procurement strategies to a more dynamic model (insert the word “agility” here if you must), the individuals responsible for maintaining those strategies within organizations may shift as well. If businesses were to sign on to Brocade’s plan (or to the competitors that will likely follow it), infrastructure would be categorized not as an asset but as a utility – and as an operating expense rather than a capital expense. As such, it may fall under the purview of the chief operating officer rather than the chief financial officer.

Which could mean a whole new playing field for Brocade, one which could very well be more level.

(Image courtesy Brocade)

“We definitely recognize the challenge. Whether you’re a CFO, a CEO, or a CIO, there is a push always to align your cost structure with your revenue structure and your demand. The key message to a CFO here is that we’re giving them a way to align capacity with demand. So you’re tying costs directly to revenue. That method resonates with the CFO… In terms of the operational aspects, the benefits of aligning costs with revenue far exceeds the operational changes required to facilitate those.”

Grasby tells us a story of one service provider customer in the EMEA region whose capital budget was 500% over-subscribed. For such customers, a Brocade Network Subscription plan could very well be their entire budget slashing program. Again, the model is pay-as-you-go, by the month, and Brocade is partnering with accounting firms to ensure that subscriptions may be claimed as operating expenses. “We’ve purposefully avoided the term ‘commitment,'” he adds, “to make sure that customers can truly treat this as an operating expense.

“We’ve seen in the past years in the software space where [vendors] are moving toward a pay-as-you-go model,” says Grasby. “Brocade is innovating in the networking space as the first vendor to offer this type of approach. Customers have been asking for this from our competitors for years, and it’s fallen on deaf ears… It provides [customers] with capital flexibility, allowing them to prioritize their capital investment and shift it to areas that generate higher value to the corporation near-term, as opposed to tying it up in the network.”