When an autonomous vehicle causes an accident – who is liable for the fault? Given the passengers are not in control of the vehicle, it would make sense for the autonomous system designer to be holding the liability. At a high-level, autonomous vehicles conceptually disrupt traditional insurance.

Tesla looking to bundle insurance with new vehicle purchases seems to suggest this is the path auto insurance is going. However, even without control of a vehicle, the passengers in the vehicle still have one large influence over a potential accident happening – they control when the vehicle is driving.

Even with the perfect driving system, variables such as weather or maintenance condition can cause an increased chance of and accidents Once connected vehicle technology gets to the point where increased risk situations can be forecasted based on geography, should the passengers start having liability due to increased risk?

Paying a premium on risk

Auto insurance is currently based on the perceived risk of the driver. Auto insurance has already taken steps to change a person’s premiums based on their risk tolerance. Progressive Auto Insurance has their Snapshot which monitors driving habits and awards a reduction in premiums based on the results . Likewise, someone who has a history of unsafe driving will be charged an insurance premium due to their increased risk of future accidents. But both these situations are based on static statistical models. What if algorithms could be designed to determine when and how long someone will be exposed to the increased risk? This would allow insurance companies to offer new products that are adaptive to their current situations rather than being purely based off of past behaviour.

Your car doesn’t have snow tires, so…

Bad weather, poor maintenance, improper tires, anomalous traffic events, etc. all create risk increases while on the road. All these situation are predictable given the right data being dynamically analyzed. Given technology developments, it is not crazy to think this data will be collected in the near future and these predictions will be made.

The insurance industry could take advantage of this with the creation of an insurance product that uses these risk predictions to determine if passengers are willing to take the increase risk exposure.

When an autonomous vehicle determines its current route will encounter a high-risk scenario, it could give its passengers or passengers-to-be three options. First, to take a different route even though it may be longer. The second would be to put the trip on hold until the risk clears. The final one would be for the passengers to pay an insurance premium for the trip to reflect the increased risks. In the ride-sharing industry, any premium could simply be built into the pre-trip fare quote making it similar to how surge pricing currently works.

Machine learning will allow insurance companies to change how they create products for connected and autonomous vehicles and in turn lower the insurance costs for everyday vehicle use.

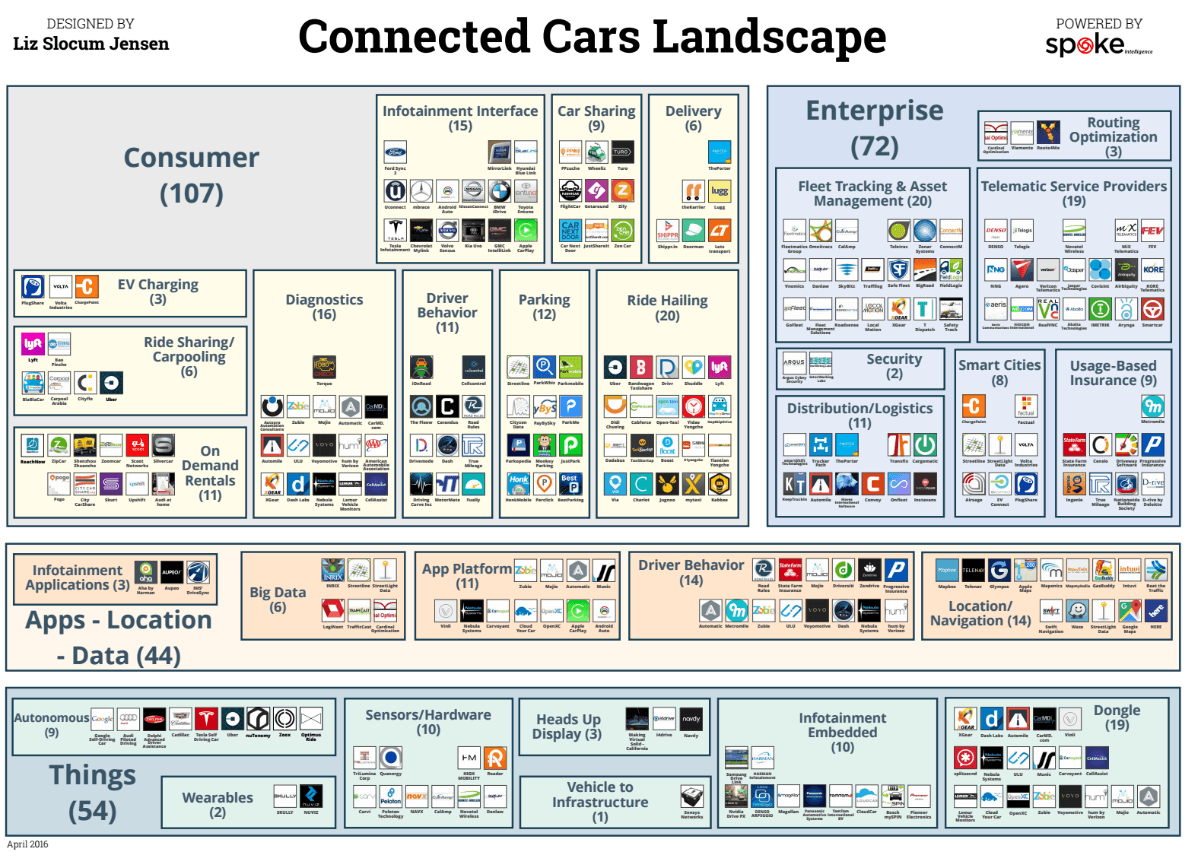

This article is part of our connected cars series. You can download a high-resolution version of the landscape featuring 250 companies here.