My nephew called me the other day, the morning before Apple released it fourth quarter earnings last week, and asked me if he should buy Apple stock. His “friend,” a stock broker, said he couldn’t think of “one good reason why not to buy the stock.”

I didn’t get a chance to speak with him before he pulled the trigger; My nephew got in at $510 per share or thereabouts. But if I had, I would have shared these 10 good reasons not to buy Apple stock – and they’re just as true after that post-earnings collapse.

(Disclosure: I’m a long-time Apple fanboy, I currently have four MacBooks, an iMac, an iPad, 2 iPhones and I don’t know how many iPods in my house. I still think the Apple IIci is the greatest computer ever made.)

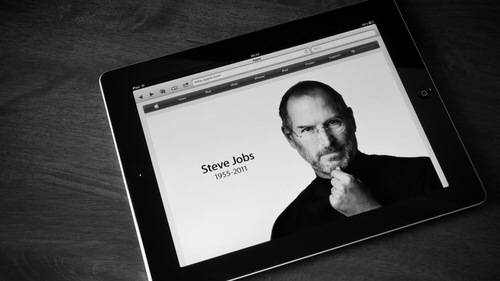

Reason 1: As You May Have Heard, Steve Jobs Passed Away

Although most often kindly thought of by the general populace as a brilliant innovator and visionary, Jobs was also “kind of a dick” – which is, of course, the best kind of guy to run a gigantic multinational corporation. Tim Cook was a great CFO, but may not be sociopathic enough to be a great CEO – and he doesn’t emit a reality distortion field. Apple leadership also took a big hit when Cook fired Scott Forstall, Apple’s most prolific inventor. Which brings us to…

Reason 2: Apple Is No Longer Innovating

Remember how crazy people went over the iPhone when it first came out? Over the iPad in 2010? Those products were “beautiful” and “revolutionary” and cool as hell. Now we’ve got the iPad Mini and the iPhone 5 – and the reaction is… not so much. As far as status symbols go, the iPhone is now sold at a discount at WalMart.

Reason 3: Apple Now Has Real Smartphone Competition

You might disagree, and will let go of your iPhone only when somebody pries it from your cold, dead fingers. But lots of people love those Samsung phones with the big-ass screens, not to mention the Google Nexus 4 – if the Nexus supply wasn’t constrained, Apple might have sold evenfewer iPhones, and iPhone sales account for an incredible two-thirds of the company’s profit.

Reason 4: Trees Don’t Grow All The Way To The Sky

Apple has enjoyed a lovely run, from $6.56 a share on April 17, 2003 to slightly more than $702.10 last September 19, an increase of – wait for it – slightly more than 107,000%. Do you think the stock is going to repeat that growth over the next 12 years? Are you crazy? Did you pass middle-school math?

The company’s revenue growth has also been astounding: Apple grossed $156 billion in 2012, vs. $6.2 billion in 2003, or “only” an increase of about 25 times. If it were to repeat that performance, in 10 years Apple’s revenue would be close to the GDP of a major European nation, like the UK, France or Italy. Not likely.

Reason 5: Never Catch A Falling Knife

Apple was a “generational buy” last November 16th at $522 per share, according to CNBC’s Joe Terranove. I’m not sure how long a generation is – 20 years? But Apple was in the $300s just 15 months ago. Is 15 months a generation? If it was a generational buy at $525, what is it at $450? So maybe a generation is now 10 weeks?

Reason 6: There’s Nothing Sadder Than A Momentum Stock That’s Lost Momentum

Remember our old friends Krispy Kreme, Soda Stream, Crox, Solar Fun…? Better yet, let’s try to forget them. I’m not comparing Apple the company to those companies, but Apple the stock is all too similar.

Reason 7: Apple Is Over-Owned And Over-Loved

One out of every four mutual funds owns Apple, and many have limits on how much of one individual stock they can own. Apple makes up 20% of the Nasdaq 100 (QQQ). Who’s left to buy it? Remember what happened to Sun, Microsoft, Cisco and Qualcomm – other brilliant, innovative, widely owned and loved stocks when the chickens came home to roost? To put things in perspective, Apple’s staggering loss of $70 billion in market capitalization in one day last week was only the third largest one-day drop in history – Microsoft holds first and second place, from back in the Spring of 2000. It was also a can’t-miss company that grew like crazy year after year – until it didn’t. And Microsoft stock is still only about a quarter of what it was at its peak, 12 years later.

Reason 8: Technical Analysis

Apple’s been carving out a textbook head-and-shoulders chart pattern for a few months now, with left and right shoulders at around $590 per share.

This is a very common pattern, so common it holds true only about 50% of the time. But as Apple has become a plaything of hedge funds and algos (over 70% of trading on Wall Street is computer-based these days), it has worked perfectly with various technical analysis methods. Turns out Apple did start to fulfill the head-and-shoulders prediction last week, when it broke the neckline at $500, and according to some, is now perhaps headed to $340. Perhaps not coincidentally, $340 is also a classic 50% Fibonacci retracement of the March 2009 to September 2012 climb from $80 to $700.

Some other technical analyses to keep in mind: Apple made a “death cross” last December 10, meaning the 50-day-moving average dipped below the 200-day-moving average. The stock is now trading well below both its 50-day and 200-day moving averages. As Apple started its descent in September, the volume picked up on selling, and was light on the uptick days; those mini-rallies were probably due to short covering. This is not a pretty picture.

Finally, note that the stock went vertical at $425, and is destined to return there, according to Jeffrey Gundlach, perhaps the world’s most successful bond trader. But if you look at the chart, there’s some gaps around $375, and the initial take-off was on very light volume. Hard to imagine a worse technical setup.

Reason 9: The Market Was Going Up While Apple Was Going Down

Most damning of all, perhaps, is the fact that the market went up the last two days of last week. Apple couldn’t even manage a dead-cat bounce on short-sellers covering their positions back up to $500, even on a fairly positive day, with good economic news. Imagine if the market in general was tanking, how bad this would be? In general, it’s a good idea to stay away from stocks that show red while everybody else is green.

Reason 10: Conspiracy Theory Time

Apple, along with the rest of the market, is manipulated – by, whom I don’t know: Ben Bernanke, Jamie Dimon and Goldman Sachs, the Rothschilds, aliens from the hollow earth – all definite possibilities. Last Friday, the blogosphere was alight after Apple closed at exactly $500.00 when we all knew a close under $500 would be very bad for Apple, and thus the market, because in the last few years, Apple was the market. But that all changed. If you were watching closely, you might have wondered why AAPL plummeted five bucks in the last moments of trading last Friday. Apparently, some whale dumped 800,000 shares of Apple one second before the market close, and bought an equal dollar amount of ES-Minis (S&P 500 futures).

WTF is that? Do you really trust a market where such things are commonplace? Anybody who owns any individual stock these days is taking a helluva risk. (More disclosure: I own some individual stocks.)

The Counter Arguments

There are two main counter-arguments for buying Apple:

One is the fact that it enjoys a low price-to-earnings (P/E) ratio, right round 10. Long story short, P/E ratios are rarely a good indicator of when to buy a stock, and do not necessarily a bargain make. A great time to have bought Apple was in October 2004, when its P/E ratio was 45.

The other is that Apple has tons of cash in the bank ($137 billion or so – enough to buy every man, woman and child on the planet the new Nicki Minaj CD and a slice of pizza). Unfortunately, Apple doesn’t have ready access to most of that money, as the company is stashing it overseas for tax reasons.

Sure, maybe Apple may have one last ace up its sleeve with the Apple TV, but we won’t know until it finally gets here – if it ever does.

To sum up, Apple’s leadership and vision are suspect, its market share, margins and cool factor are shrinking, the stock is technically broken, and it’s over-owned and over-loved. To me, it looks bad, really bad. But I’m so bearish that I’m probably wrong already. Apple could still get to $1,000 next year. But whether it hits new heights or falls to $200, or both, expect plenty of volatility, dead cat bounces and flash crashes along the way.

With that in mind, maybe the one thing I should have told my nephew before he bought his five shares Wednesday morning is this: “Nobody knows anything.” On the other hand, as it was his first stock trade, this was probably a wonderful learning opportunity for him. He now knows everything he needs to know about the stock market.

Finally, please remember that everything I’ve said is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness or fitness for any particular purpose. These points are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor.

Lead image courtesy of bloomua / Shutterstock. Other images courtesy of Shutterstock and ReadWrite.