While the pervasive innovation into connected cars has driven a frenzy in development, the “connected” portion of the vehicle is only as good as the network it is running on. This potentially creates risk points where dead spots in connectivity pose an issue, especially as many connectivity solutions leverage the user’s cell phone which is connected to a single carrier. Are there ways around this issue?

Remember those times you reached for your phone and tried to do something, only to realize that you had no service? That frustration is only amplified when you need it in your car. For those who have ever taken a road trip using your phone as your GPS — especially across rural areas or off the major highways — you may have run into a situation where your cellular network connectivity went through a dead spot in coverage, and as a result, the map wouldn’t load.

See also: Connected cars driving consolidation in the chip sector

Or perhaps a child in the vehicle is streaming a video, and screaming tears fill the car because of a disruption to the stream as the carrier’s signal is lost. These situations are inconvenient and aggravating, but imagine the helplessness of being in the same predicament during a real emergency such as a breakdown or crash.

With connected car solutions proliferating across the market, many of these solutions either pair with your mobile phone, or have their own connectivity. In both cases, these are still locked into a single carrier. As a result, the solutions become ineffective when out of range of the carrier’s network.

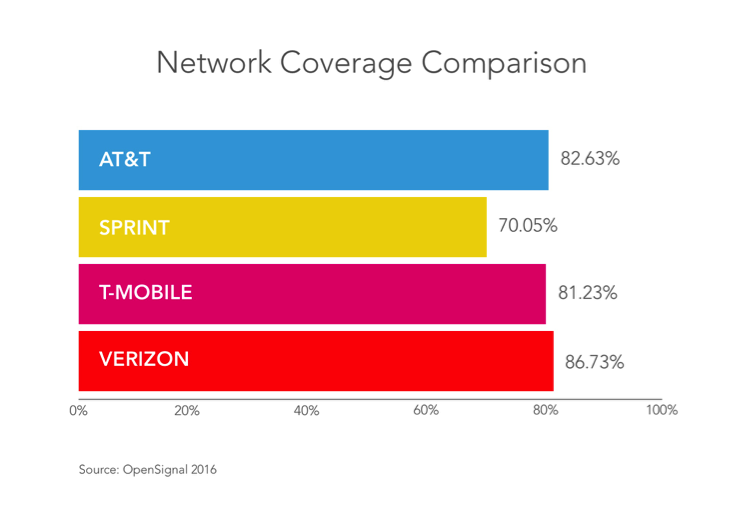

Opensignal has surveyed the US top carriers and found that every single one was below 87% national coverage, with one falling as low as 70%. The same survey also suggests that the carriers seem to be more focused on download speeds instead of coverage.

As the EU begins to launch eCall in 2018, the regulation will require cars to connect to emergency services automatically in the event of an accident. Imagine if the car was unable to do so due to a dead spot in service coverage?

Consortium formations like IoT World Alliance (Cisco Jasper) and RACO Wireless (acquired by KORE) try to address global coverage, however as each geographic area is only covered by one carrier, the problem still arises with dead spots.

Mobile Virtual Network Operators (MVNO) have also popped up in the IoT connectivity space. MVNO’s do not own towers or the network. Instead, they buy blocks of bandwidth from different carriers. However, as these providers can buy bandwidth from any provider, the connectivity coverage may change over time. As a result there may be inconsistencies in service as the underlying carrier changes.

Orange Business Services, a global communications service provider, has agreements with multiple carriers in nearly every country in the world. What’s interesting is that the Orange IoT connectivity solution automatically connects to the strongest cell tower from its partners. This essentially provides a commercially viable solution to dramatically reduce the probability of dead spots in coverage.

“Much of the innovation happening around cars right now revolves around the theme ‘connectivity.’ Connected vehicles offer a host of opportunities to create a new transport experience for customers, from reducing maintenance costs and the risk of accidents to increasing passenger safety,” said Julien Masson, Head of Connected Car at Orange Business Services.

As connected cars and the world of IoT grows, the industry needs to consider reliability and redundancy in service, especially if it is touted as a security or emergency service. Having connectivity to stream data for your passengers is great, however, in the end, the solution is only as good as the connection it runs on, especially when it could be the difference between life and death.

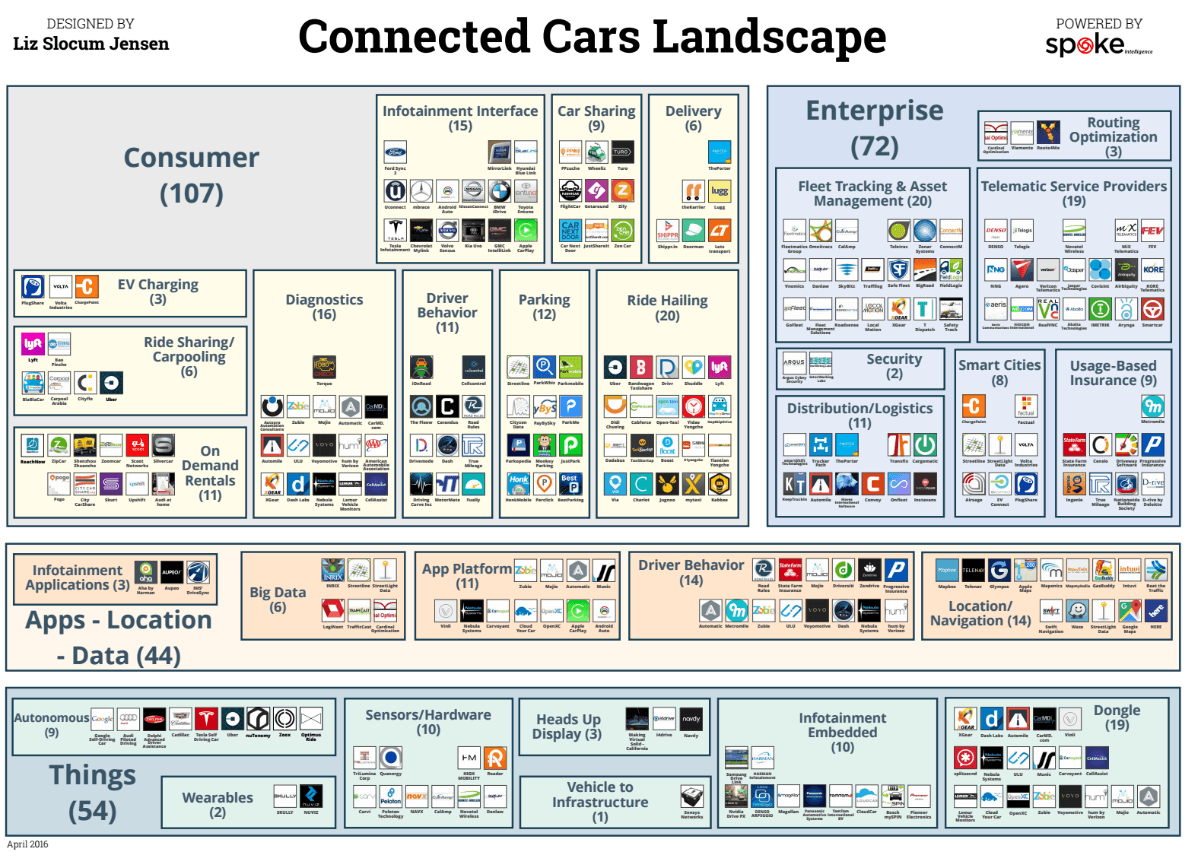

This article is part of our connected cars series. You can download a high-resolution version of the landscape featuring 250 companies here.